Competitiveness

Related Files:

Slovenian Economic Mirror 1/2016

The EC and IMF predict a continuation of economic growth in Slovenia’s main trading partners in 2016, but point to increased risks particularly with regard to developments in emerging economies. Most short-term indicators of economic activity in Slovenia remained at the achieved levels towards the end of 2015. Towards the end of the year, the number of employed persons continued to grow; in December and January, the decline in the number of registered unemployed came to a halt

Related Files:

- International invironment

- Economic developments

- Labour market

- Prices

- Balance of payments

- Financial markets

- Public finance

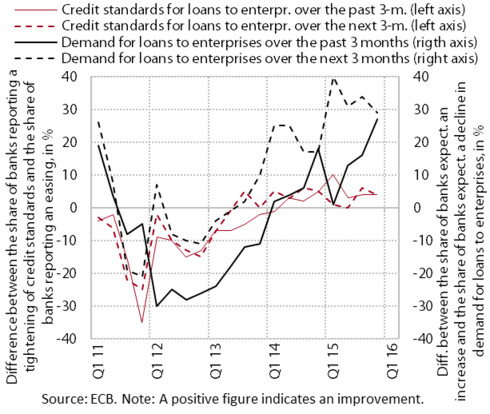

The indicators of the ECB survey for the final quarter of 2015 indicate a further improvement in lending conditions for enterprises for all loans regardless of maturity and enterprise size and for household housing and consumer loans. In addition to higher competition between banks, a significant factor in the improvement is access to alternative sources of funding. The structure of loan demand is changing, as enterprises increased demand for working capital loans and inventories, fixed investment and loans for corporate restructuring, which is a sign of improvement of the situation in the business sector.

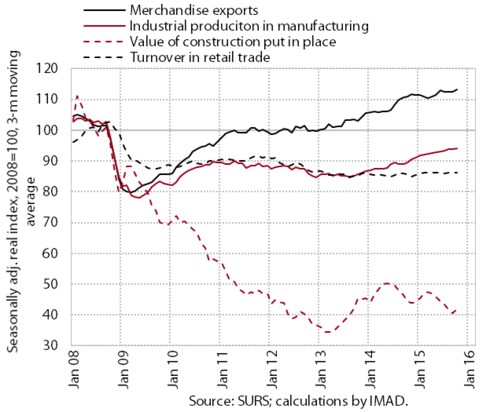

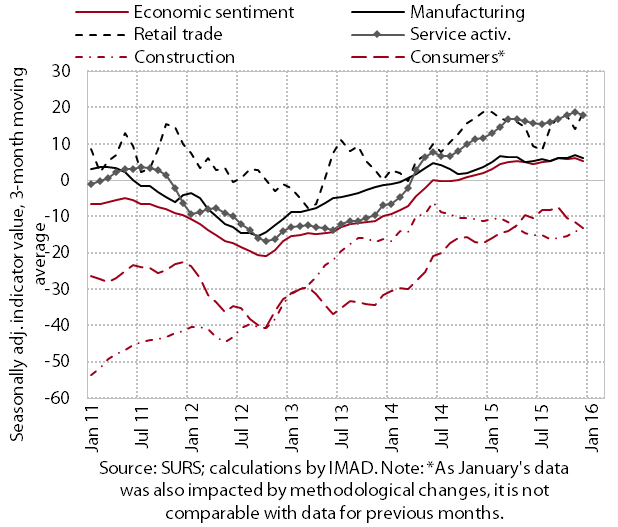

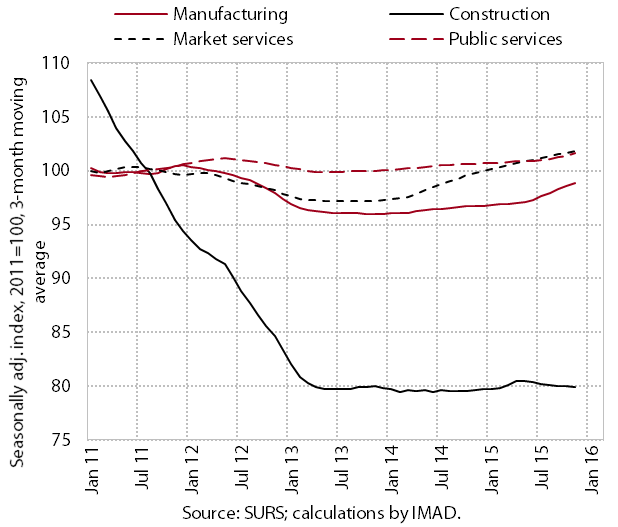

Most short-term indicators of economic activity in Slovenia remained unchanged at the end of 2015. In the eleven months to November, real merchandise exports and production volume in manufacturing were around 5% higher year-on-year, but their growth eased slightly in the last few months of the year. As in the previous year, they strengthened under the impact of positive developments abroad and due to the improvement in the competitiveness of Slovenia’s economy in the last few years. They also had a positive impact on services, where turnover is steadily rising. This is also attributable

