Slovenian Economic Mirror

Related Files:

Slovenian Economic Mirror 6/2022

Domestic consumption growth in Slovenia remained high in the spring months. Household consumption was boosted by the easing of containment measures and record high employment. Household purchasing power is increasingly affected by rising prices, especially of energy and food. Inflation continued to rise in June. Prices rose by more than a tenth compared to the previous year. Inflation was mainly driven by energy prices, which were more than a third higher. Food price increases were also high. Growth in industrial producer prices and real estate prices also continued. Construction activity in April was again significantly higher than last year. Compared to previous years, the highest growth was seen in the construction of buildings. Cost pressures in construction, as in other activities, continue and are an important source of uncertainty about the future. This is also true for the export part of the economy, where activity increased in the spring months, but the high level of uncertainty in the international environment, in addition to rising costs and supply chain disruptions, have led to a decline in export orders in recent months.

Related Files:

- International environment

- Economic developments

- Labour market

- Prices

- Financial markets

- Balance of payments

- Public finance

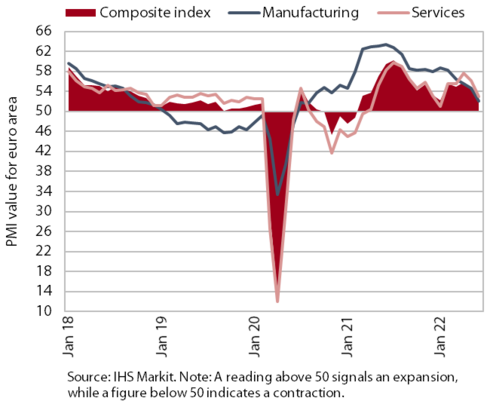

Euro area composite Purchasing Managers’ Index (PMI), June 2022

According to the available indicators, the growth of economic activity in the euro area continued in the second quarter. Growth in the first quarter stood at 0.6% quarter-on-quarter (GDP was 0.8% higher than before the beginning of the epidemic) and 5.4% year-on-year on a low base. The quarterly growth was driven by inventories and net trade in goods. Private consumption fell by 0.7% quarter-on-quarter, the most since the first quarter of 2021, amid high inflation and ongoing containment measures. According to the average value of the composite PMI, growth of economic activity in the euro area continued in the second quarter, albeit at a slower pace since May. In June, the indicator fell to the lowest level in 16 months. With the lifting of pandemic restrictions, growth in the second quarter was boosted by consumption in the services sector, while manufacturing activity was affected by increased supply chain disruptions due to the partial shutdown of the economy in China and the war in Ukraine. The economic sentiment indicator (ESI) in the euro area continued to deteriorate in June due to lower confidence among consumers, in trade and in construction, but it remains above the long-term average.

World trade and industrial production, April–June 2022

According to the composite PMI, global economic activity slowed in the second quarter as a whole compared to the first. The main hindering factors were the war in Ukraine and the shutdown of parts of the economy in China due to COVID-19, which affected commodity prices and caused supply chain problems. Growth in global economic activity accelerated in June following the lifting of lockdown in parts of China, thanks in particular to momentum in emerging markets. Growth slowed in the developed countries, especially in the US and the euro area. Several PMI indicators for June (new orders, confidence) point to an increased risk of a further slowdown in economic growth in the third quarter, as central banks around the globe are adjusting their monetary policies in response to strong inflationary pressures, contributing to tighter financing conditions. According to the OECD’s June forecast, global economic growth will slow from 5.8% last year to 3% this year and 2.8% in 2023.

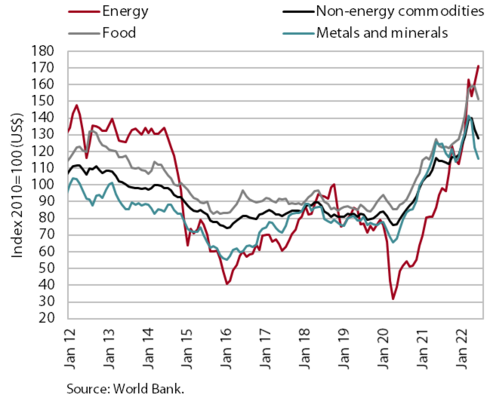

Commodity prices, June 2022

The price of Brent crude rose sharply again in June after the EU decided to cut imports from Russia. Compared to the previous month, the average dollar price increased by 8.5% to USD 122.7 per barrel and was up 67.7% year-on-year. The oil price in EUR recorded an even higher year-on-year increase, i.e. 91.1%, as the US dollar hit its highest level against the euro in 20 years in June. Dollar prices of natural gas on the European market increased by 15.1% compared to May, while they were 233.5% higher year-on-year. According to the World Bank, the average dollar prices of non-energy commodities in international markets fell in June compared to May, as prices of most non-energy commodity groups dropped. Dollar prices of non-energy commodities were on average 12.0% higher year-on-year, prices of food and fertilisers continued to rise sharply, while prices of wood and metals and minerals fell year-on-year, though remaining well above pre-epidemic levels. Rising energy prices continue to be the biggest contributor to annual inflation in the euro area, which averaged 8.6% in June.

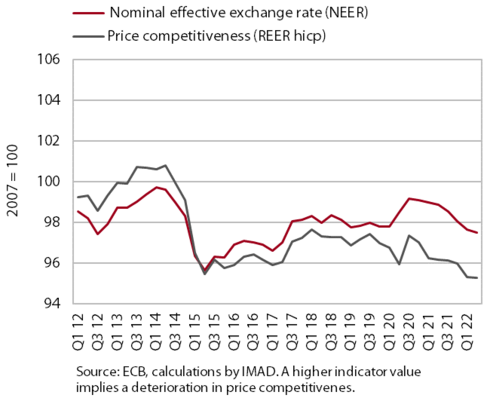

Effective exchange rate, Q2 2022

Also in the second quarter, the weak euro contributed to the favourable value of the price competitiveness index. The euro continued to depreciate against the currencies of some of the EU’s main trading partners, i.e. the US dollar, the Chinese yuan and the Swiss franc. Its value fell well below its long-term average against these currencies. At the same time, the euro appreciated, among others, against some European currencies (the Hungarian forint, British pound and Polish zloty). In the second quarter, the nominal effective exchange rate of the euro against a basket of 37 trading partners’ currencies thus remained at a comparable, relatively low, level to that in the first quarter of the year. The price competitiveness indicator (REER hicp), which is influenced by consumer price trends (measured by the HICP) in addition to currency relations, also remained at a similar level. The weak euro has a positive effect on exporters’ price competitiveness, but cost pressure from imported commodities and materials is increasing.

