Slovenian Economic Mirror

Related Files:

Slovenian Economic Mirror 8/2022

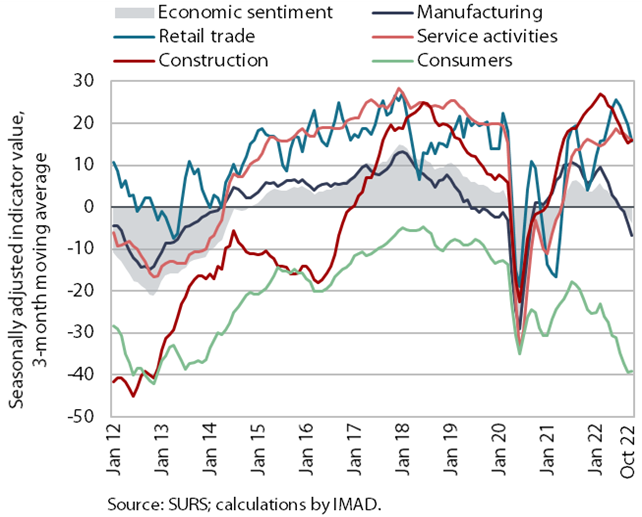

In the third quarter of this year, GDP in Slovenia fell by 1.4% compared to the second quarter, and the year-on-year growth (3.4%) was lower than in the first half of the year and in line with IMAD’s expectations in its Autumn Forecast of 5% GDP growth for 2022. Household consumption growth, which was driven mainly by the sale of non-food products and services, moderated year-on-year in the summer months as consumer confidence fell and real income declined. Investments remained strong in the third quarter, especially in construction. Lower export expectations have not yet had a pronounced impact on the growth of goods exports. Amid great uncertainty in the international environment, this segment has been subject to strong monthly fluctuations since the spring. Growth in trade in services also continued, albeit at a somewhat slower pace. The overall growth of exports exceeded the growth of imports, which contributed to a positive external trade balance. Data on the economic sentiment at the beginning of the last quarter of this year point to a further deterioration. Compared to the previous month, confidence fell the most in retail trade in October, followed by manufacturing and service activities. Consumer sentiment was slightly more upbeat than in September, which we believe is related to the government’s measures to mitigate the impact of high energy prices; sentiment also improved in construction. The cooling of the economy is not yet reflected in the labour market, and companies continue to solve their problems in finding qualified workers by hiring foreigners. Year-on-year inflation remains high and is increasingly broad-based. Economic growth in the euro area slowed significantly in the third quarter but remained positive; the European Commission revised its forecasts significantly downwards in November. Forecasts are subject to great uncertainty, mainly due to the limited availability and high prices of energy, but with natural gas stocks currently high, it is moving towards the next winter.

Related Files:

- International environment

- Economic developments

- Labour market

- Prices

- Financial markets

- Balance of payments

- Public finance

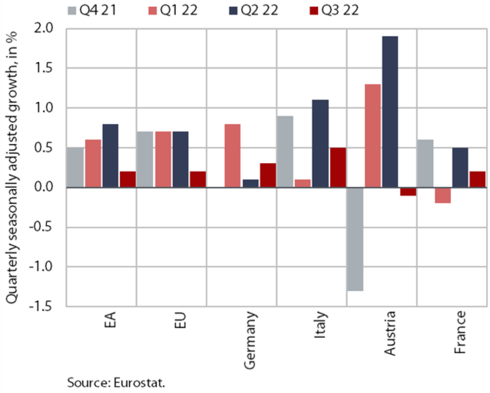

Economic growth in Slovenia’s main trading partners, Q3 2022

Economic growth in the euro area slowed in the third quarter but exceeded expectations. Quarterly growth, which was driven by private consumption, was 0.8% in the second quarter before slowing to 0.2% in the third (from 4.3% to 2.1% year-on-year). Growth in our two main trading partners (Germany and Italy), whose PMIs have pointed to a contraction since July, was much higher than had been expected by international institutions – quarterly GDP growth was 0.5% in Italy and 0.3% in Germany. GDP growth in France was 0.2%, while in Austria economic activity declined in the third quarter after high growth of almost two per cent in the previous quarter. For the last quarter of this year, confidence indicators point to a contraction of activity in the euro area. The value of the composite PMI for the euro area in October was the lowest since 2020, as was that of the Economic Sentiment Index (ESI). Against a backdrop of high prices and high uncertainty, the indicators deteriorated in both industry and services.