to increased private consumption related to the steady recovery on the labour market. Activity in construction remains very low, although it swung upwards at the end of the year owing to increased government investment. Confidence in the economy deteriorated in early 2016, but remains high and indicates a continuation of the gradual recovery of economic activity in 2016.

Real merchandise exports increased again at the end of the year, while imports declined. Within merchandise exports – which were mostly expanding amid growing foreign demand in 2015 – particularly exports of machinery and miscellaneous manufactured articles rose towards the end of the year; exports of vehicles, metals and chemical products, the main drivers of growth for one year and a half, remained unchanged. Reflecting the sluggish recovery of domestic demand, growth in merchandise imports lagged behind export growth. Imports had even declined slightly since the summer months, on account of lower imports of intermediate and consumer goods, while imports of investment goods rose.

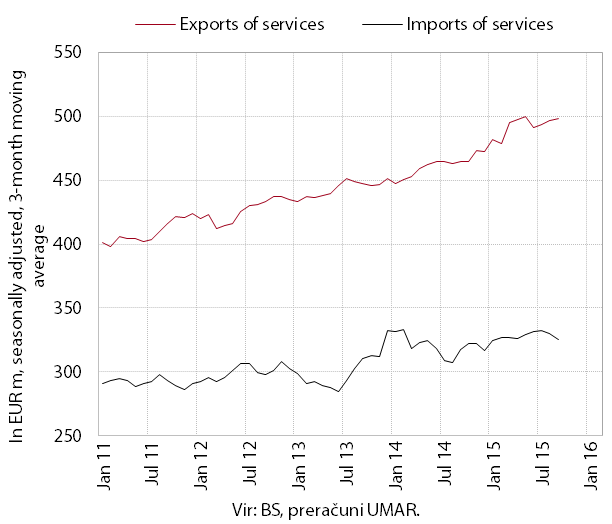

At the end of the year, nominal exports of services continued to increase, while the decline in imports came to a halt. Growth in services exports in the first eleven months was mainly due to exports of travel underpinned by higher spending by foreign tourists and exports of transport services. Imports were also up year-on-year in the first eleven months, owing largely to higher imports of travel amid higher spending by domestic tourists abroad and imports of telecommunication and technical, trade related, services. In contrast, imports of construction services dropped by half relative to the same period in 2014.

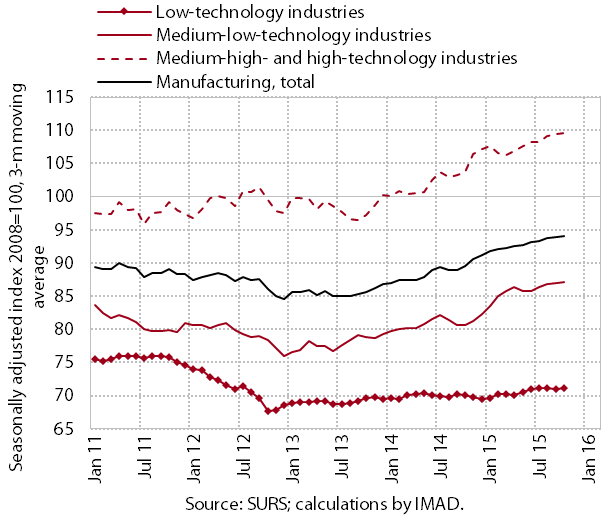

At the end of the year, manufacturing production remained at a high level similar to that in the third quarter. In the eleven months to November, it was up year-on-year in almost all industries. Amid higher foreign demand, the largest year-on-year increases in production were seen in some more export-oriented medium-lowtechnology industries (the metal and rubber industries) and industries with higher technological intensity (the manufacture of ICT and electrical equipment, the manufacture of transport equipment). In some industries production was also boosted by lower import prices. The strong growth in the manufacture of motor vehicles, which eased notably in the second half of the year, was mostly the result of increased activity at the beginning of production of two new passenger car models in the

second half of 2014. Production was also up year-on-year in most low-technology industries, in addition to the wood-processing industry (because of the base effect), particularly in the export-oriented eather industry.