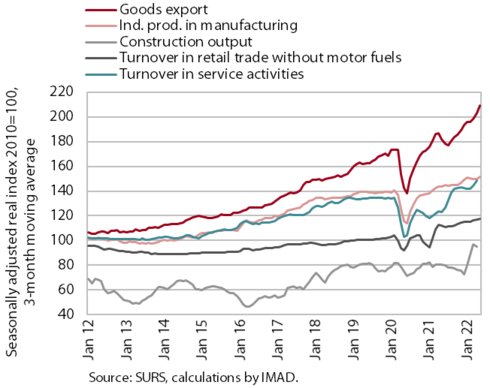

Short-term indicators of economic activity in Slovenia, April–June 2022

Domestic consumption growth in Slovenia remained high in the spring months, while price pressures are increasing; activity in the export part of the economy also increased, but future expectations are accompanied by great uncertainty. The easing of containment measures amid record high employment and, according to our estimates, further unwinding of household savings had a favourable impact on household consumption growth. Current consumption was boosted by the continued redemption of vouchers, and year-on-year growth was also the result of last year’s lockdown in the first third of April. In April, turnover continued to grow in trade and market services. After a sharp increase at the beginning of the year, construction activity declined slightly in April, but it remained significantly higher than last year. Compared to previous years, the highest growth was seen in the construction of buildings. Cost pressures in construction, as in other activities, continue and are an important source of uncertainty concerning future developments. Manufacturing production increased slightly in May, with high-technology industries recording the highest year-on-year growth this year. Lower growth than a year ago was recorded in particular in the manufacture of motor vehicles, mainly due to supply chain disruptions, lower demand and restructuring towards a greater supply of electric vehicles. Trade in goods with EU Member States increased slightly in May and was significantly higher year-on-year. Despite the high value of merchandise exports, Slovenia’s export market share in the EU market decreased year-on-year in the first quarter, with the largest decrease in France, due to the lower export volume of road vehicles. Uncertainty in the international environment (war in Ukraine, rising inflation, supply chain disruptions) has led to a decline in export orders in recent months, while export expectations have fluctuated more markedly from month to month. The surplus of the current account of the balance of payments has declined due to price trends and development in trade in goods. The strengthening of domestic consumption and the rising prices of energy and other primary commodities are having a negative effect mainly on the balance of payments. The values of the sentiment indicators are declining. The value of the economic sentiment indicator continued to fall in June but remained above the long-term average; confidence was lower in all components of the indicator. The value of the consumer confidence indicator fell below the long-term average (due to the rise in prices and the resulting deterioration in household purchasing power), while the manufacturing confidence indicator was on par with the average (bottlenecks in the supply of raw materials, rising commodity and energy prices, and the Russian–Ukrainian war).

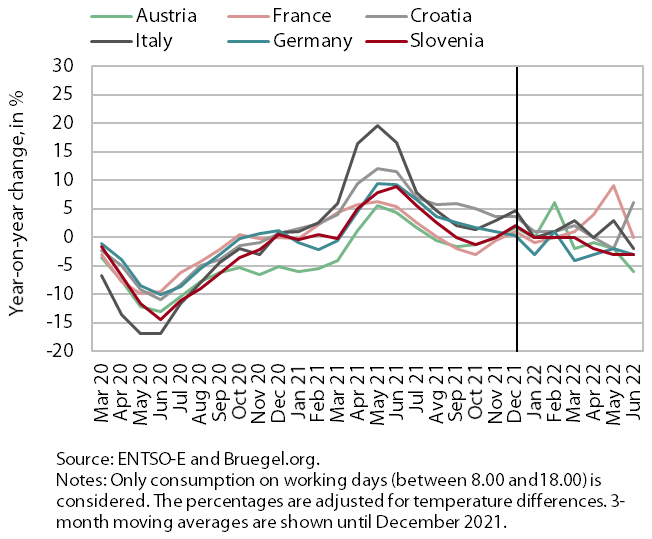

Electricity consumption, June 2022

In June, electricity consumption fell by 3% year-on-year – the same figure as in May. According to our estimates, part of the decline was due to lower household consumption compared to the same period last year, while the rest may be due to supply chain problems and material shortages, as well as the energy crisis and related production adjustments, especially in some energy-intensive companies. Among Slovenia’s main trading partners, lower consumption compared to June 2021 was recorded by Austria, Germany and Italy (-6%, -3% and -2% respectively). In France, consumption was unchanged year-on-year, while in Croatia it increased significantly (+6%), which we associate with favourable trends in tourism due to the relaxation of COVID-19 containment measures.

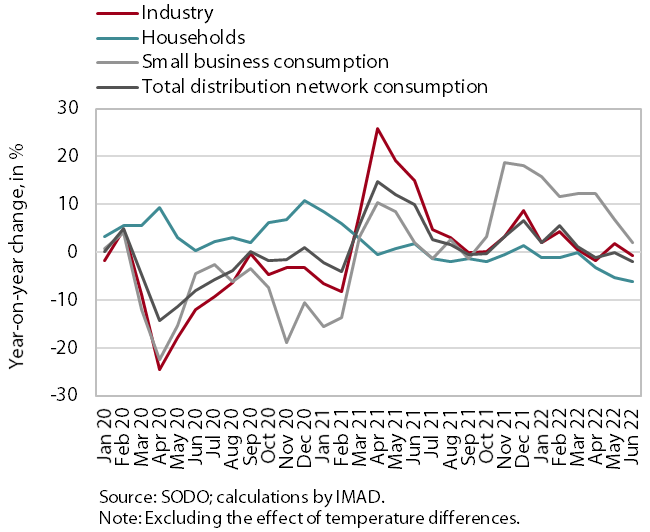

Electricity consumption by consumption group, June 2022

In June, electricity consumption in the distribution network was lower than in the same periods of 2021 and 2019. Despite one more working day, industrial electricity consumption in June was 0.6% lower year-on-year, while small business electricity consumption was 2.0% higher. The latter may have been partly influenced by last year’s low base due to the restrictive measures in trade and services. Household consumption in June was 6.2% lower than a year ago and 4.3% lower than the same period of 2019, which could already be due to higher electricity prices for households. Industrial electricity consumption and small business electricity consumption in June were more or less the same as in June 2019, with three more working days this June. This development is the result of unstable supply chains, material shortages and higher electricity prices.