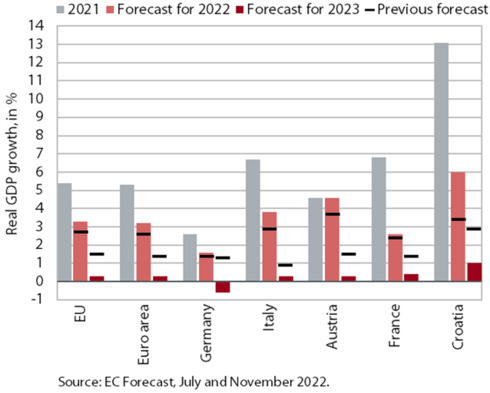

EC economic forecasts for Slovenia’s main trading partners, November 2022

In November, the EC revised its economic growth forecasts for Slovenia’s main trading partners for the coming year significantly downwards; the forecasts do not deviate significantly from the assumptions made by IMAD in its Autumn Forecast. The EC projects that elevated uncertainty, high prices, erosion of households’ purchasing power, a weaker external environment and tighter financing conditions will tip most Member States (including all Slovenia’s main trading partners) into recession in the last quarter of the year. On the back of favourable growth in the first half of the year, when the services sector in particular recovered after the easing of COVID-19 restrictions, real GDP in the euro area is expected to grow by 3.2% on average this year (3.3% in the EU as a whole). The contraction of activity is expected to continue in the first quarter of 2023. The EC expects growth to return to Europe in the spring, as inflation gradually relaxes its grip on the economy. However, with powerful headwinds still holding back demand, economic activity is set to be subdued (0.3% in the EU and the euro area). By 2024, economic growth is forecast to progressively regain traction (averaging around 1.6% in the EU and the euro area). According to the EC forecast, inflation is expected to peak at the end of this year and the average yearly inflation rate in the euro area to be 8.5% (9.3% in the EU). Inflation is expected to decline in 2023 but to remain high, at 6.1% (7% in the EU), before moderating in 2024 to around 3%. Forecasts of economic growth are surrounded by great uncertainty. The biggest risk is a possible shortage of gas in Europe, especially in the 2023–2024 winter. Longer-lasting inflation and the uncertain scale and impact of monetary tightening also remain important risk factors. From a fiscal policy perspective, the EC forecasts only take into account the measures to mitigate the impact of surging prices and other measures that have already been adopted or announced with a high degree of credibility.

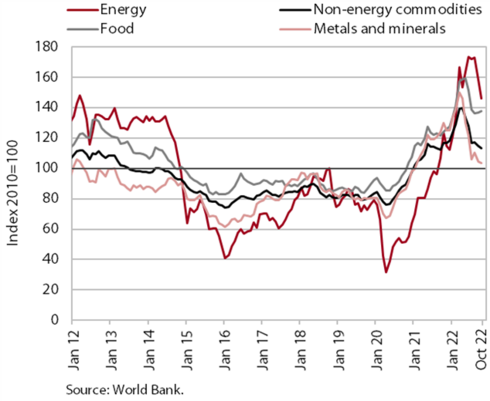

Commodity prices, October 2022

Although the average prices of energy and non-energy commodities on international markets fell further in October, they still remained high. With European storage capacities almost full, prices of natural gas (TTF) on the European market fell by 32.8% compared to September, although they were still high (+48.3% year-on-year). In October, the OPEC+ production cut agreement halted the decline in oil prices that began in July, and the dollar price of Brent crude rose 4% to USD 93.3 per barrel in September, up 11.7% on a year earlier. With the appreciation of the dollar, euro oil prices recorded an even higher year-on-year increase (32%). According to the World Bank, the average dollar prices of non-energy commodities continued to fall in October compared to September, as prices of most non-energy commodity groups (except food) fell. Dollar prices of non-energy commodities were also lower year-on-year on average (by 3%), although still significantly higher than before the epidemic. The prices of food and fertilisers continued to rise sharply, while prices of industrial raw materials and metals and minerals fell significantly year-on-year.

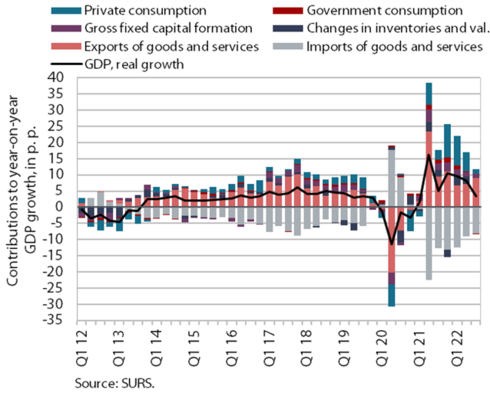

GDP, Q3 2022

In the third quarter of this year, GDP fell by 1.4% compared to the second quarter; the year-on-year growth (3.4%) was lower than in the first half of the year and in line with IMAD’s expectations in its Autumn Forecast. Household consumption growth moderated to 2.6% year-on-year in the summer months as consumer confidence fell and real income declined. Growth was underpinned by the sale of non-food products and services. Investment remained strong in the third quarter, especially in construction. The deterioration in export expectations has not yet had a pronounced impact on the growth of goods exports, where steady growth continued in the third quarter, but since the spring this segment has been subject to large monthly fluctuations due to the great uncertainty in the international environment. Growth in trade in services also continued, albeit at a somewhat slower pace. The overall growth of exports exceeded the growth of imports, which contributed to a positive external trade balance. General government expenditure declined year-on-year after a period of increased growth, with lower spending on containment measures and lower government budget spending on certain types of goods and services. The contribution from the change in inventories, after high positive values in the first half of the year, was neutral in the third quarter compared to the same period last year.

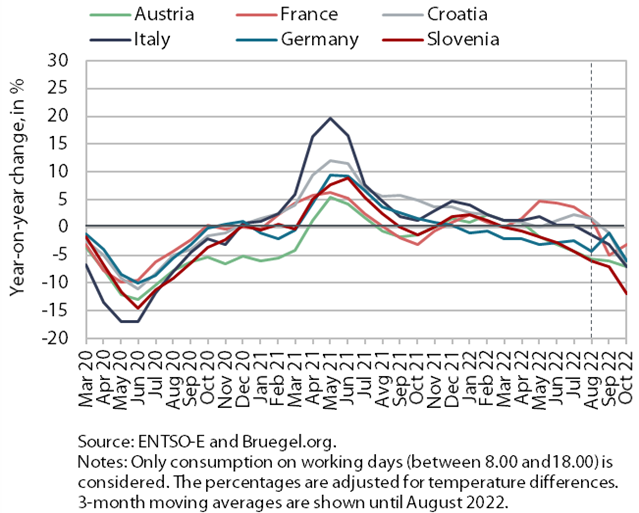

Electricity consumption, October 2022

Electricity consumption was 12% lower year-on-year in October. We assess that this was mainly due to lower industrial consumption. This is related to a reduction in production activity, especially in some energy-intensive companies, due to high energy prices, and to more efficient energy consumption. Slovenia’s main trading partners also recorded a year-on-year decline in consumption in October (France by 3% and Austria, Italy, Germany and Croatia by 7%).