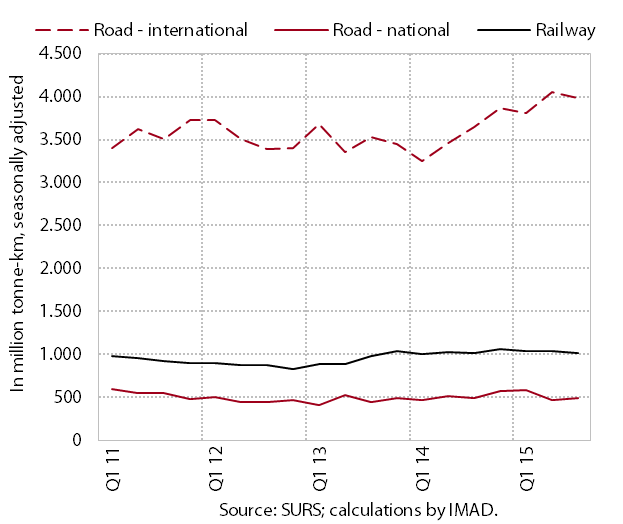

After increasing for a long period, road freight transport maintained its relatively high level in the third quarter of 2015. Its growth was mainly related to international transport, particularly journeys performed solely abroad. The volume of national freight transport remained down year-on-year, reflecting a decline in activity of some domestic sectors. With lower growth in demand for transport services from foreign companies, the volume of rail freight transport has stagnated for quite some time.

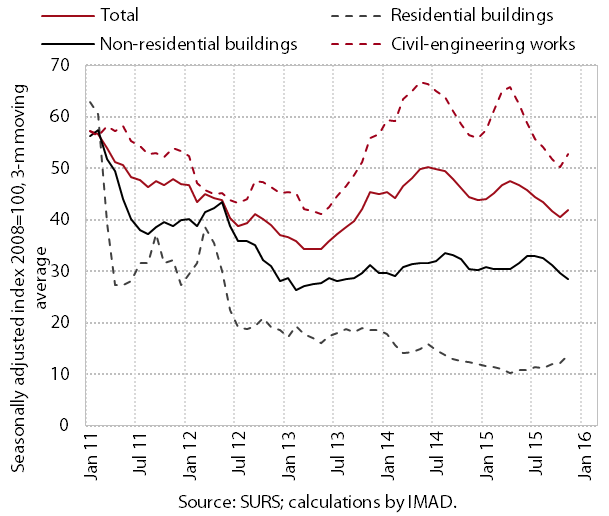

At the end of last year, the value of construction put in place swung upwards but remained low. The upswing at the end of the year was mainly due to activity in civil engineering as a result of intense government investment before the expiry of access to EU funds from the 2007–2013 financial perspective. With further declines in the stock of contracts and the value of new contracts in all three construction segments, the prospects for 2016 remain poor.

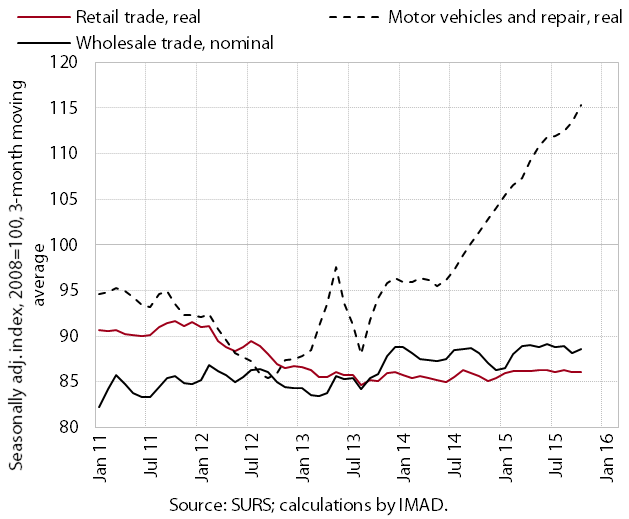

At the end of 2015, the distributive trades sector recorded further growth in the sale of motor vehicles and some nonfood segments. The sales of new cars to natural and legal persons were up again.6 Within retail trade, turnover continued to fall in stores selling food, while turnover growth in the sale of non-food products moderated at the end of the year. The latter recorded a further increase in the sale of semi-durable goods, particularly clothing, footwear, medicines and cosmetics.

