Charts of the Week

Charts of the week from 15 to 22 December 2025: Slovenian industrial producer prices, electricity consumption by consumption group and other charts

Year-on-year growth of Slovenian industrial producer prices eased slightly in November compared with October, to 1.1%. With the number of working days unchanged year-on-year, industrial electricity consumption in November declined by 2.4%, while household consumption increased by 2.2%. Year-on-year nominal growth in the average gross wage was higher in October (7.7%) than in the preceding months, primarily due to stronger growth in the public sector. The number of persons in employment has stagnated for several months (seasonally adjusted), while on a year-on-year basis it was 0.4% lower both in the first ten months and in October. Following a decline in the first quarter, growth in the value of construction put in place strengthened markedly from the second quarter onwards; over the first ten months it was one tenth higher year-on-year. The 12-month current account surplus (up to October) amounted to EUR 2.7 billion (3.8% of estimated GDP), and was EUR 545.5 million lower than in the previous 12-month period.

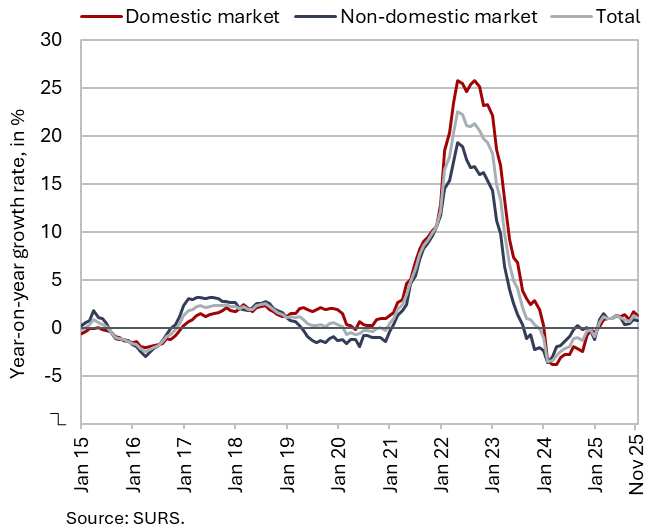

Slovenian industrial producer prices, November 2025

In November, the year-on-year growth in Slovenian industrial producer prices declined by 0.2 p.p., to 1.1%, amid a 0.3% month-on-month increase. The lower growth rate was primarily driven by a higher base effect in energy products, which had risen by more than one tenth in November last year. Energy prices were thus 7.3% lower year-on-year, and prices in the capital goods group were also slightly lower (by 0.1%). Prices of consumer goods continue to record the fastest growth (4.1%). This is driven mainly by the increase in prices of non-durable consumer goods (4.7%), where high year-on-year price growth in the manufacture of food products (5.5%) and beverages (5.6%) persists. Growth in raw material prices was 0.9% in November. Slovenian industrial producer prices were 1.3% higher year-on-year on the domestic market and 0.9% higher on foreign markets.

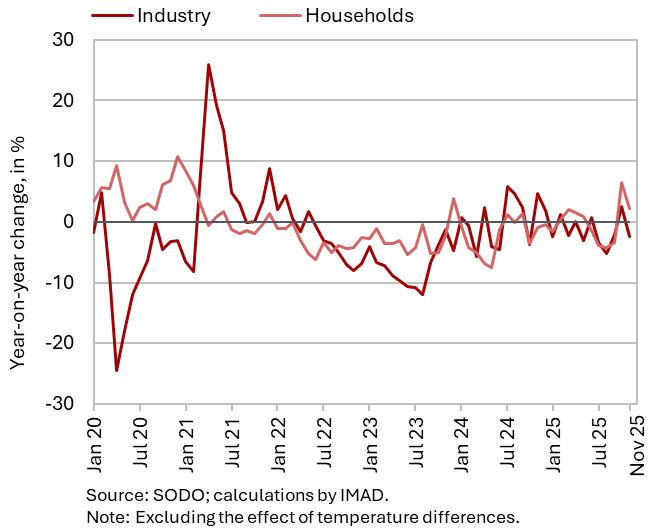

Electricity consumption by consumption group, November 2025

The November data indicate a year-on-year decrease in electricity consumption in industry. With the same number of working days, consumption in November was 2.4% lower than in the same month last year. By contrast, household electricity consumption increased by 2.2% year-on-year.

