Charts of the week from 16 to 20 February 2026: gross domestic product, number of persons in employment and average gross wage per employee

GDP grew by 1.1% last year, with growth primarily driven by construction investment. Growth in private consumption more than halved, while growth in government consumption also moderated. The contribution of external trade balance was negative. According to the Statistical Register of Employment (SRDAP), the…

Cooperation between IMAD and the World Health Organization in the preparation of a national study on affordable access to health care in Slovenia

The Institute of Macroeconomic Analysis and Development of the Republic of Slovenia (IMAD) and the Ministry of…

Charts of the week from 9 to 13 February 2026: consumer prices, production volume in manufacturing, activity in construction and other charts

Consumer prices were 2.6% higher in January than a year earlier. The largest contribution to inflation again came from food and non-alcoholic beverages, although price growth in this category continues to moderate gradually.…

Charts of the week from 26 to 30 January 2026: economic sentiment, turnover in trade, turnover in market services and Slovenian industrial producer prices

At the end of last year, real turnover in trade and other market services increased. In the trade sector, growth was driven primarily by wholesale trade, while among other market services, ICT services recorded the…

National productivity board

IMAD analyses productivity and competitiveness as the national productivity board

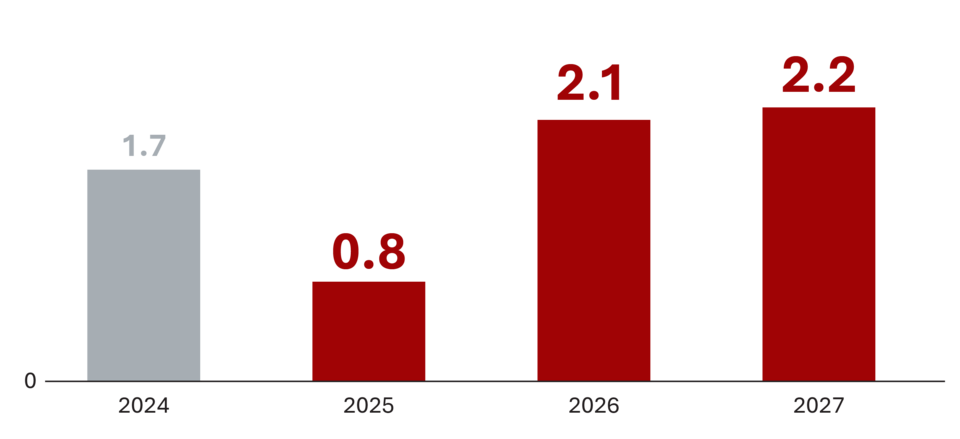

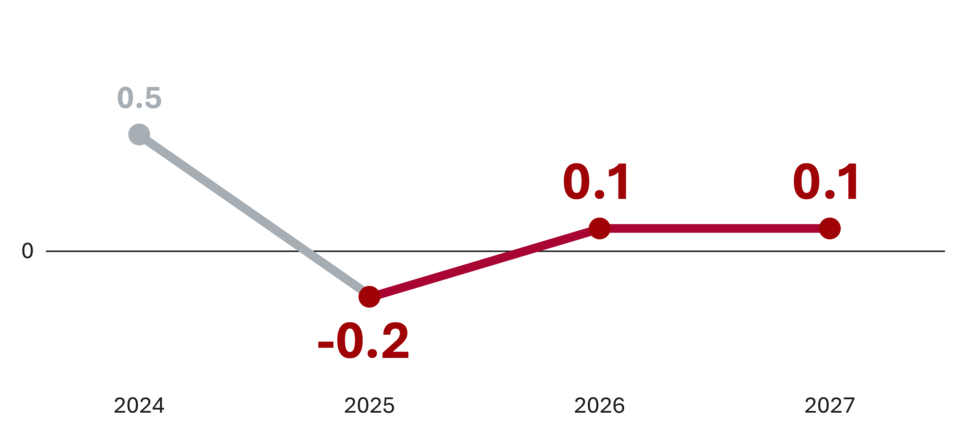

GDP and prices

This year, GDP growth is expected to slow to 0.8% (down from 1.7% last year), well below the levels projected in the spring (2.1%). The deceleration is primarily attributable to weaker export activity, particularly in the first half of the year, reflecting the economy’s relatively strong exposure to challenges in European industry. Economic growth in 2025 will be driven mainly by domestic demand, especially household consumption, supported by robust employment and accelerating wage growth. Inflation in 2025 (2.9% year-on-year at end-2025) will be somewhat higher than last year, mainly due to higher food prices, and above the level projected in the spring, before gradually easing over the next two years (towards 2.3%).

Labour market

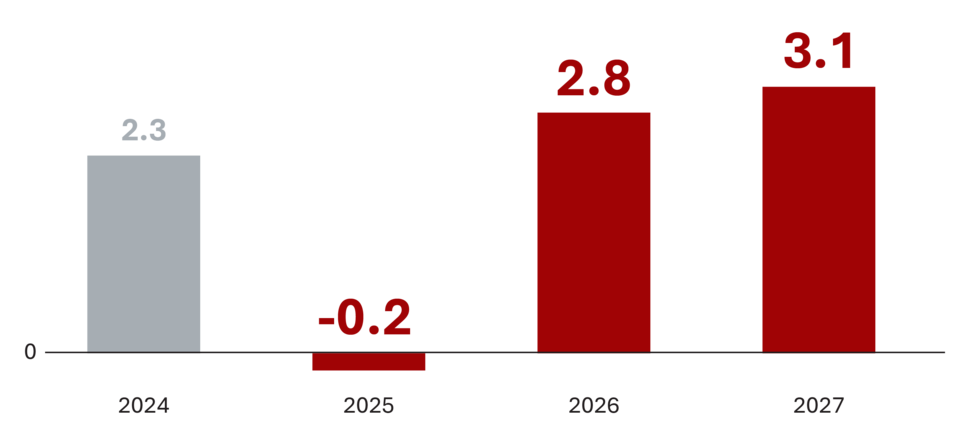

Employment is projected to decline on average in 2025, and then largely stagnate over the following two years, while unemployment is expected to remain low throughout the entire period. Nominal wage growth in 2025 will exceed last year’s growth, driven mainly by increases in the public sector (phasing-in of the wage reform) before easing somewhat thereafter. Real wage growth will exceed the rates observed a decade ago.

International trade

Total exports this year are expected to remain broadly unchanged from last year, and significantly below the levels projected in the spring. Goods exports are projected to decline, mainly due to lower exports of intermediate goods, while services exports are expected to increase. With a gradual improvement in foreign demand, a recovery in the export-oriented sector of the economy is anticipated over the next two years. The current account surplus is gradually declining.

IMAD

The Institute of Macroeconomic Analysis and Development of the Republic of Slovenia is an independent government office.

The Institute performs the following tasks:

- it monitors and analyses current trends and development in its economic, social and environmental dimensions;

- it monitors and analyses the achieving of the development objectives of the country;

- it prepares macroeconomic forecasts and other expert groundwork that serve as the basis for budgetary planning and formulating economic policy measures;

- it analyses productivity and competitiveness as the national productivity board;

- it carries out research work.