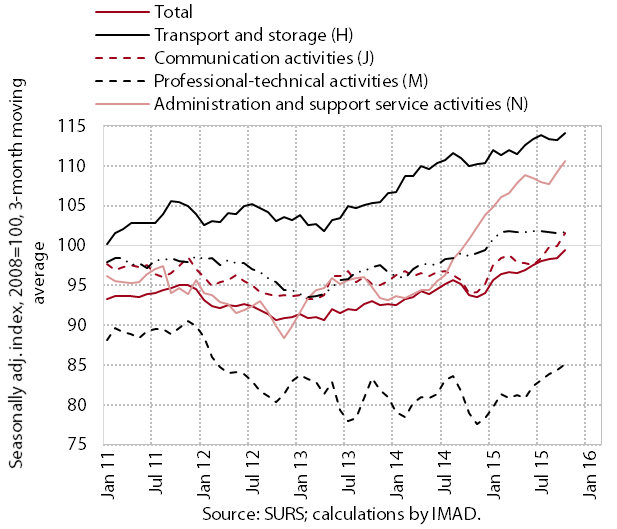

Nominal turnover in market services continued to increase at the end of 2015 in most services. Its growth stemmed from the relatively high production activity (particularly in employment services) and the pick-up in private consumption. In some services, foreign demand also made a significant contribution to growth (especially in transport and computer services).

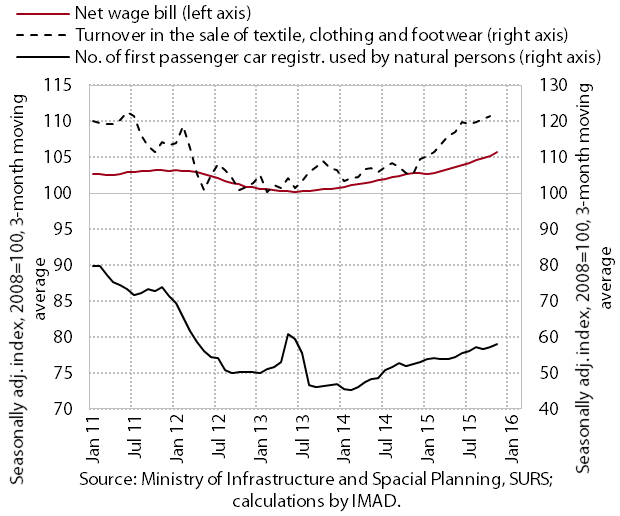

With growing household incomes, some categories of household final consumption expenditure rose further in the last quarter of 2015. Boosted by extraordinary payments, the wage bill growth strengthened further at the end of 2015. Within household final consumption expenditure, expenditure on vehicle purchases recorded further growth; spending on some semi-durable goods was also up. Household also increased expenditure on tourism-related services.typo3/#_ftn1

Confidence in the economy remains high, despite the deterioration early this year.typo3/#_ftn1

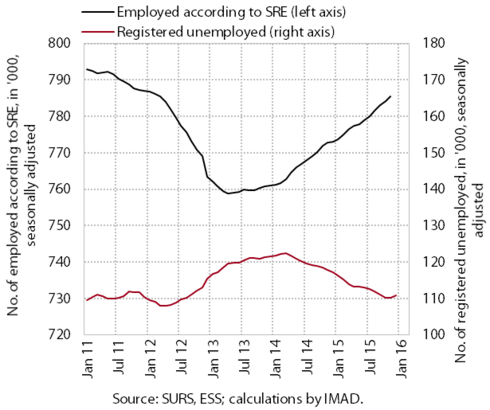

The number of employed persons continued to grow at the end of the year. Higher activity in manufacturing and market services was reflected in a further increase in employment in these sectors. We estimate that the manufacturing sector also employed a considerable number of people hired through employment placement agencies. In public service activities, employment remained up year-on-year in health and education, particularly pre-primary and primary education as a result of larger generations enrolled; in public administration it remained down, consistent with the adopted policy.

The number of registered unemployed ceased to decline in December and January. Having been falling since April 2014, it rose slightly at the end of 2015 and stayed at a similar level at the beginning of 2016, the main reason being that more people registered as unemployed due to the termination of fixed-term contracts than usual at this time of the year.10 The number of registered unemployed nevertheless remained 4.9% lower year-on-year at the end of January, at 118,165.

