Charts of the Week

Charts of the week from 26 to 30 January 2026: economic sentiment, turnover in trade, turnover in market services and Slovenian industrial producer prices

At the end of last year, real turnover in trade and other market services increased. In the trade sector, growth was driven primarily by wholesale trade, while among other market services, ICT services recorded the strongest expansion. In the first eleven months of the year, turnover increased year-on year in most trade and other market service activities. Economic sentiment improved slightly further at the beginning of the year, reflecting stronger consumer confidence and a renewed confidence upturn in manufacturing activities. In 2025, Slovenian industrial producer prices were, on average, 1.1% higher across all main industrial groups, with the exception of energy.

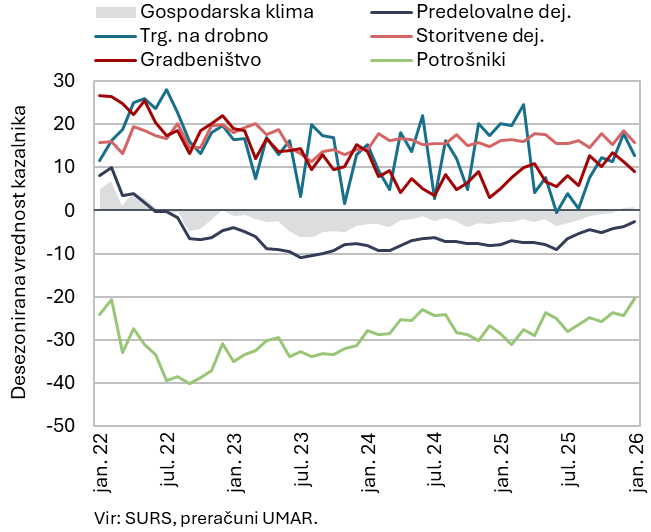

Economic sentiment, January 2026

The economic sentiment indicator edged up further at the beginning of the year and remained higher year-on-year; it also stood slightly above its long-term average. The modest improvement recorded in January was driven primarily by the consumer confidence indicator and, once again, by the manufacturing confidence indicator, both of which have improved markedly since mid-last year. Despite this improvement, the manufacturing confidence indicator remained the only one below its long-term average. By contrast, other confidence indicators (in retail trade, services, and construction) deteriorated in January and were mostly lower year-on-year (except in construction).

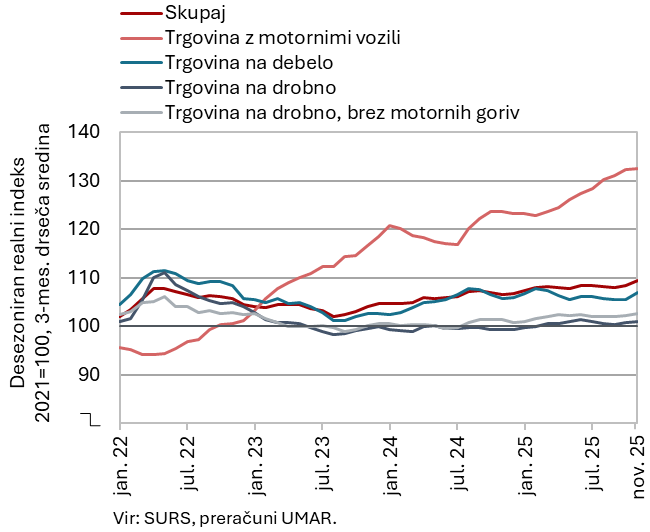

Turnover in trade, November 2025

Real turnover increased in most trade segments on average in October and November, following a decline in the third quarter of 2025. In wholesale and retail trade in food and non-food products, sales rose on average in October and November, after a period of decline or stagnation in the third quarter. Growth also continued in the sale of motor vehicles (all seasonally adjusted). Over the first eleven months of the year, sales in all trade sectors were higher than or similar to those in the same period of 2024 (retail trade in food products). The strongest growth (7%) was recorded in the sale of motor vehicles, while turnover in retail trade with non-food products increased by 2% and in wholesale trade by 1%.