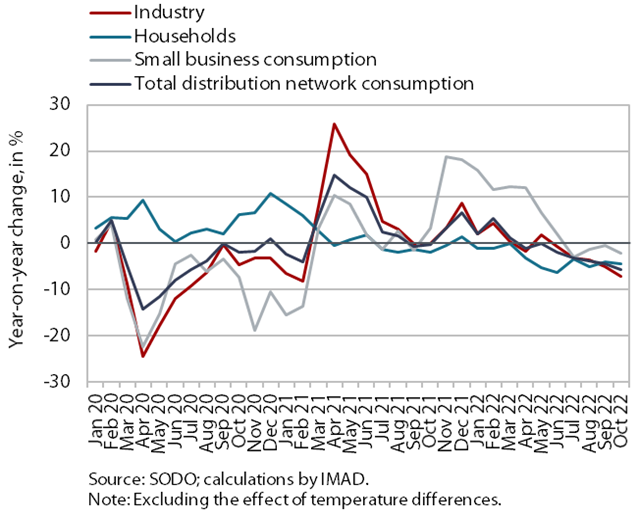

Electricity consumption by consumption group, October 2022

In October, electricity consumption in the distribution network was lower year-on-year in all consumption groups. The largest decrease was in industrial consumption (by 7.1%). This is mainly due to the lower consumption by some energy-intensive companies, which reduced their production volume due to high electricity prices but were also able to reorganise their production processes and introduce more modern technologies, which made them more energy efficient. Due to more rational use of energy, household consumption and small business consumption were also lower year-on-year in October (by 4.3% and 2.2% respectively).

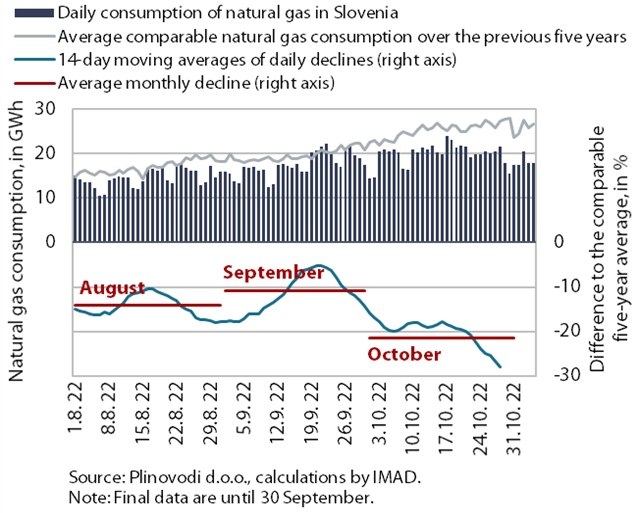

Natural gas consumption, August–October 2022

Natural gas consumption in August and September was below the comparable average consumption in the five preceding years (by 14% and 11% respectively), and based on available data, the decline in October is expected to be more than 20%, due to warmer than average weather. According to Eurostat, the average decline in gas consumption in EU Member States in August was the same as in Slovenia, while in September it was 15%. The decrease has been driven by various measures taken by EU Member States to reduce gas consumption and by adaptation of various industries to rising prices of gas by reducing consumption. The warm weather in October also contributed to lower consumption compared to previous years and helped to ensure that European gas storage facilities were almost full. According to preliminary data, gas consumption in Slovenia from 1 August to 4 November 2022 was about 17% lower than the comparable average consumption over the last five years.

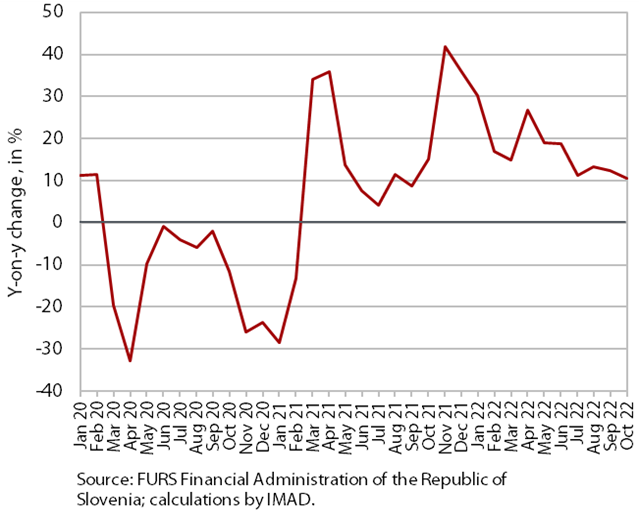

Value of fiscally verified invoices – nominal, October 2022

Amid high price growth, the value of fiscally verified invoices in October was higher year-on-year and compared to the same period of 2019 (by 11% and 13% respectively). The somewhat lower growth compared to previous months is mainly due to lower growth in trade (10%), which accounted for slightly more than three-quarters of the total value of fiscally verified invoices. On last year’s low base, growth in accommodation and food service activities (due to high growth in food and beverage service activities) and in some cultural, sports, entertainment and personal services was higher than in the previous two months.