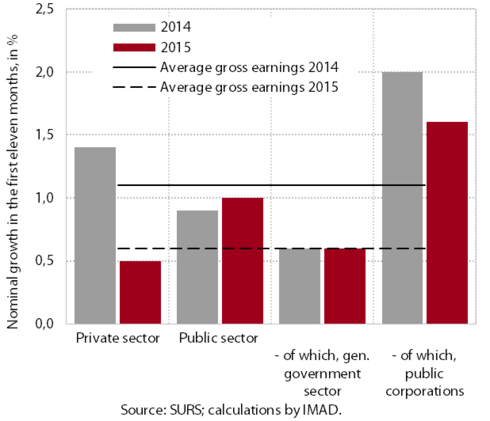

At the end of last year, the growth of average gross earnings strengthened, but in the eleven months to November, it was significantly lower than in the same period of 2014. With the highest 13th month payments and Christmas bonuses in seven years, earnings in the private sector and public corporations rose visibly with regard to the previous month. Earnings in the general government sector also continued to rise, in the last two months primarily on account of increased overtime and extraordinary payments, which can be attributed to increased workload due to the inflow of refugees.

Although they rose strongly in November, private sector earnings recorded much lower year-on-year growth in the first eleven months of 2015 than in the same period of 2014, which is, besides companies’ efforts to maintain competitiveness, mainly attributable to the absence of price pressures and changes in employment structure. In the public sector, earnings increased further year-onyear in the first eleven months of 2015, on account of the payments of suspended promotion raises in 2014 and growth in public corporations.

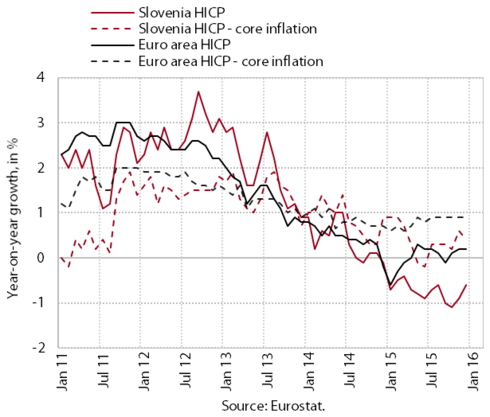

Slovenia recorded deflation11 at the end of the year (-0.6%), while prices at the level of the entire euro area rose slightly (0.2%). Deflation was mainly due to lower energy prices. As a result of the larger share of energy consumption in total household consumption, their negative contribution was greater than on average in the euro area. With a slower recovery in household consumption, prices of non-energy goods were also lower year-on-year in Slovenia, which is the main reason for the considerably lower core inflation. Prices of food and services were up both in Slovenia and across the euro area.

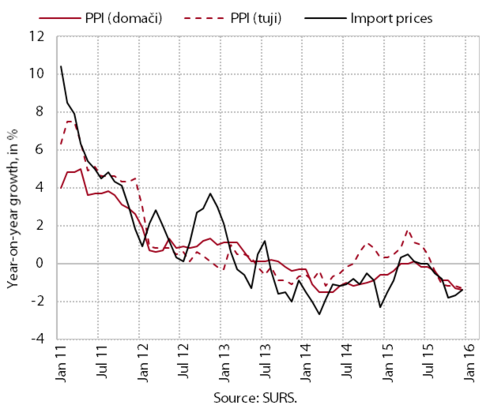

With a further decline of commodity prices on global markets, import prices remained down year-on-year at the end of 2015; the decline in industrial producer prices on the domestic marked deepened; prices on foreign markets also remained lower.