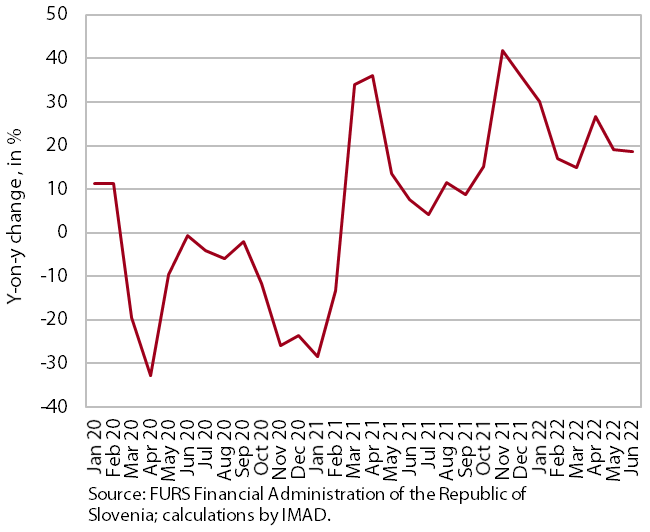

Value of fiscally verified invoices – nominal, June 2022

Amid high price growth, the value of fiscally verified invoices in June was higher year-on-year and compared to the same period of 2019 (by 19% and by 27% respectively). The nominal 14% growth of turnover in trade, where about three-quarters of the total value of fiscally verified invoices is issued, was the biggest contributor to the year-on-year growth, which was similar to that recorded in May. Another significant growth factor, given the low base, was the 71% nominal growth of turnover in accommodation and food service activities (mainly due to high growth in accommodation), which was slightly lower than in previous months due to the continued lifting of operating restrictions last June. The same applies to some other tourism-related activities (casinos and travel agencies), where turnover remained high year-on-year but lower than in previous months.

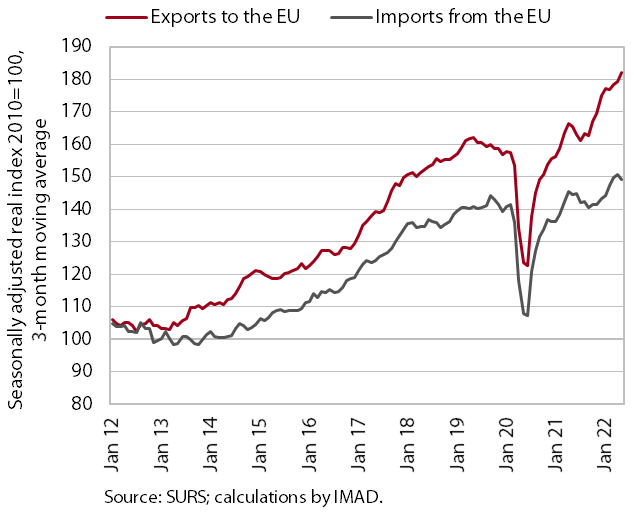

Trade in goods – real, May 2022

Trade in goods with EU Member States increased slightly in May; uncertainty remains high. Real exports and imports of goods to and from EU Member States (seasonally adjusted) rose slightly in May and were significantly higher than a year ago. Compared to the same period in 2019 (i.e. before the epidemic), exports to EU Member States rose by 12.5% in real terms and imports from them by 4.4%. Trade with non-EU countries is also higher than a year ago and before the epidemic, but it has been fluctuating noticeably on a monthly basis due to operations involving processing, which account for more than half of trade with these countries. Uncertainty in the international environment (war in Ukraine, rising inflation, supply chain disruptions) has also had a noticeable impact on sentiment in export-oriented activities in recent months, as export orders continued to decline in June, while export expectations show stronger monthly fluctuations.

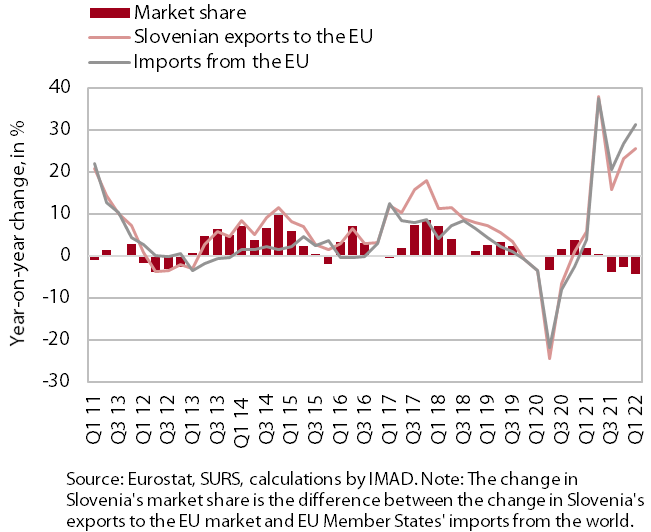

Slovenia’s export market share in the EU market, Q1 2022

Slovenia’s export market share in the EU market remained lower year-on-year in the first quarter of 2022 despite the high value of merchandise exports. The nominal euro value of Slovenian merchandise exports increased by 25.5% compared to the first quarter of 2021, and merchandise imports recorded an even higher year-on-year increase. According to initial estimates, Slovenia’s market share in the EU market decreased by 4.4% year-on-year in the first quarter. Due to unfavourable trends in the second half of last year and at the beginning of this year, it was already 2.6% lower than in the same quarter before COVID-19 broke out (Q1 2019). Among its main trading partners, Slovenia’s market share declined most significantly compared to pre-epidemic levels in France (by a good quarter), which was strongly affected by the decline in exports and market share of road vehicles, and in Germany (by almost a tenth).

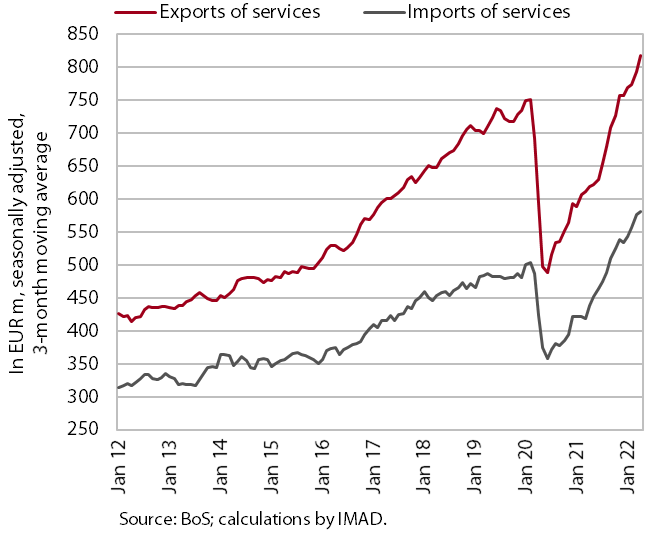

Trade in services – nominal, April 2022

Trade in services continued to increase at the beginning of the second quarter, and the current growth of services exports has exceeded the growth of imports for several months. Relatively high growth continued, especially in transportation services. Trade in other business services, which which had fluctuated strongly in recent months, contributed significantly to the increase in April (seasonally adjusted). Trade in tourism-related services was similar to previous months, while trade in construction and ICT-related services was lower. In April, year-on-year growth in services trade remained very high (32%), due to last year’s low base, and exceeded the level of the same period in 2019 by about 15%. Only trade in tourism services still lags behind the same period before the epidemic (by a little less than a third), while other important groups of services significantly exceed the comparable pre-crisis levels.