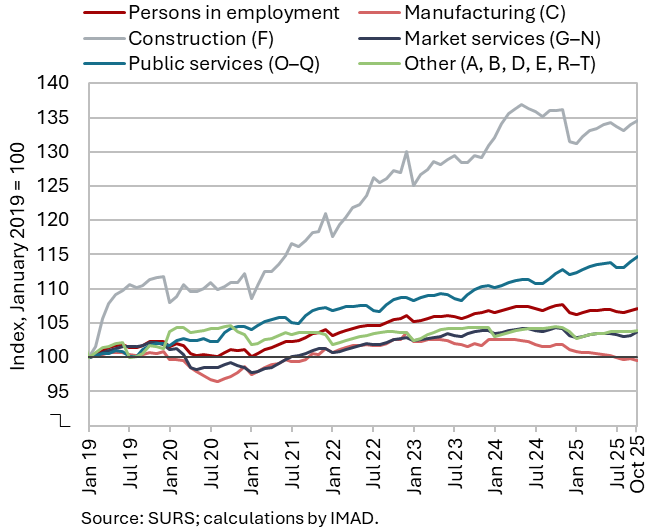

Number of persons in employment, October 2025

The number of persons in employment remained similar in October to previous months (seasonally adjusted) and was 0.4% lower year-on-year. The number of employees was lower year-on-year (–0.6%), while the number of self-employed increased (1.4%). The sharpest year-on-year decline in the number of persons in employment was recorded in administrative and support service activities (–3.6%), mainly due to a decrease in employment agencies, followed by manufacturing (–2.3%), and information and communication (–1.2%). The number of persons in employment continued to increase on a year-on-year basis in public service activities, particularly in human health and social work activities (up 3.4%). The number of foreign citizens in employment increased by 1.5% year-on-year in October, while the number of Slovenian nationals in employment declined by 0.7%.

In the first ten months, the number of employed persons remained 0.4% lower year-on-year.

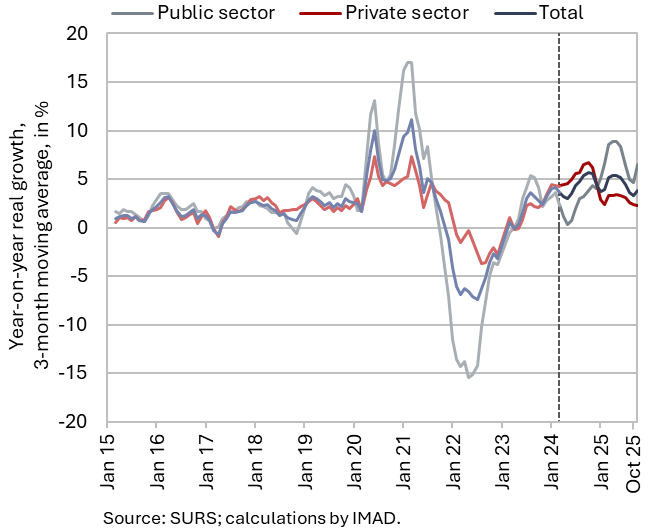

Average gross wage per employee, October 2025

Year-on-year nominal growth in the average gross wage was higher in October (7.7%) than in the preceding months, primarily due to stronger growth in the public sector. In the latter, the nominal wage was 12.1% higher year-on-year in October. The strengthening compared with the preceding months was due to the payment of the agreed second instalment of the increase in base wages. Growth in the private sector also remains relatively strong (5.2 %) amid still considerable labour shortages.

In the first ten months, the overall average gross wage increased by 4.6% in real terms (by 7% in nominal terms) – by 7.4% in the public sector and by 2.9% in the private sector (by 9.8% and 5.3% in nominal terms respectively).