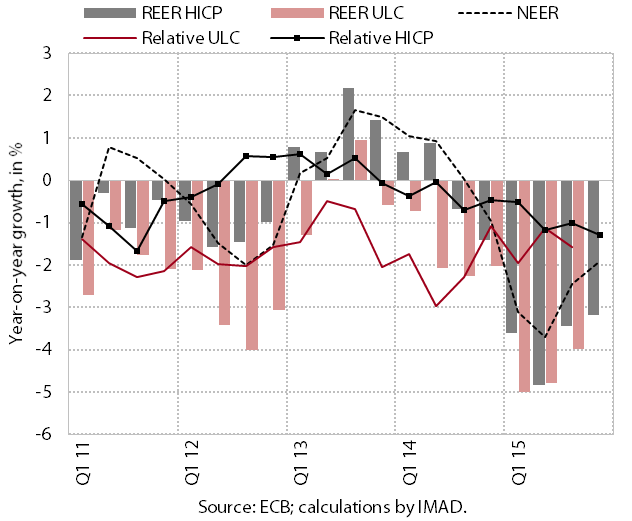

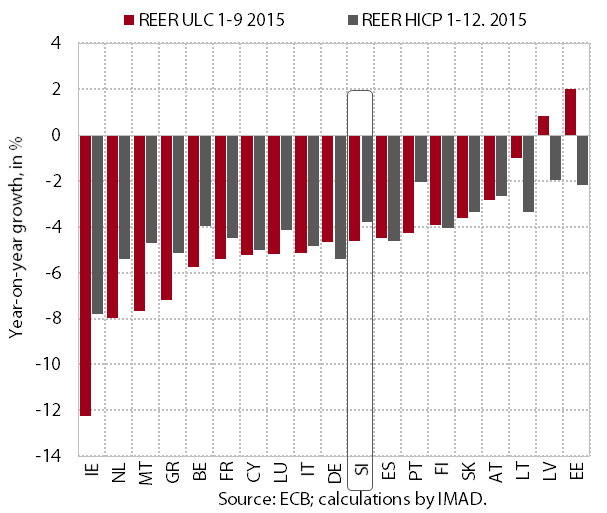

In the second half of 2015, Slovenia’s price and cost competiveness continued to improve. The improvement was due mainly to the decline in the nominal effective exchange rate and partly to lower relative12 prices and unit labour costs.

In terms of gains in price and cost competitiveness as measured by the real effective exchange rate, Slovenia ranked in the middle of euro area countries in 2015. It recorded a smaller decline in the nominal effective exchange rate than most other euro area countries because of the geographical structure of its trade. In contrast, the year-on-year declines in relative prices and costs were among the largest in the euro area.

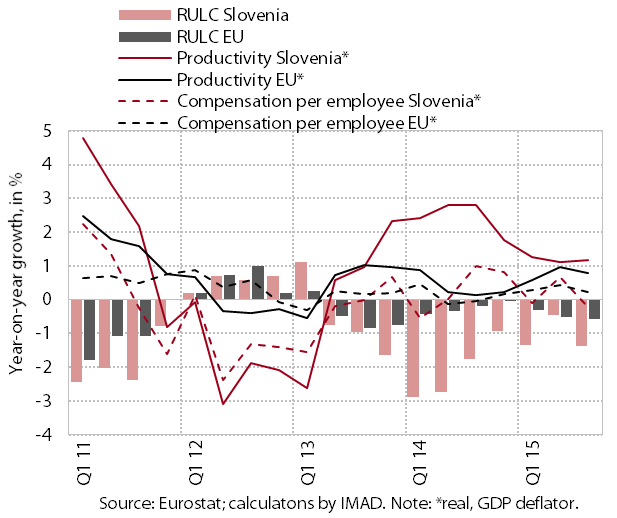

The larger decline in unit labour costs in the first nine months of 2015 than, on average, in the euro area and the EU was a consequence of stronger growth in labour productivity. In Slovenia, compensation per employee remained at the same level as one year before, similar to the euro area as a whole, while it rose in the EU. Slovenia’s position therefore continued to improve. Nevertheless, the level of unit labour costs in the first nine months of 2015 compared with the pre-crisis year 2007 was still higher than on average in the EU.

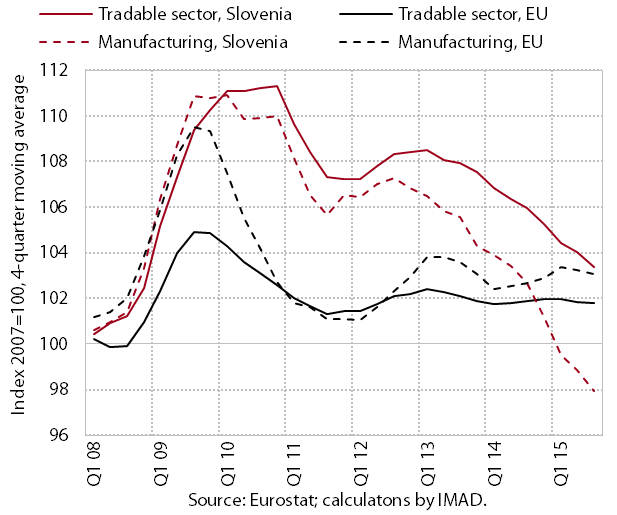

Last year, too, the improvement in cost competitiveness mainly stemmed from the tradable sector,14 particularly manufacturing. The level of real unit labour costs in manufacturing has already been lower than in 2007 since the first quarter of 2015. Their position with regard to the pre-crisis period is also better compared with the average in the euro area and the EU.