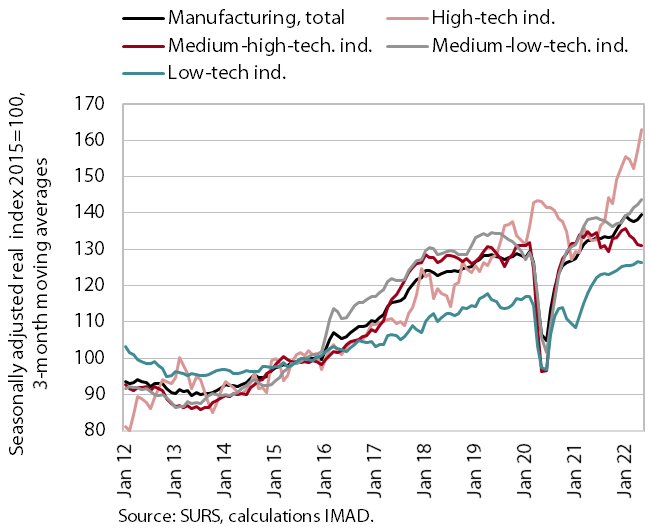

Production volume in manufacturing, May 2022

Manufacturing production continued to rise slightly in May. Growth continued in the high-technology and medium-low-technology industries, while production in the other two groups declined again. In the first five months, production was 5.1% higher than a year ago, with the strongest growth in the high-technology industries. Most other industries were also at or above last year’s levels, while the manufacture of motor vehicles, trailers and semi-trailers in particular was lower and was also the only industry that has not yet reached pre-epidemic levels, this due to various factors (supply chain disruptions, lower demand and restructuring towards a greater supply of greener vehicles).

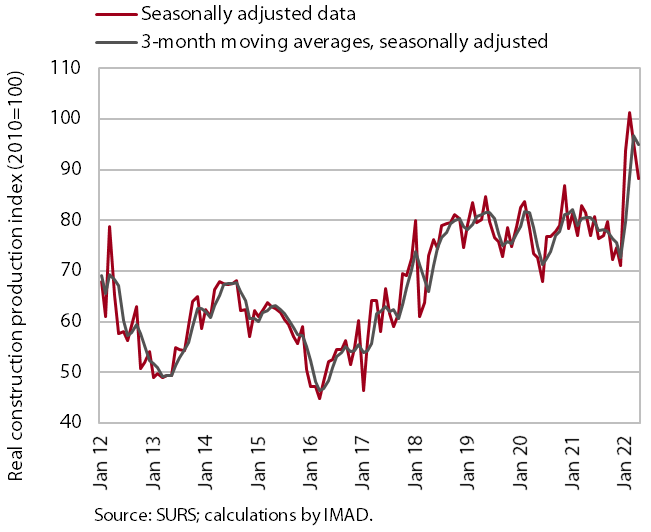

Activity in construction, April 2022

According to figures on the value of construction put in place, construction activity decreased in April but remained higher year-on-year. After a strong pick-up in construction activity at the beginning of this year, the value of construction put in place declined on a monthly basis in March and April but remained higher than in the same months of the previous year. Compared to previous years, construction of buildings stands out in terms of growth in activity. Activity also increased in civil engineering, while activity was lower in specialised construction work (installation works, building completion, etc.). Cost pressures continue to increase. The implicit deflator of the value of construction put in place (used to measure prices in the construction sector) was 22% in April, the highest level in 20 years. According to business trends in construction, high material costs were reported as a limiting factor by 69% of companies in May, while material shortage was reported by 40% of companies. Both indicators have risen sharply in the past year, reaching their highest levels in 20 years.

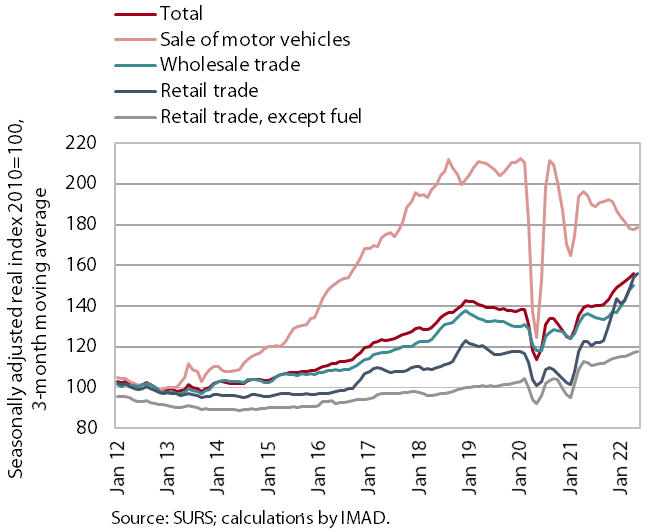

Turnover in trade, April–May 2022

Growth of turnover in trade continues. In April, growth was strongest in trade in motor vehicles, where turnover rose sharply again in May, according to preliminary data. Despite this growth, it was the only major trade segment that lagged behind pre-epidemic levels, due to low sales in previous months. After recording high growth in the first quarter, turnover further increased in wholesale trade. It fell in retail trade, which, in addition to lower turnover in the trade in automotive fuel (where real turnover fluctuated sharply in recent months), was also affected by lower turnover in the sales of food, beverages and tobacco. Turnover increased (in April and also in May, according to preliminary data) in retail trade in non-food products. Given the low base last year (due to the lockdown in the first third of April), it achieved high year-on-year growth of 12.5% in April.

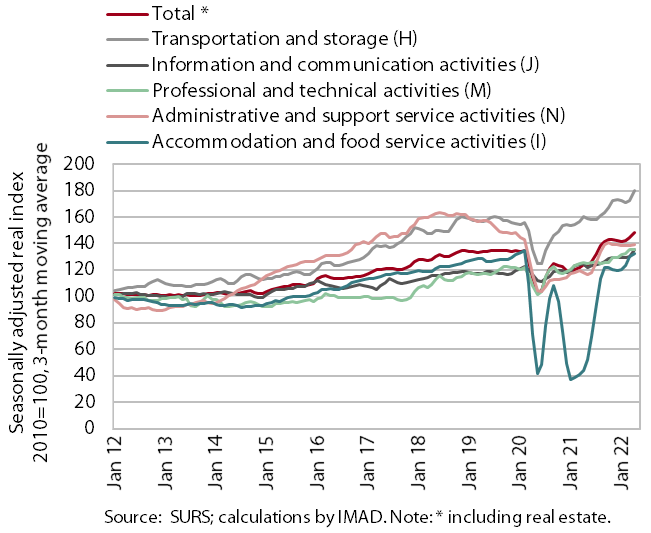

Turnover in market services, April 2022

Real turnover growth in market services continued in April. Total real turnover increased by 2.5% month-on-month and by 23.5% year-on-year, given the low base in April 2021. In current terms, growth accelerated in information and communication activities and transportation and storage. In the former group, this was mainly due to the resumption of significant turnover growth in telecommunication services, where turnover has mostly increased since December last year, and the continued favourable trend in computer services in the domestic and foreign markets. In the latter group, growth was mainly driven by land transport and postal activities. Turnover in professional and technical activities and administrative and support service activities stagnated. After high growth in the previous months, turnover only decreased in accommodation and food service activities. A lag compared to pre-epidemic turnover (April 2019) was only noticeable in travel and employment agencies (by 40% and 28% respectively).

