Charts of the Week

Charts of the week from 29 Aprila to 3 May 2024: consumer prices, value of fiscally verified invoices, trade in goods and other charts

In April, year-on-year inflation dropped to 3%, the lowest level since October 2021. The slowdown was mainly due to less pronounced seasonal rises in prices of package holidays and clothing and footwear. Prices of food remained unchanged year-on-year, while prices of durable goods continued to fall. In the second half of April, the nominal value of fiscally verified invoices increased by 3% year-on-year, similar to the previous periods of this year. Imports and exports increased month-on-month in the first quarter but remained lower than a year ago. Sentiment in the export oriented part of the economy remained low in April. Total real turnover in market services decreased significantly in February and the year-on-year growth declined.

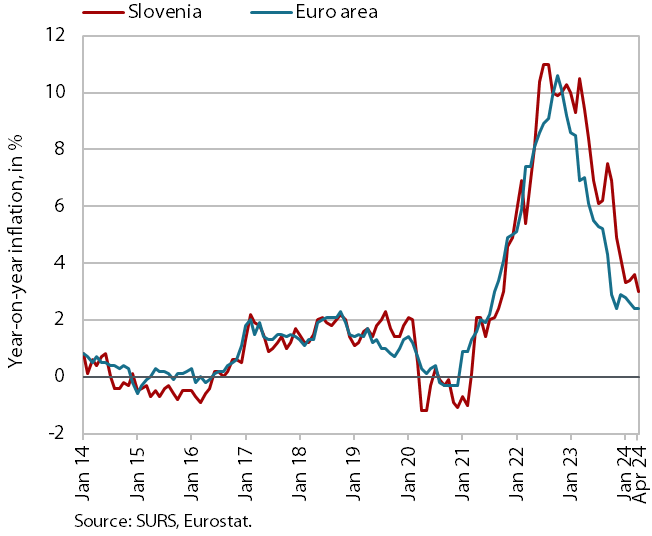

Consumer prices, April 2024

After a slight increase in the preceding two months, year-on-year growth of consumer prices fell to 3% in April, marking the lowest level since October 2021. The slowdown in year-on-year growth was primarily driven by a less pronounced seasonal increase in prices of package holidays (rising by 13.8% month-on-month). The year-on-year price increase in the recreation and culture group nearly halved compared to March (3.2%), while the growth in service prices decreased by around one-quarter to 4.5%. Similarly, the seasonal price hike in the clothing and footwear group was less pronounced (4.2%), contributing to a lower price growth in semi-durable goods, which increased by 1.8% year-on-year. Prices in the food and non-alcoholic beverages group fell by 1% month-on-month but remained stable year-on-year. The prices of durable goods fell year-on-year (-0.7%). Among the twelve groups of goods and services, the most significant price increases were observed in the restaurants and hotels group (7.3% year-on-year), where growth accelerated again after a slowdown at the beginning of the year. Prices in the education and health groups are also rising rapidly (by 6.6% and 6.1% respectively).

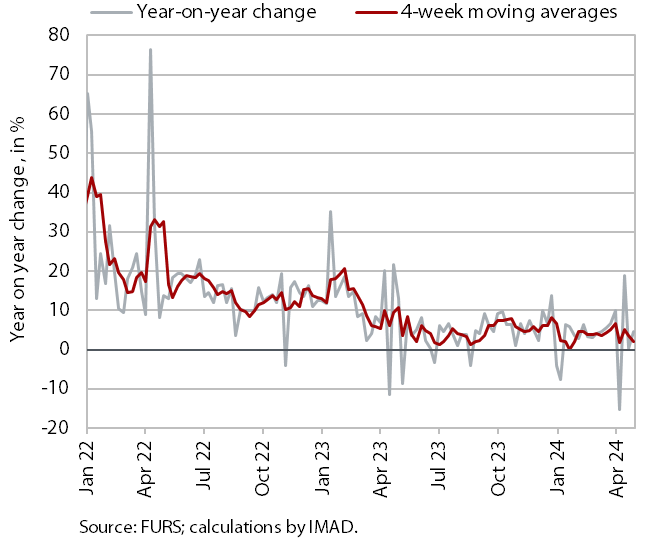

Value of fiscally verified invoices, in nominal terms, 14–27 April 2024

The nominal value of fiscally verified invoices between 14 and 27 April was 3% higher year-on-year. Growth was similar to previous periods of this year, with the exception of fluctuations in the last two 14-day periods related to the timing of the Easter holidays. Turnover in trade, which accounted for almost 80% of the total value of fiscally verified invoices, increased by 2% year-on-year. The highest growth was still recorded in the sale of motor vehicles (11%). Turnover in wholesale trade remained lower year-on-year. Year-on-year turnover growth in accommodation and food service activities, certain creative, arts, entertainment, and sports services, and betting and gambling weakened (overall growth in accommodation and food service activities and in other service activities was 4%, compared with an average of 8% in the previous periods of the year).