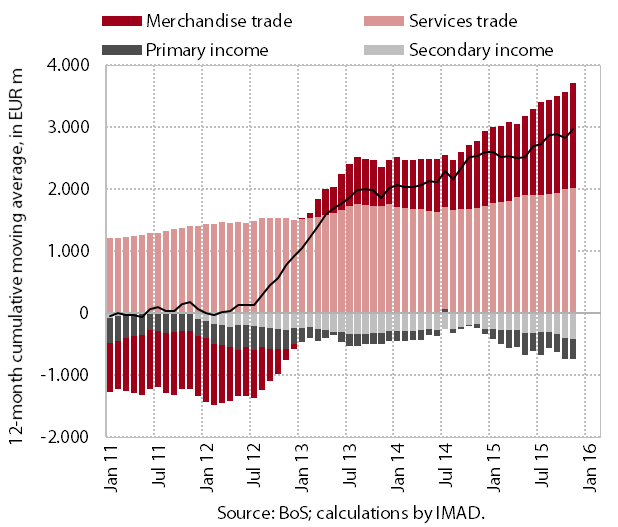

The current account surplus widened further towards the end of 2015. In the eleven months to November, it was up year-on-year owing to a larger surplus in international trade in goods and services, which was impacted not only by favourable export developments, but also the improved terms of trade. The deficit in primary income was up chiefly as a result of the net outflow of direct investment income, in particular estimated reinvested earnings of equity capital of direct investment. The year-on-year widening of the deficit in secondary income was mostly due to a larger net outflow of various current transfers. In the twelve months to November 2015, the current account surplus totalled 7.7% of estimated GDP.

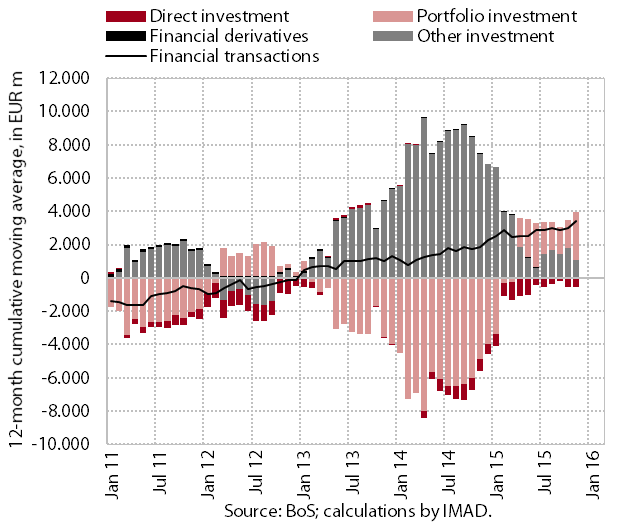

With the change in the structure of financial flows, the net outflow of international financial transactions in the first eleven months of 2015 (EUR 3.1 bn) was higher than in the same period of 2014 (EUR 2.0 bn). Its year-onyear increase was mainly due to the lower net external debt. A part of the private financial sector increased financial investment in foreign securities, which is linked to excess liquidity on the domestic market and higher yields on international financial markets. The year-onyear decline in the net outflow of other investment was mainly attributable to the Bank of Slovenia withdrawing currency and deposits from foreign accounts. Commercial banks’ deleveraging abroad was lower than in 2014.

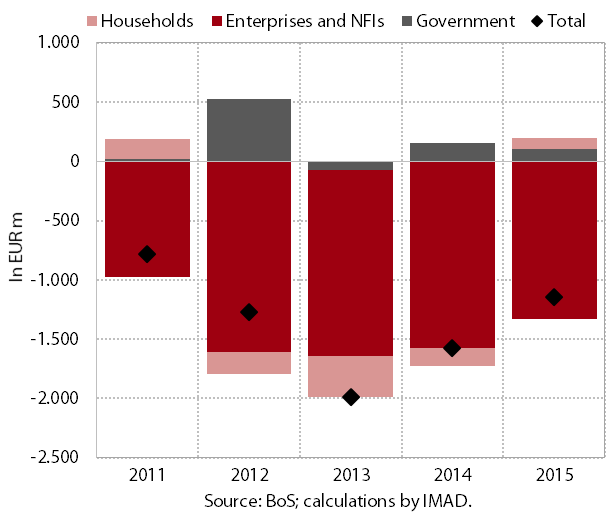

The decline in the volume of loans by domestic nonbanking sectors in 2015 was smaller than in 2014.18 Loan volume contracted by EUR 1.1 bn, by almost 30% less than in 2014, which was a consequence of an increase in household loans and an approximately 15% smaller decline in corporate and NFI loans. In the last quarter of 2015, the volume of corporate and NFI loans for other purposes otherwise also rose more noticeably, by more than EUR 90 m. Corporate and NFI net deleveraging abroad stabilised at an annual level of EUR 600 m to EUR 700 m in the second half of the year. This is more than a quarter less than in the same period of 201419 and entirely the result of net repayments of long-term loans. In

November, the share of non-performing claims dropped slightly more because of a decline in on-performing claims against non-financial corporations, but is still

relatively high, at EUR 3.7 bn, and accounts for 10.3% of

the banking system’s total exposure.