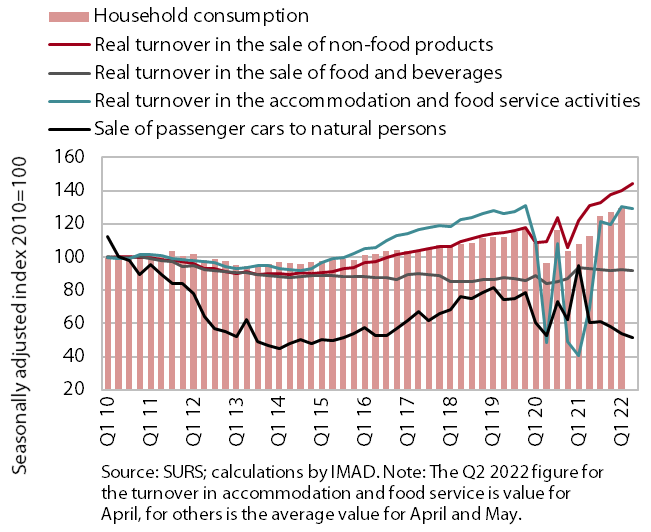

Selected indicators of household consumption, April–May 2022

Household consumption at the beginning of the second quarter was significantly higher than last year. In addition to current consumption, which was also boosted by the redemption of vouchers, the high year-on-year growth in April was also the result of the impact of last year’s lockdown in the first third of April. Expenditure on non-food products (in April and May combined) was a good tenth higher year-on-year, and the number of overnight stays by domestic tourists was three times higher, which also translated into higher expenditure on accommodation and food and beverage service activities. Expenditure on tourism services abroad was also significantly higher. Due to extended delivery times as a result of supply chain disruptions, sales of passenger cars to private households remained below the previous year’s level, and sales of food, beverages and tobacco products was also slightly below the previous year’s level. Given the high level of consumption, the saving rate, which in the first quarter was significantly below the level of a year ago and before the epidemic (11.4%), could remain relatively low in the second quarter.

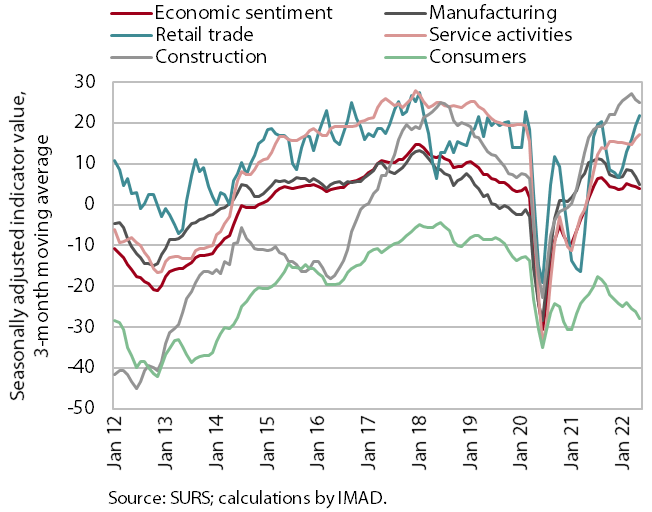

Economic sentiment, June 2022

The value of the economic sentiment indicator deteriorated further in June and was also lower year-on-year, though still above the long-term average. Compared to May, confidence fell everywhere, especially in construction and retail trade, and compared to June last year, it was significantly lower among consumers and in manufacturing. It was higher year-on-year only in services. The consumer confidence indicator remained below the long-term average, while it was the same as the average in manufacturing. Lower confidence among consumers was related to rising prices and the resulting deterioration in household purchasing power, while lower confidence in manufacturing was related to the current situation in the international environment (bottlenecks in the supply of raw materials, rising commodity and energy prices, and the Russian–Ukrainian war). Indicators in construction and in trade and services remained well above the long-term average, which is related to this year’s revival of construction activity and the lifting of operating restrictions after the COVID-19 epidemic.

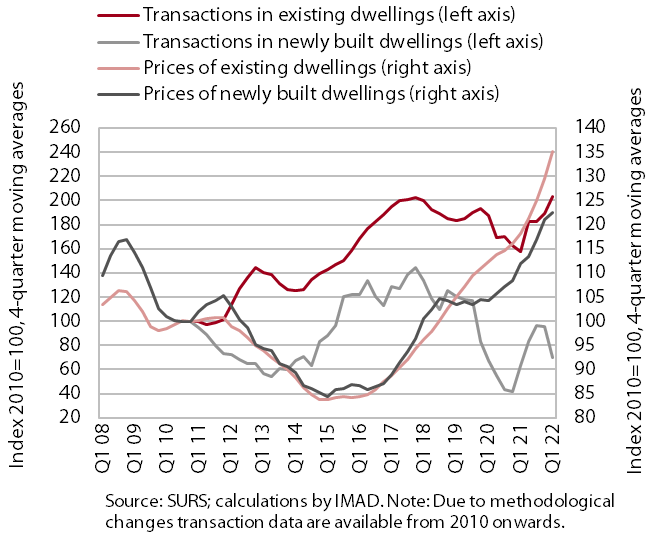

Real estate, Q1 2022

Given the high number of transactions, the high growth of dwelling prices continued in Q1 2022. After growing by 11.5% in 2021 as a whole, prices rose by 16.9% year-on-year. The high growth was driven by higher prices of existing dwellings (by 18.3%), while prices of newly built dwellings, which accounted for only 1% of all transactions due to limited supply, were 1.5% higher. The brisk trading in the real estate market was also reflected in the continued high level of lending to private households – the value of new loans granted for the purchase of dwellings was more than 50% higher in the first quarter than in the same period of 2021.

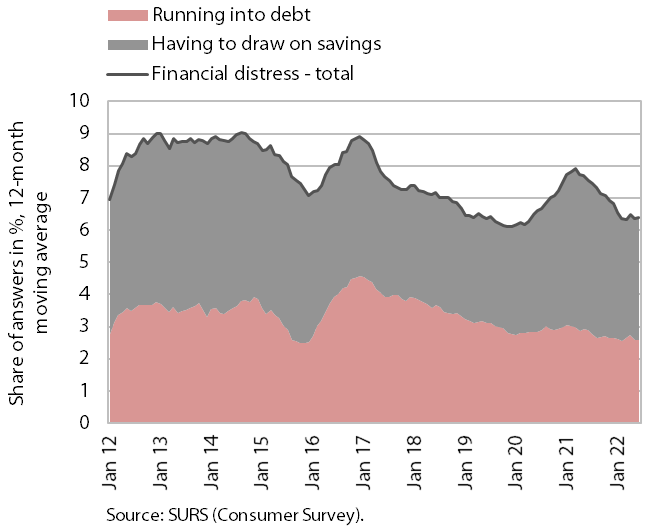

Households facing financial distress, June 2022

Since the middle of last year, households’ financial distress has gradually diminished, mainly due to the improvement in the labour market situation. In June 2022, 6.7% of households were in financial distress, which is linked to growth in average disposable income as the labour market recovers rapidly and employment in low-skilled jobs grows. The share of households running into debt has fallen slightly since 2019, which, according to our assessment, may have been due to the Bank of Slovenia’s binding instrument, which limited the creditworthiness of low-income households in particular. Households in the two lowest income quartiles therefore covered their financial needs to a greater extent by drawing on savings.

