Charts of the Week

Charts of the week from 27 to 31 January 2025: economic sentiment, turnover in trade and turnover in market services

The value of the economic sentiment indicator remained at a similarly low level in January as in the previous month. While it was higher year-on-year, it remained below the long-term average. Turnover trends in all trade sectors were less favourable at the end of 2024 than in the third quarter, while turnover in market services increased in November after two consecutive months of decline. In the first eleven months of 2024, turnover in all trade sectors and most market services – excluding transportation and storage, and professional and technical activities – was higher than in the same period of 2023.

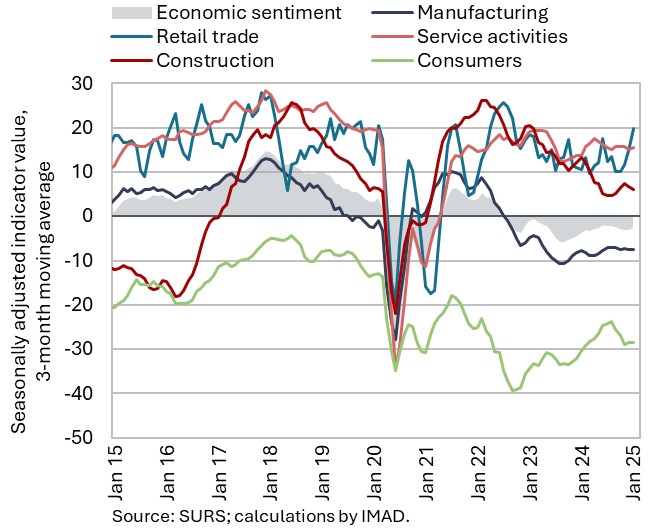

Economic sentiment, January 2025

The value of the economic sentiment indicator was at a similarly low level in January as in the previous month but remained higher year-on-year. Confidence indicators improved month-on-month in manufacturing, services and construction, while they declined in retail trade and among consumers. Although economic sentiment remains higher than a year ago, it has been below the long-term average for nearly two years. Year-on-year, confidence indicators improved in all activities, except in construction, where most companies surveyed cited a shortage of skilled labour as the primary limiting factor. Consumer confidence was also lower than in January 2024.

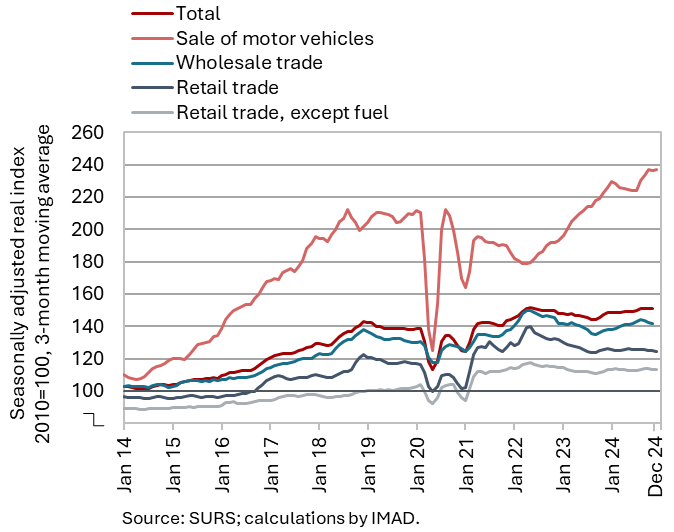

Turnover in trade, November–December 2024

At the end of 2024, real turnover trends across all trade sectors were less favourable compared to the third quarter of 2024. After modest growth in November in most trade sectors, December saw a significant decline across the majority of sectors (according to preliminary SURS data). On average, turnover in the sales of motor vehicles increased quarter-on-quarter in the fourth quarter of 2024. However, this growth was notably lower than in the third quarter. Turnover in the sales of food, beverages, and tobacco continued to rise slightly after stagnating during the first half of 2024. Following growth in the third quarter, retail sales of non-food products fell in the fourth quarter, making it the only major trade sector where turnover also declined year-on-year. After robust growth in mid-summer, turnover in wholesale trade also declined at the end of the year. In the first eleven months of 2024, turnover in all trade sectors was higher than in the same period of 2023. The strongest real growth was recorded in the sales of motor vehicles (7%). Growth in other sectors was much more modest (around 1.5% on average).

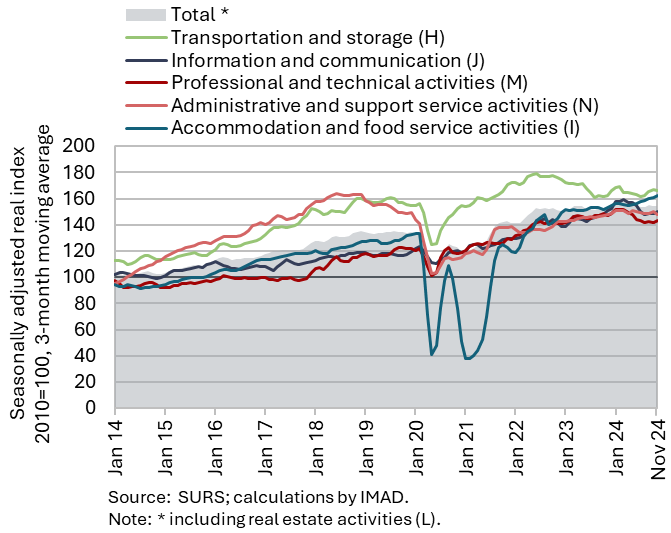

Turnover in market services, November 2024

After two months of decline, total real turnover in market services increased in November 2024 (by 1.4%, seasonally adjusted), but on a year-on-year basis, it fell (by 1.4%) due to the high base in November 2023 in all activities, except for accommodation and food service activities. The strongest growth was recorded in information and communication, where turnover has mostly been rising since mid-2024. This increase was driven by higher sales in the two most important services (telecommunications and computer). Growth in turnover in accommodation and food service activities accelerated towards the end of last year amid a relatively strong increase in the number of overnight stays by foreign tourists. Since mid-2024, turnover in professional and technical activities has been on an upward trend mostly, with particularly strong growth in architectural and engineering services. Turnover in administrative and support service activities stagnated at a relatively high level last year, though it followed a downward trend. Turnover in employment agencies fell again, while the favourable trend in travel agencies continued for the fourth month in a row. Turnover in transportation and storage also mostly stagnated in 2024, apart from a slight decline in the summer. In eleven months of 2024, real turnover decreased year-on-year only in transportation and storage and professional and technical activities.