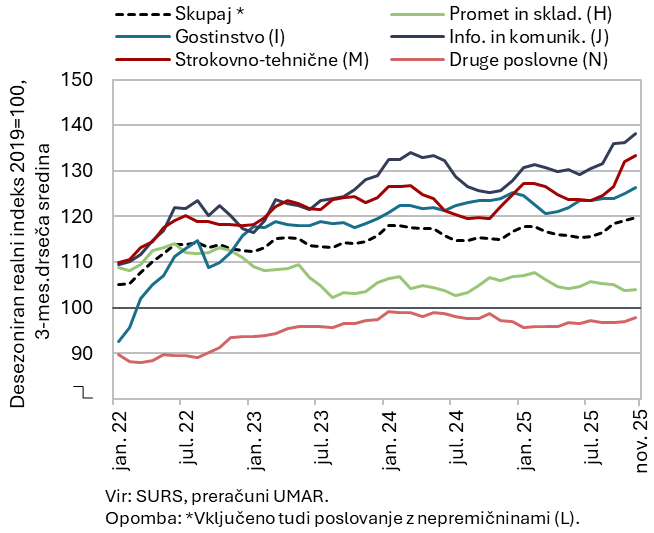

Turnover in market services, November 2025

The strengthening of total real turnover in market services, which had been interrupted in October 2025, resumed in November (seasonally adjusted). On a month-on-month basis, the largest increase in turnover was recorded in information and communication, with growth supported by both main activities (telecommunications and computer services). Turnover in transportation and storage, which had been mostly contracting since the beginning of 2025, also increased slightly (particularly in land transport). A modest increase was likewise observed in administrative and support service activities following a prolonged period of stagnation. In November, the previously negative trend in employment services came to a halt. Turnover in accommodation and food service activities rose for the fourth consecutive month. By contrast, after three months of strong growth, turnover declined only in professional and technical activities, primarily owing to a pronounced decrease in architectural and engineering services (all seasonally adjusted). Total real turnover in market services also remained higher year-on-year in November (by 2.6%). Over the first eleven months of the year, it exceeded the level recorded in the same period of 2024 by 1.1%; year-on-year growth was negative only in administrative and support service activities.

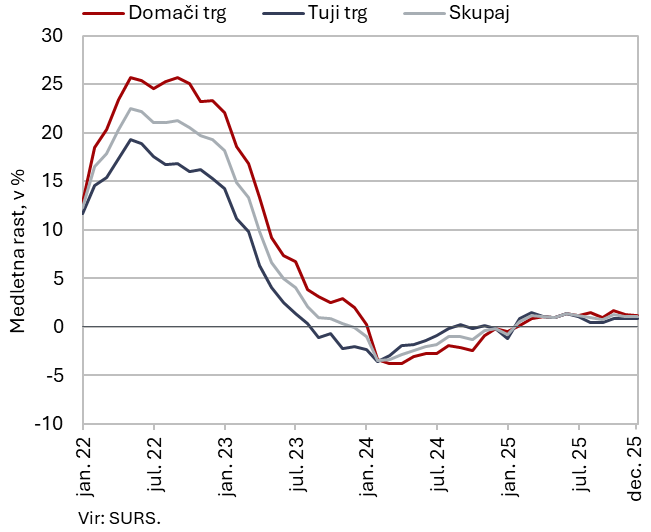

Slovenian industrial producer prices, December 2025

Slovenian industrial producer prices increased by 1.1% in 2025, following a 1.2% decline in the previous year. In 2025, price growth was recorded on both the domestic market (1.2%) and foreign markets (0.9%). Prices rose across all main industrial groups, with the exception of energy (down 7% year-on-year). The largest increase was observed in consumer goods prices, which rose by 3.5%, driven in particular by higher prices of non-durable consumer goods (up 3.8% year-on-year), although the latter declined by 0.7% month-on-month in December. In the second half of the year, prices of durable consumer goods were also higher year-on-year, increasing by 2% over the year as a whole. Prices of intermediate goods rose by 1%, while prices of capital goods remained broadly unchanged compared with a year earlier (+0.2%).