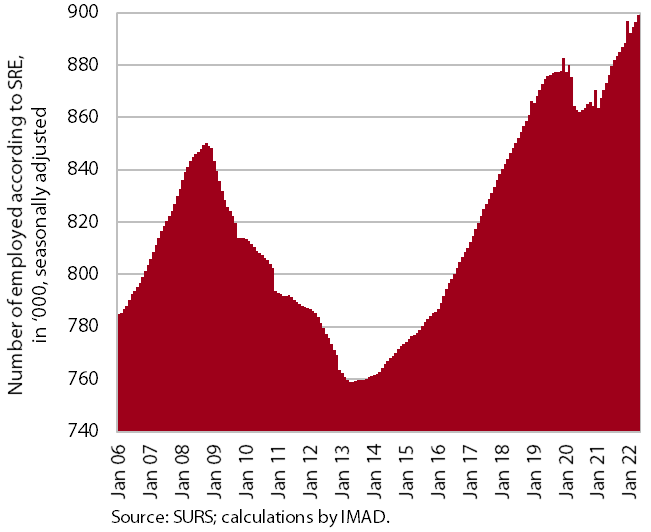

Number of persons in employment, April 2022

Year-on-year growth in the number of persons in employment in April was the same as in March (2.9%) and slightly lower than at the beginning of the year. It was still very high in accommodation and food service activities and in construction. As the economy recovered, growth in the number of persons in employment again depended largely on the employment of foreign workers, whose contribution to overall year-on-year growth was 58% in April. The share of foreigners among all persons in employment is also increasing, up 1.3 p.p. to 13.1% (in April 2022) over the last year. This is largely due to the shortage of domestic labour, which (given the high vacancy rates) is greatest in construction, accommodation and food service activities, and administrative and support service activities. The activities with the largest share of foreigners are construction (46%), transportation and storage (31%), and administrative and support service activities (25%).

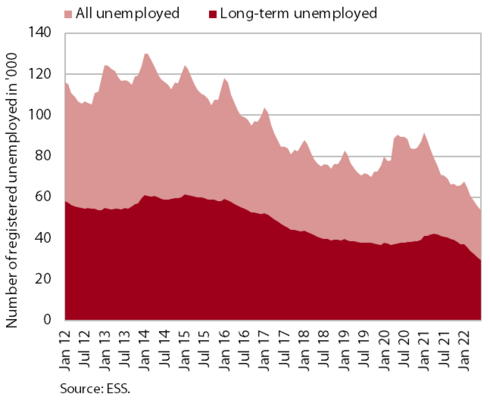

Number of registered unemployed persons, June 2022

The number of registered unemployed persons reached a new low in June. The month-on-month decrease was the smallest (1.7%, seasonally adjusted) in 15 months. At the end of June, 53,860 people were unemployed (original data), which is 24.2% less than a year ago. Under conditions of high demand for labour, which is also reflected in the high vacancy rate, the number of long-term unemployed has also been declining since May last year – their number fell by a good quarter year-on-year in June. Among the long-term unemployed, the share of people who have been unemployed for more than two years increased (71%), as they have more difficulties in finding a job than other long-term unemployed.

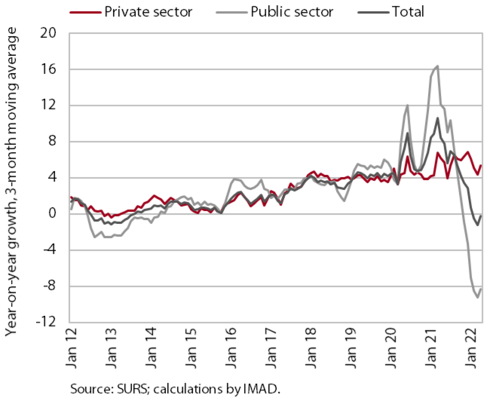

Average gross wage per employee, April 2022

In April, average wages in the public sector were 8.1% lower year-on-year in nominal terms, while they were 6.4% higher in the private sector (0.4% overall). Year-on-year wage growth in the public sector has been negative since November last year. This is related to allowances paid during the period when the epidemic was declared, which are no longer paid this year. In the private sector, year-on-year growth strengthened in April compared to previous months of this year. Wage growth was again the strongest in accommodation and food service activities and was also strong in trade and transportation and storage. In all these activities, the growth is affected by labour shortages. In real terms, the average wage was 6.1% lower year-on-year in April (14% lower in the public sector and 0.5% lower in the private sector).

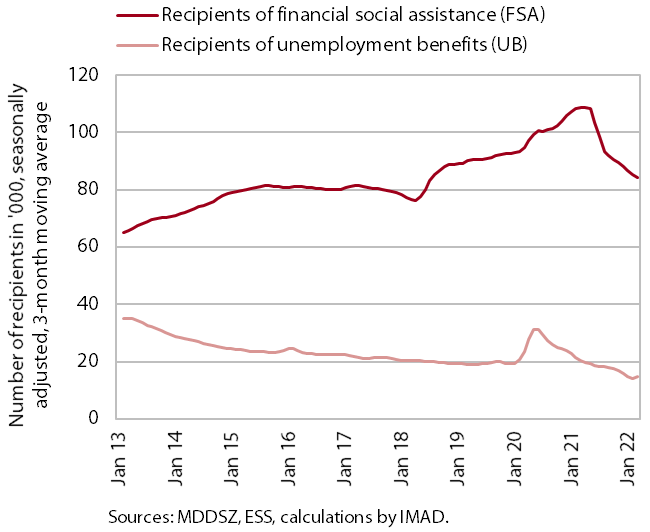

The number of FSA beneficiaries and UB recipients, April 2022

As economic activity has recovered and the labour market situation has improved, the number of financial social assistance (FSA) beneficiaries and unemployment benefit (UB) recipients continues to decline. The number of FSA beneficiaries increased until mid-2021, partly due to the measures to mitigate the impact of the epidemic, and has declined thereafter. In April 2022, their number was 22.8% lower year-on-year, mainly due to the improved situation on the labour market and the fact that fewer recipients of unemployment benefits became recipients of financial social assistance. The number of UB recipients has been declining since mid-2020; in April 2022, their number was at an all-time low (14,691 people), amid high employment of the jobless and historically high employment in the face of high labour demand and labour shortages.