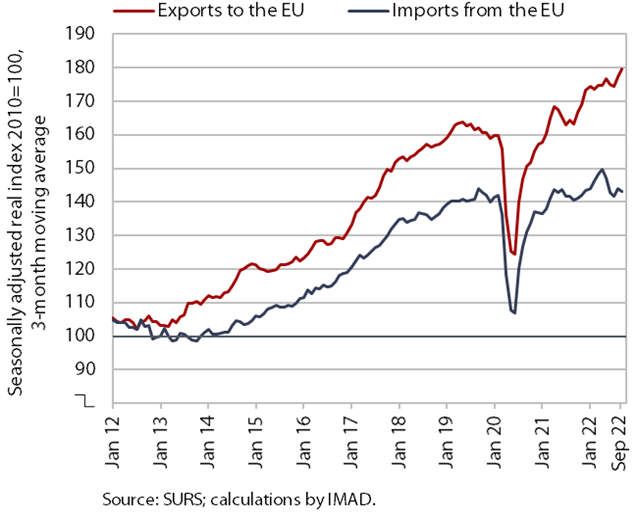

Trade in goods – in real terms, September 2022

Trade with EU Member States increased quarter-on-quarter in the third quarter; sentiment in export-oriented sectors deteriorated further in October. Amid considerable monthly fluctuations, real exports of goods to EU Member States rose by 2.6% compared to the previous quarter, while real imports of goods from EU Member States remained at the level reached (seasonally adjusted). Year-on-year growth in trade in goods with EU Member States in the third quarter was mainly driven by exports (exports 8.5%, imports 0.5%) and was more favourable than expected given the situation in the international environment and deteriorating confidence indicators. The high level of uncertainty in the international environment has had a significant impact on sentiment in export-oriented activities in recent months, as export orders continued to decline in October, reaching the lowest level since the end of 2020. According to the survey data, companies expect their competitive position both in the EU and non-EU markets to deteriorate in the last quarter and the volume of new orders to decline further.

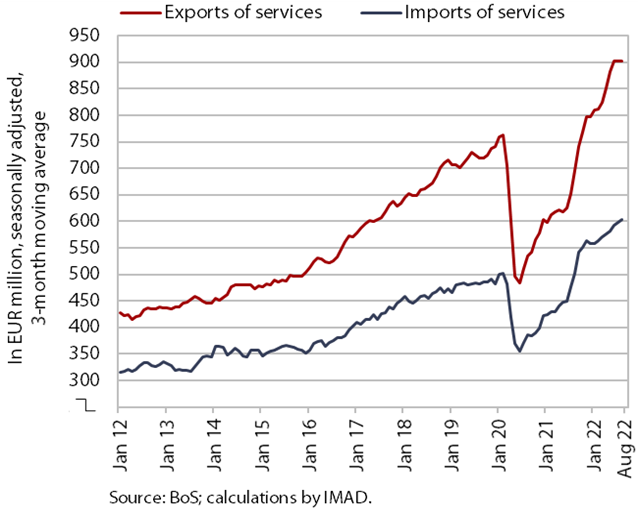

Trade in services – nominal, August 2022

After a pause in growth in June and July, trade in services picked up again in August. Compared to the previous month, both imports and exports of services increased in August (seasonally adjusted). The favourable monthly development of trade in tourism-related services, which exceeded pre-epidemic levels in July and August, continued. Trade in most other main groups of services (transportation, other business services, ICT) also increased, with the exception of construction. Due to last year’s low base, year-on-year growth in trade in serviced remained very high in the first eight months (32.5%), exceeding pre-epidemic levels (January–August 2019) by more than a fifth.

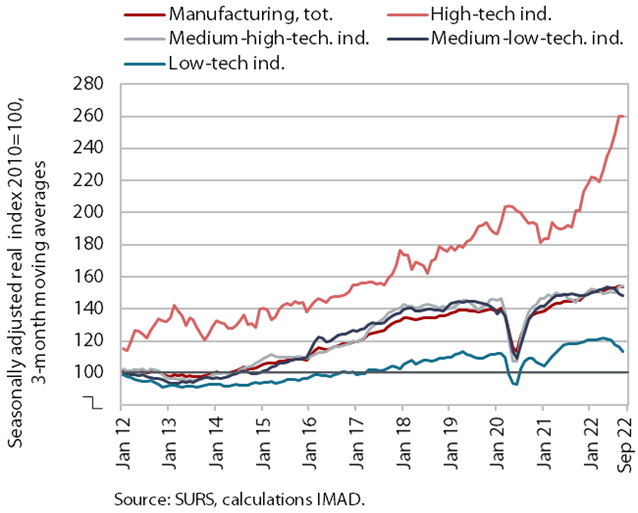

Production volume in manufacturing, September 2022

Manufacturing output rose slightly in the third quarter after falling in September. Growth continued in high-technology industries, and, after less favourable results in the first half of the year, manufacturing output also increased in medium-high-technology industries. Manufacturing output in low-technology industries declined and was lower than in the same period last year in most segments. In the more energy-intensive industries (the metal and paper industries and, among the high-technology industries, the manufacture of chemicals), production in the third quarter was also lower than a year ago or its growth slowed significantly (manufacture of other non-metallic mineral products n.e.c.). On average, manufacturing output in the third quarter was still higher than in the same quarter last year. The strongest growth was recorded by the pharmaceutical industry (according to our estimates) and the manufacture of ICT equipment, and there was also considerable growth in the manufacture of electrical equipment and, after a deep slump in the first half of the year, the manufacture of motor vehicles.