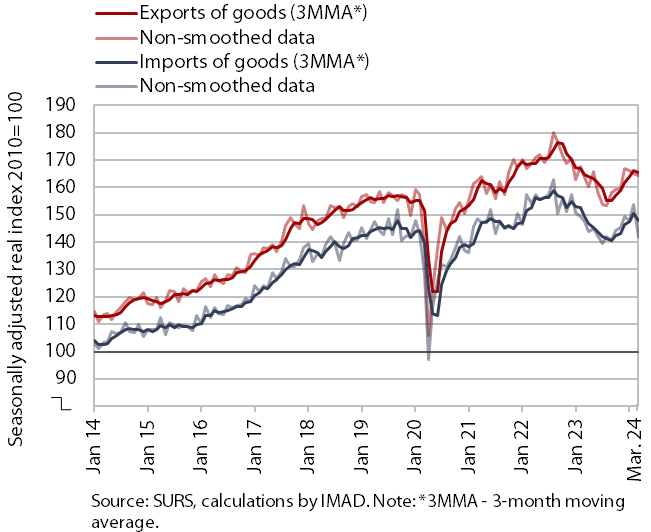

Trade in goods – in real terms, March 2024

Trade in goods increased month-on-month in the first quarter of this year (seasonally adjusted) but was still lower than a year ago. Real exports of goods declined by 2.1% compared to the previous quarter, while imports fell by 1%, marked by significant monthly fluctuations. Exports of vehicles rose sharply (which also contributed to the sharp increase in exports to France) and exports of chemical products also increased. Imports of intermediate goods and consumer goods contributed to the increase in imports of goods, while imports of capital goods fell (seasonally adjusted). Compared to the same period last year, both exports and imports continued to decline in the first quarter of this year, with exports to non-EU countries and imports from EU countries experiencing particularly steep declines. In April, sentiment in export-oriented industries remained subdued, and export orders remained at very low levels. In the second quarter, companies continued to cite uncertain economic conditions, weak foreign demand, and a shortage of skilled labour as the main limiting factors to business operations.

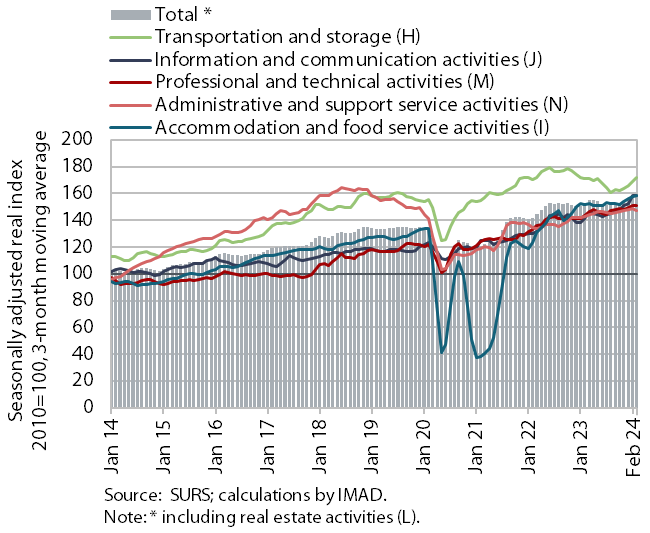

Turnover in market services, February 2024

In February, total real turnover in market services fell significantly (by 1.8%), while it was 1.8% higher year-on-year in real terms. Following robust growth in January, the most significant downturn occurred in information and communication. Additionally, a sharp decline in turnover was recorded in professional and technical activities, where only one sector, a small one in terms of turnover, recorded growth. In accommodation and food service activities, turnover fell for the second month in a row, following a period of relatively strong growth in the fourth quarter of last year. Turnover continued to decline in administrative and support service activities, with further decreases noted in employment services. Only transportation and storage recorded a slight increase in turnover, with both land transport and warehousing and storage contributing to this growth. Year-on-year growth in total turnover of market services slowed significantly in February (from 5.8% in January to 1.8%), and a marked decline was recorded in real estate activities.