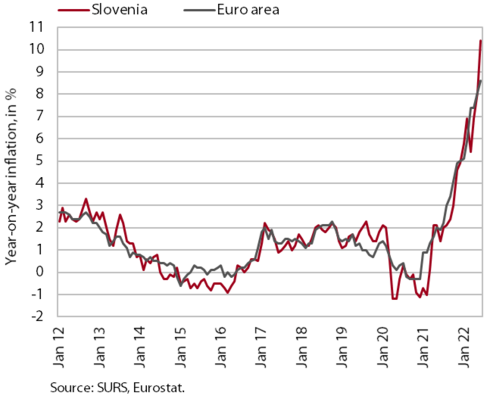

Consumer prices, June 2022

Inflation rose sharply again in June, to 10.4% year-on-year (2.7% month-on-month). This was mainly due to the expiry of the temporary exemption from the payment of certain electricity charges, which had been adopted in February to cushion the impact of high energy prices. As these charges were imposed again, the electricity price in June was more than 50% higher month-on-month. Energy prices have been on the rise since March last year and have been given an additional boost by the aggravation of the situation in Ukraine. According to our estimates, they were already about 35% higher year-on-year in June, contributing more than 4 p.p. to inflation. This does not yet take into account the impact of the change in the regulation of oil product prices on 21 June, which will be fully reflected in July’s inflation. Higher energy and food commodity prices, which to some extent are also due to geopolitical tensions, are increasingly affecting final food prices, which were 12.8% higher year-on-year in June. A significant contribution to growth came from higher prices of bread, cereal products, cooking oils and meat. The price of services continued to rise by around 5%, especially due to higher prices for rents, package holidays, and accommodation and food service activities. Price increases were high across most groups of goods and services. Only in education and communications was the price increase below 2% (0.4% and -5.3% respectively).

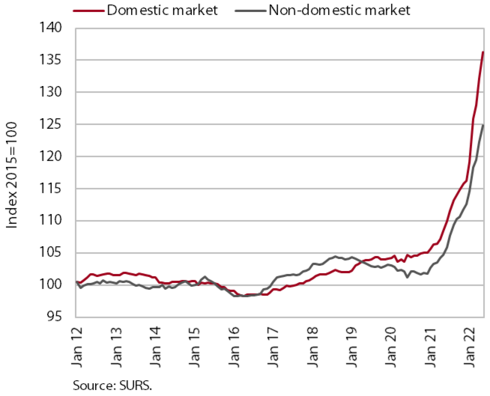

Slovenian industrial producer prices, May 2022

Geopolitical tensions, tighter conditions in energy and non-energy commodity markets, and supply chain bottlenecks continue to drive growth in Slovenian industrial producer prices, which already reached 22.5% in May. Price growth has increased in all industrial groups, especially on the domestic market, where it reached 25.7% year-on-year (19.3% on non-domestic markets). Overall price growth continues to be driven mainly by prices of intermediate goods, which were 28.5% higher year-on-year. The largest year-on-year increase was still recorded by energy prices, which rose by almost 75%, but due to their lower weight, their contribution to overall growth was smaller than that of intermediate goods. Compared to energy and intermediate goods, the increase in Slovenian industrial producer prices of capital goods and consumer goods (12.8% and 10.4% respectively) was relatively small, though still well above the long-term average. Prices of durable consumer goods and non-durable goods were higher year-on-year (by 8.9% and 10.8% respectively).

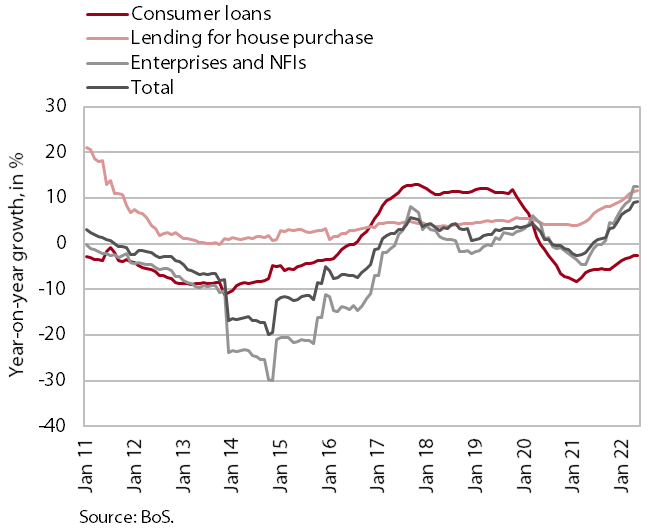

Growth in loans to domestic non-banking sectors, May 2022

The year-on-year growth in the volume of bank loans to domestic non-banking sectors further increased, to 9,2% in May. In anticipation of a rise in interest rates in connection with a faster normalisation of the ECB’s monetary policy, borrowers were still able to obtain loans on relatively favourable terms. Amid growth of economic activity, loans to enterprises and NFIs recorded the strongest growth, rising 12.6% year-on-year. The growth of loans to households was lower (7.6%), with the volume of housing and other loans increasing. The decline in consumer loans continues to slow gradually. After a few months of slowdown, year-on-year growth in non-banking sector deposits picked up slightly in the last two months but at 5.8% was still about one-third lower than at the end of the previous year. In particular, household deposit growth has strengthened, which according to our estimates is partly due to higher extraordinary wage payments combined with favourable business results last year. The quality of banks’ assets remains good and the share of non-performing loans in the first four months remained at the level of the end of 2021 (1.2%).

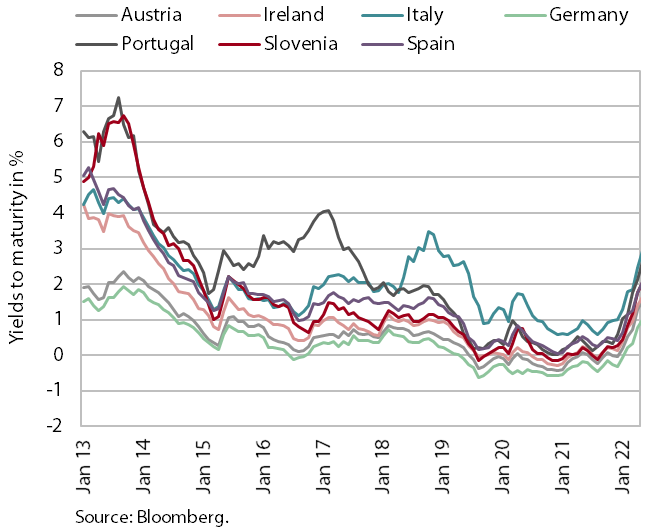

Bonds, Q2 2022

Yields to maturity of euro area government bonds rose significantly in the second quarter. The decisive factors were the rise in inflation in the euro area and the announcement by the ECB to accelerate monetary policy normalisation. Yields to maturity of government bonds of peripheral countries are increasing more markedly. The yield to maturity of the Slovenian government bond was thus 2.11% in the second quarter, which is the highest since 2014. The spread to the German bond was 102 basis points, about 40 basis points higher than in the previous quarter and twice as high as before the epidemic.