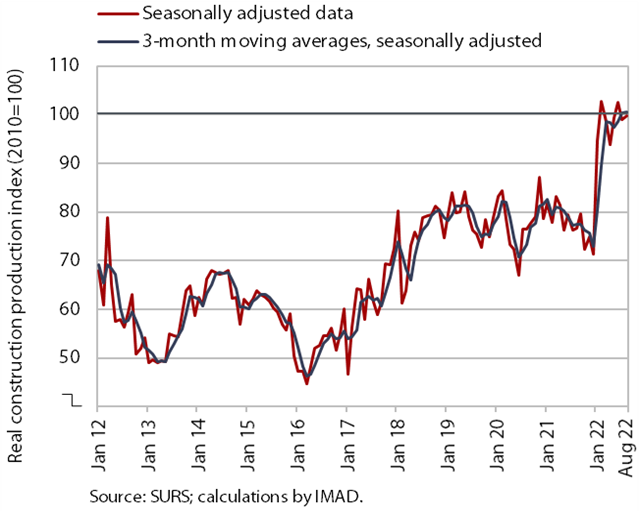

Activity in construction, August 2022

According to figures on the value of construction work put in place, construction activity in August was considerably higher than last year. After a marked upturn in activity at the beginning of this year, the value of construction work remained at the new level during the rest of the year and was 30.2% higher in August than in the same month of 2021. Compared to previous years, construction of buildings stands out; activity was also high in civil engineering, while it was lower in specialised construction work (installation works and building completion). The implicit deflator of the value of completed construction works (used to measure prices in the construction sector) was 18% in August, which is slightly less than in previous months.

Some other data suggest significantly lower construction activity. According to the data on VAT, the activity of construction companies in the first seven months was 7% higher than last year. Based on data on the value of construction put in place, the difference in the growth of activity was 17 p.p.

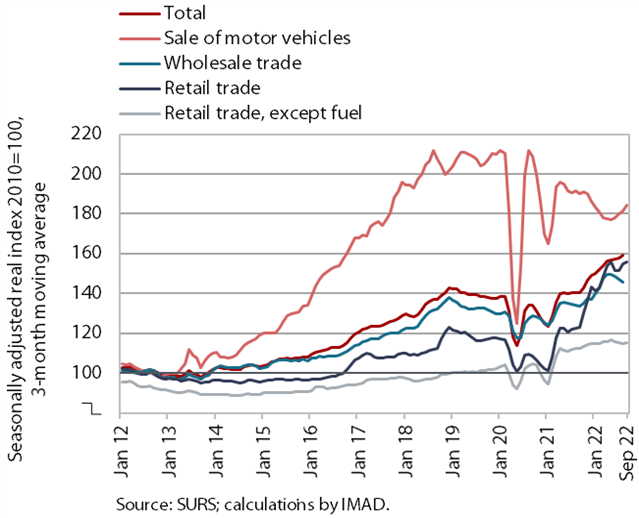

Turnover in trade, September 2022

According to preliminary data, turnover in trade declined in September after growth in August, but in the third quarter as a whole it remained similar to the second quarter in most sectors. The exception was turnover in wholesale trade, which recorded a significant drop, and turnover in the sale of motor vehicles, which increased significantly. Despite the increase, the latter was the only major trade segment to fall far short of pre-epidemic turnover, and turnover was also lower than in the third quarter last year. In the third quarter, turnover in retail sales of food, beverages and tobacco products also remained lower year-on-year. In other sectors, year-on-year turnover growth continued to weaken.

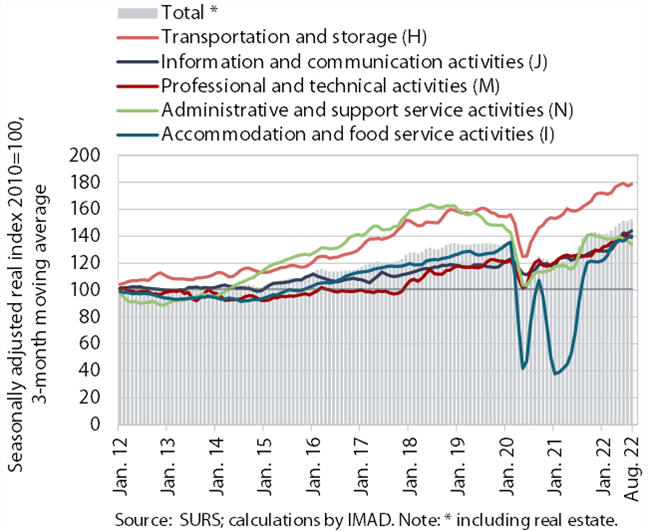

Turnover in market services, August 2022

After falling in July, real turnover in market services rose again in August, by 3.2% in current terms and by 7.8% year-on-year. After several months of decline, turnover in transportation, especially in storage, rose strongly again in current terms. Turnover also rose again in information and communication activities, with all services contributing to growth. Turnover continued to decline in administrative and support service activities, mainly due to a significant drop in travel agency activities. With the decline in current terms in overnight stays by domestic and foreign tourists, turnover in accommodation and food service activities also fell slightly. Turnover in professional and technical activities declined again, this due to a decrease in consultancy activities.

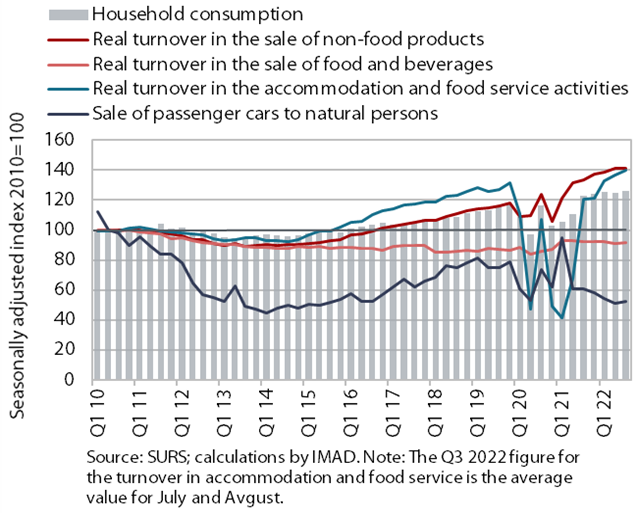

Selected indicators of household consumption, August–September 2022

Household consumption in the third quarter was 2.6% higher than a year ago. Turnover in retail sales of non-food products increased by 3.7% year-on-year in real terms in the third quarter. The consumption of tourist services abroad was also slightly higher than last year, while household consumption of tourist services in the domestic market was significantly lower year-on-year after the deadline for the redemption of vouchers expired. Sales of new passenger cars to individuals and sales of food, beverages and tobacco products were also lower year-on-year (by 15.3% and 1.9% respectively). Since mid-September, a low base effect has also contributed to the year-on-year growth due to the tightening of COVID-19 measures last autumn, which (according to fiscal cash registers) mainly led to higher year-on-year growth in some cultural, sports, entertainment and personal services, food and beverage service activities, and in certain shops selling non-food products.