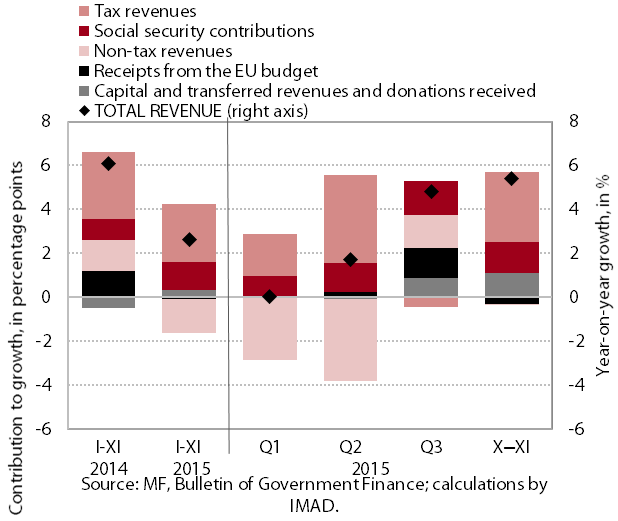

General government revenue in the first eleven months of 2015 was 2.6% higher year-on-year. Total revenue growth stemmed mainly from tax revenues, among which the following increased the most: (i) revenues from the corporate income tax (mainly as a result of positive annual tax assessments after the improvement of business performance in 2014) and the personal income tax (owing to higher employment and earnings); and (ii) revenues from VAT (as a result of growth in private consumption and more efficient tax collection) and excise duties (partly as the payments of some excise

duties were postponed from November to December 2014). Revenues from most other taxes were also higher than in the same period of 2014, in particular revenues from taxes on financial and insurance services and CO2 emissions (as a result of the increase in tax rates). Further growth was also recorded for social contributions, which is related to increased employment, higher average earnings and the broadening of the contribution base. The significant year-on-year decline in non-tax revenues is related to one-off revenues20 in 2014 and was the main factor in last year’s moderation in total revenue growth.

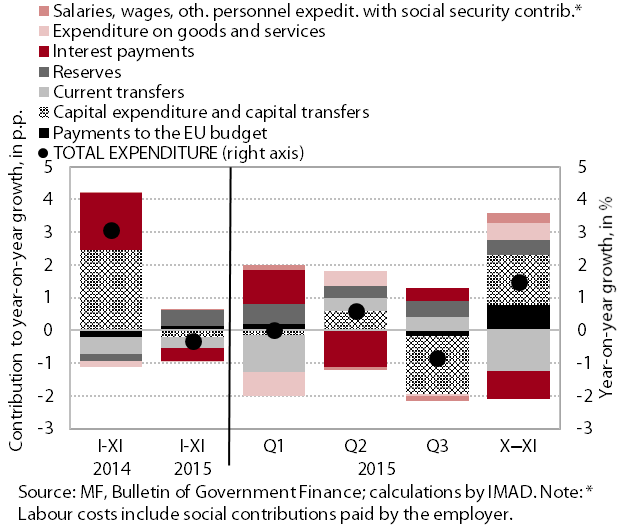

General government expenditure in the first eleven months of 2015 was similar to that in the same period of 2014 (-0.3%). Expenditures with the largest year-on-year declines include the following: (i) payments of subsidies; (ii) interest payments, as a result of new borrowing at a rate lower than that on the matured portion of debt; and (iii) investment expenditure, which is estimated to have increased significantly in December 2015 according to the released data on government budget outturn. The largest increases were posted for expenditure on special funds (the water protection fund and the climate change fund), which are recorded under reserves. Transfers to households were also higher, which is attributable to higher expenditures on sickness benefits, the annual pension supplement21 and cash benefits, while transfers to the unemployed were down due to lower unemployment. The wage bill22 did not change much year-on-year, given that most measures were extended from 2014 to 2015.