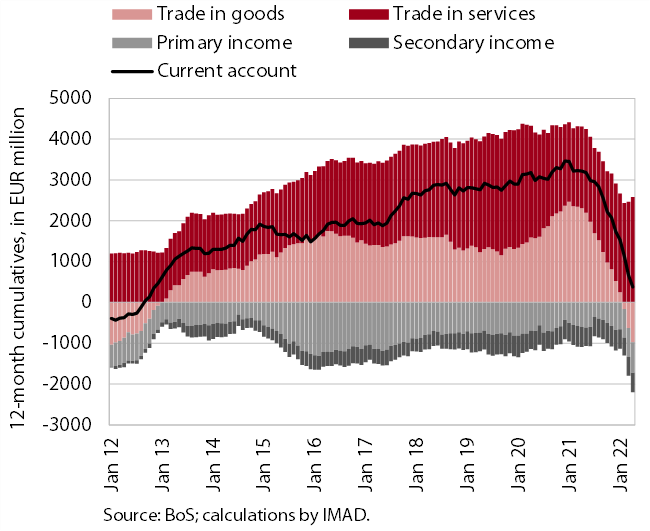

Current account of the balance of payments, April 2022

The surplus of the current account of the balance of payments fell again in April, mainly due to the trends in trade in goods. The 12-month current account surplus was lower than a year earlier, amounting to EUR 379.7 million (0.7% of estimated GDP). The year-on-year decline in the surplus in current transactions arose mainly from the goods trade balance, which turned from a surplus to a deficit at the end of last year. This is related mainly to faster real growth of imports, supported by the strengthening of domestic consumption, and rising prices for energy and other commodities, which have a negative effect on the balance of payments due to the relatively rigid demand for them. The primary income deficit was also higher, largely due to higher payments of dividends and profits to foreign investors and partly also to higher payments of traditional own resources to the EU budget. The surplus in trade in services has increased, especially in trade in travel (lifting of restrictions to contain the spread of COVID-19) and in other business services (lifting of restrictions on business activity). The deficit in secondary income was lower, mainly due to year-on-year lower VAT- and GNI-based contributions to the EU budget.

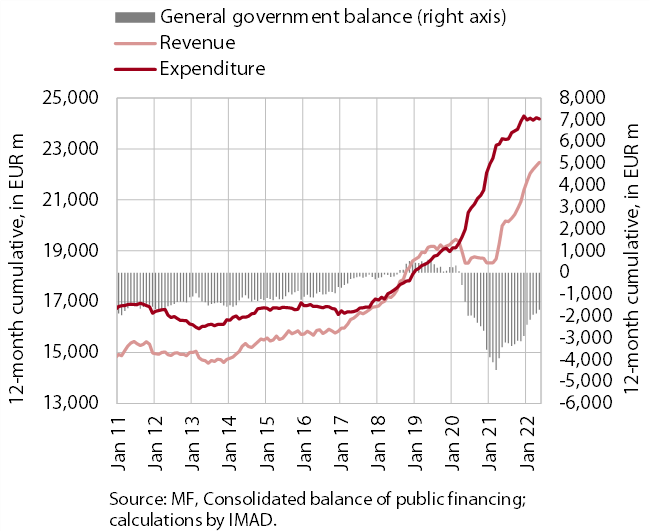

Consolidated general government budgetary accounts, May 2022

The consolidated general government budgetary accounts recorded a surplus in May; overall deficit in the first five months of 2022 was noticeably lower than in the same period of 2021. This reflects growth in economic activity and high employment. Revenue in the first five months was higher year-on-year (12.7%). The growth came mainly from VAT and corporate income tax, where growth increased significantly in May due to the revenue based on the annual income tax assessment, which resulted from the good business performance of companies last year. Revenues from the EU budget increased significantly due to the inflow of funds from the Recovery and Resilience Facility and from structural funds under the 2014–2021 multiannual financial framework (MFF). In contrast, trends in some other revenues were less favourable under the influence of adopted measures and one-off factors – due to the reduction in excise duties to mitigate the impact of energy costs, revenues from this source stagnated for five months, and non-tax revenues also declined, having been influenced last year by one-off revenues from fees for the use of radio frequencies. Revenues from income taxes also fell in May compared to the previous year, this due to legislative changes and revenue based on annual income tax assessments. Expenditure decreased in the first five months (by -1.2% year-on-year), reflecting lower payments related to measures to mitigate the consequences of the epidemic. These amounted to EUR 415.6 million compared to EUR 1,560 million in the first five months of 2021. Thus expenditure was lower mainly on civil servants’ wages, transfers to individuals and households, and subsidies. On the expenditure side, investments and expenditure on goods and services have increased year-on-year.

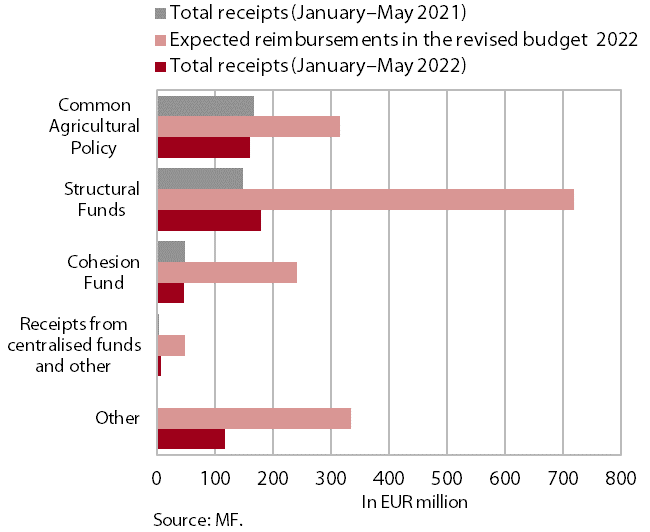

EU budget receipts, May 2022

Slovenia’s net budgetary position against the EU budget was positive in the first five months of 2022 (at EUR 210.5 million). In this period, Slovenia received EUR 513.3 million from the EU budget (30.9% of receipts envisaged in the state budget for 2022) and paid EUR 302.9 million into it (53.7% of planned payments). The bulk of receipts were resources from structural funds (35.0%), resources for the implementation of the Common Agricultural and Fisheries Policy (31.3%), and resources from the Recovery and Resilience Fund (23.1%, advance payment), while reimbursements from the EU Cohesion Fund were significantly lower (9.3%). According to SVRK data, by the end of May, operations confirmed (including REACT-EU) accounted for 102.0% and disbursements for 71.0% of the allocated funds.