Economic sentiment, October 2022

The economic climate deteriorated further in October and remained below the long-term average. Compared to the previous month, confidence in retail trade deteriorated the most, followed by manufacturing and service activities. Consumer sentiment was somewhat more upbeat than in September, and sentiment also improved in construction. Year-on-year, only confidence in retail trade was higher, while it was significantly lower than a year ago in other activities. The sharpest year-on-year decline in confidence was recorded among consumers, where it is at the level of April 2020, and in manufacturing. Amid high inflation, consumers are increasingly pessimistic about the future economic situation of the country and the financial situation of households compared to last year, and manufacturing companies are scaling back their expectations for production and exports amid high prices of energy and other commodities and supply chain problems.

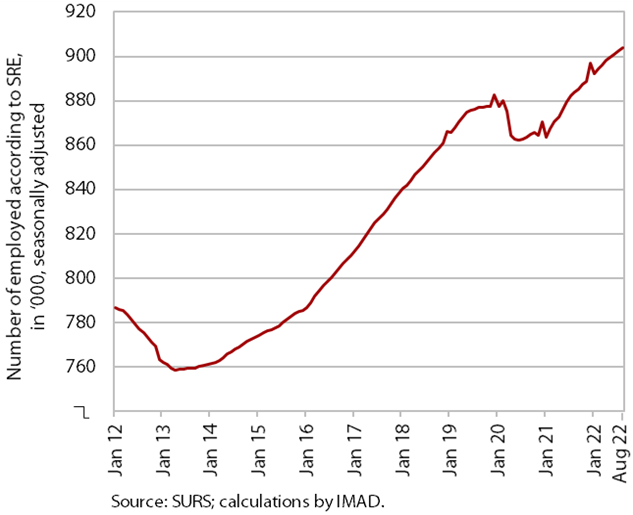

Number of persons in employment, August 2022

Year-on-year growth in the number of persons in employment in August was similar to the previous two months (2.3%) and slightly lower than at the beginning of the year. It remained high in construction, which faces a significant labour shortage. Employment of foreign workers has recently been increasingly contributing to overall employment growth – in August, foreign workers contributed 73% to year-on-year employment growth. Consequently, the share of foreign nationals among all persons in employment is also increasing, up 1.4 p.p. to 13.6% over the last year. Activities with the largest share of foreign workers are construction (47%), transportation and storage (32%), and administrative and support service activities (26%). In the first eight months, the number of people in employment rose by an average of 2.8% year-on-year.

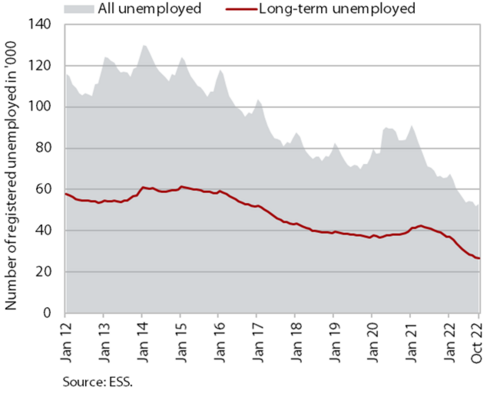

Number of registered unemployed persons, October 2022

According to seasonally adjusted data, the decline in the number of registered unemployed was similar as in previous months (-1.2%). According to original data, 52,991 persons were unemployed at the end of October, which is 1.8% more than at the end of September. This is mainly due to seasonal trends related to a higher inflow of first-time job seekers into unemployment. Year-on-year, unemployment was down 20.5%. Under conditions of high demand for labour, which is also reflected in the high vacancy rate, the number of long-term unemployed has also been declining since May last year – their number was almost a third lower year-on-year in October. The number of unemployed people over 50, who, like the long-term unemployed, are harder to place, is also declining – in October, their number was a good fifth lower than a year ago.

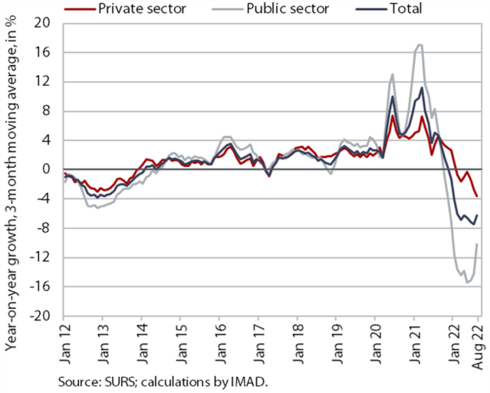

Average nominal gross wage per employee, August 2022

Amid high inflation, the average gross wage fell by 4.8% year-on-year in real terms in August; due to the base effect of last year, the decline was more pronounced in the public sector (-7.2%) than in the private sector (-3.4%). In the private sector, the year-on-year decline was somewhat smaller in real terms than in July but stronger than in other months this year. In the public sector, on the other hand, the year-on-year decline in real terms was smaller than in previous months, which is related to the year-on-year effect of the cessation of payment of most COVID-19 bonuses in July last year. In the first eight months of this year, the average salary was 6.7% lower in real terms than in the same period last year (2.1% in the private sector, 13.5% in the public sector).