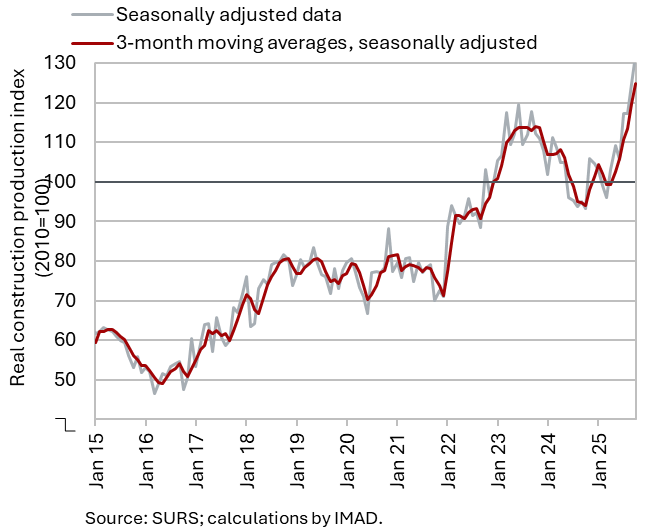

Activity in construction, October 2025

In October, the value of construction work put in place continued to strengthen markedly. Following a decline in the first quarter, construction activity strengthened over the remainder of the year. In October, it further increased by 6% month-on-month and was 36% higher than in October last year. In the first ten months of the year, the total value of construction put in place was 10% higher than in the same period last year. The values of all types of construction works increased, in particular in the construction of non-residential buildings (16%) and specialised construction activities (15%); growth was also higher in civil engineering (7%), while it remained modest in the construction of residential buildings (1%).

However, some other data suggest lower growth in construction activity. According to VAT data, the activity of construction companies in October was 18% higher than in the same month last year. The difference in activity growth compared with the data on the value of construction work put in place amounted to 18 p.p. Similarly, data on the value of industrial production in the manufacture of non-metallic mineral products, which is traditionally strongly linked to construction, do not indicate such high growth: in October, it was only 1% higher than in October last year.

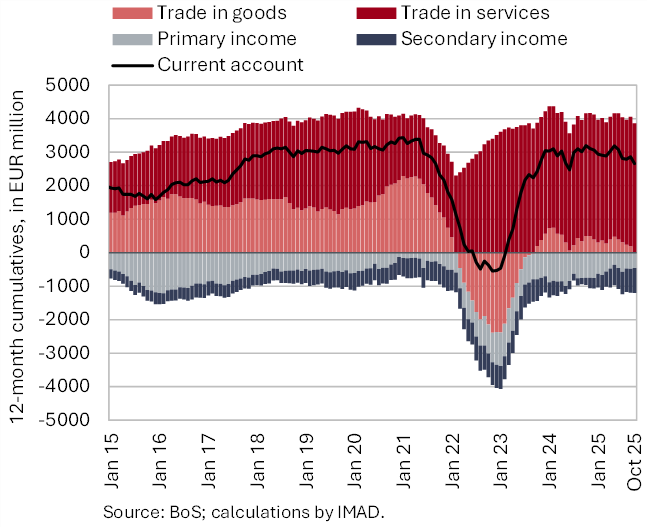

Current account of the balance of payments, October 2025

The 12-month current account surplus (until October) decreased by EUR 545,5 million compared to the previous 12-month period, amounting to EUR 2.7 billion (3.8% of estimated GDP). This change was driven by the secondary income balance and the goods trade balance. The higher secondary income deficit resulted from lower receipts of the general government sector from the EU budget and higher net transfers paid by the private sector to the rest of the world. The lower goods surplus was influenced by a smaller trade surplus with non-EU countries and a higher trade deficit with EU Member States. The services surplus increased slightly, mainly in trade in travel and transportation services. The primary income deficit narrowed, mostly due to lower net outflows of income from equity capital (dividends and profits). Net inflows of compensation of employees also increased, reflecting stronger growth in the earnings of Slovenians working abroad rose compared with the earnings of foreign workers employed in Slovenia.