Charts of the Week

Charts of the week from 6 to 10 October 2025: production volume in manufacturing

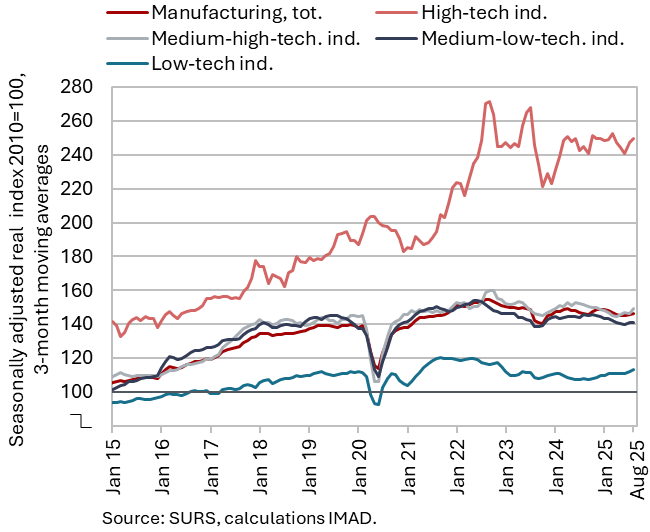

Manufacturing output has been strengthening across all groups of industries by technological intensity (seasonally adjusted) since mid-year; however, in the first eight months, it was 1% lower year-on-year. The sharpest declines were recorded in the manufacture of motor vehicles, trailers and semi-trailers, and in the metal industry. The volume of total orders in manufacturing also remained at a low level in September. Expectations regarding future production improved slightly but continued to lag behind the long-term average.

Production volume in manufacturing, August 2025

Manufacturing output has been strengthening across all groups of industries by technological intensity (seasonally adjusted) since mid-year; however, in the first eight months, it was 1% lower year-on-year. Since June, production has increased across all groups of industries by technological intensity, with the weakest growth observed in medium-low-technology industries (seasonally adjusted). Over the first eight months, production in medium-low- and medium-high-technology industries was on average lower than a year earlier, with the largest declines recorded in the metal industry (by 7.7%) and in the manufacture of motor vehicles, (semi-)trailers and other transport equipment (by 17.8%). Production also decreased across all energy-intensive industries. According to our assessment, the overall decline in manufacturing output is being mitigated mainly by the pharmaceutical industry, which, together with some less technology-intensive industries, recorded output growth in the first eight months.

According to business tendency data, the indicator of total orders in manufacturing remained at a low level in September, comparable to that recorded a year earlier. The indicator of expected production improved and slightly exceeded last year’s levels; however, it remained (like the total orders indicator) below the long-term average.