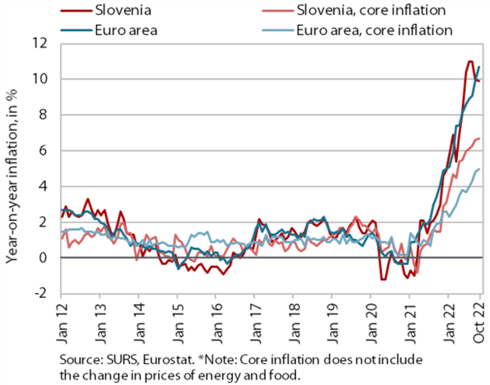

Consumer prices, October 2022

The year-on-year increase in consumer prices continued to slow slightly in October (to 9.9%). The increase in energy prices slowed further to 18.7% year-on-year, the lowest level in six months. Energy contributed 2.2 p.p. to year-on-year inflation. The slower growth was mainly the result of a higher base from last year and also the monthly decline in oil derivatives prices, which still largely exclude the 25 October price hike. In terms of energy prices, solid fuel prices continue to rise rapidly. In the last two months alone, they rose by more than 30%, and year-on-year they were up by almost 125%. The year-on-year increase in food and non-alcoholic beverage prices continued to strengthen in October, reaching 17.2% (the highest in two decades) and contributing 2.8 p.p. to inflation. The monthly increase in food and non-alcoholic beverage prices was 2.5%, the second highest this year. The year-on-year growth in durable goods prices, which had been just over 10% since the end of the first half of the year, fell to 9.8% in October. The year-on-year increase in prices of semi-durable goods was still relatively subdued at 4%. Service prices rose by almost 6% year-on-year.

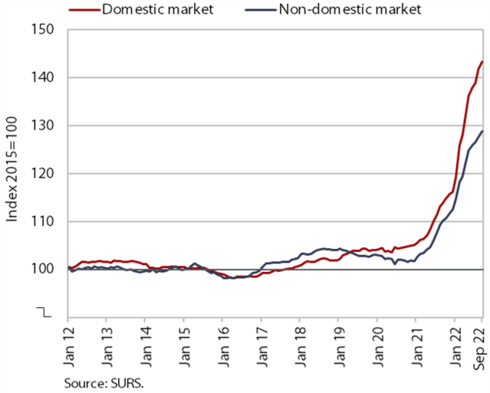

Slovenian industrial producer prices, September 2022

The year-on-year increase in Slovenian producer prices had gradually slowed in recent months before rising slightly again in September (to 21.3%). This was mainly due to the renewed increase in the growth of prices on the domestic market, where, as in August, energy prices rose the most (they were about 110% higher year-on-year), but also to the increase in consumer goods prices (16.9%). The year-on-year increase in the growth of producer prices in the groups of intermediate goods (19.8%) and capital goods (10.5%) slowed further as economic activity slowed. Prices on foreign markets rose year-on-year with a dynamics similar to that in August. The high, almost 30% monthly increase in energy prices stands out (23.3% year-on-year), but its contribution to overall growth is relatively small due to its low weight (1.8%). Year-on-year, the price increases in the intermediate goods (25.4%) and consumer goods (8.4%) groups slowed slightly.

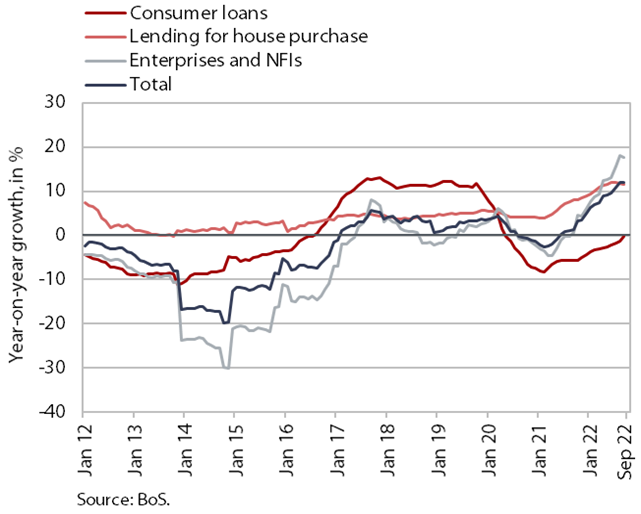

Growth in loans to domestic non-banking sectors, September 2022

The year-on-year growth in the volume of bank loans to domestic non-banking sectors remained unchanged at 12% in September. We assume that the tightening of credit conditions is already having some impact on bank lending activity, especially on the volume of corporate and NFI loans, which stagnated in September compared to the previous month. The growth of loans to households also slowed slightly. Despite the slowdown, year-on-year growth in corporate and NFI loans remained relatively high (17.6%), while growth in household loans remained slightly above 8%. Growth in domestic non-banking sector deposits slowed year-on-year in the first half of the year; while it strengthened again slightly as the year progressed, at 7.1% in September it was still 1.5 p.p. lower than at the end of last year. In particular, growth in deposits by non-financial corporations (8.1%) is increasing, which we believe will strengthen funds in bank accounts after the elimination of deposit fees, while creating liquidity reserves as borrowing conditions tighten and economic activity slows. The quality of banks’ assets remains solid and the share of non-performing loans is still only slightly above 1%.

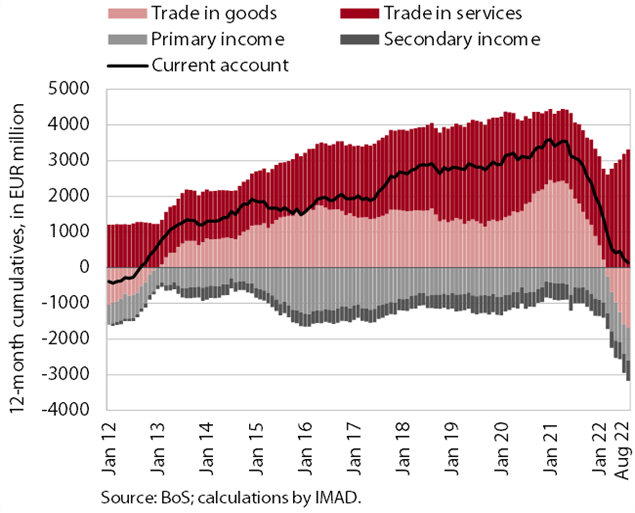

Current account of the balance of payments, August 2022

The current account surplus in the last 12 months was significantly lower year-on-year (EUR 137.3 million compared to EUR 3 billion) and a deficit of EUR 212.5 million was recorded in the first eight months of 2022. The lower surplus was mainly due to the goods trade balance (the surplus turned into a deficit), as imports of goods grew faster in nominal terms than exports in the face of stronger domestic consumption and deteriorated terms of trade. Net outflows of primary and secondary income were also higher year-on-year. The primary income deficit was higher due to lower subsidies from the EU budget and more customs duties paid into the EU budget this year related to the import of electric vehicles for the entire EU market (via the port of Koper). The higher secondary income deficit arose from higher private sector transfers abroad. The services surplus increased, especially in trade in travel (easing of COVID-19 restrictions) and in trade in transport services related to the growth of international trade in goods.

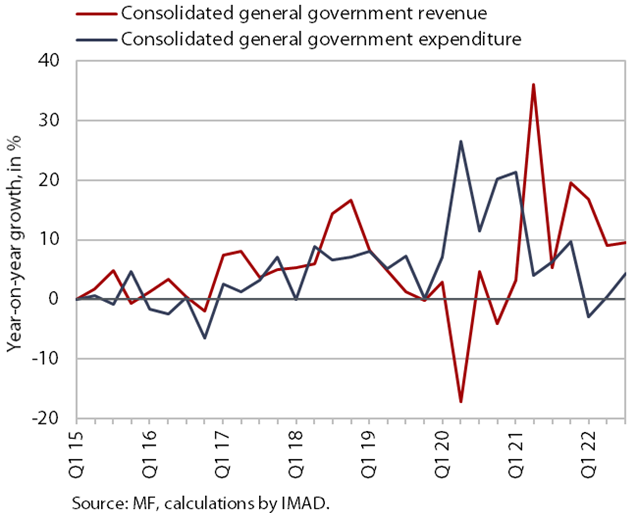

Consolidated general government revenue and expenditure, September 2022

The deficit of the consolidated balance of public finances was noticeably lower in the first nine months of 2022 than in the same period of 2021. It totalled EUR 378 million in the first nine months of 2022, compared with EUR 2.1 billion in the same period last year. Revenue increased by 11.7% year-on-year in the first nine months of the year. Due to better corporate performance, the growth came mainly from corporate income tax and, with the strengthening of private consumption and inflation, from VAT. Due to the reduction in excise duties on energy and electricity and changes in the personal income tax legislation, the growth in these revenues is modest, as is the growth in non-tax revenues, as there will be no one-off revenues from fees for the use of radio frequencies this year. Revenues from the EU budget increased significantly, due to the inflow of funds from the Recovery and Resilience Facility and from structural funds under the 2014–2021 multiannual financial framework (MFF). In the first nine months of the year, expenditure increased by 0.6% year-on-year. Expenditure on goods and services, capital formation and payments to the EU budget increased year-on-year. In the first nine months, measures to mitigate the consequences of the epidemic amounted to EUR 654 million, compared to EUR 2,388 million in the same period last year. Thus expenditure was lower mainly on civil servants’ wages, transfers to individuals and households, and subsidies.

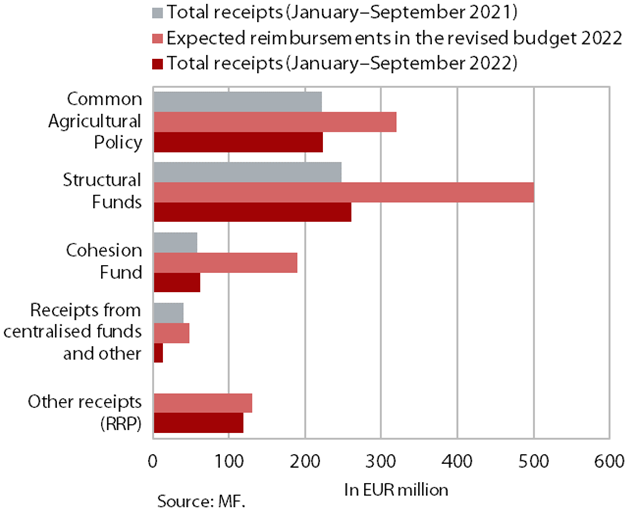

EU budget receipts, September 2022

Slovenia’s net budgetary position against the EU budget was positive in the first nine months of 2022 (EUR 142.4 million). In this period, Slovenia received EUR 677.3 million from the EU budget (56.9% of receipts envisaged in the state budget for 2022) and paid EUR 534.9 million into it (74.9% of planned payments). The bulk of receipts in this period were resources from structural funds (38.5% of all reimbursements to the state budget) and resources for the implementation of the Common Agricultural and Fisheries Policy (32.9%), while resources from the EU Cohesion Fund (9.1%) represented only a small part. The second instalment of the advance payment for the implementation of RRP was paid into the state budget from the Recovery and Resilience Facility. According to SVRK data, by the end of June 2022, Slovenia had absorbed (payments to beneficiaries) 71% of funds available under the 2014–2020 financial perspective (including React-EU).