Slovenian Economic Mirror

Related Files:

Slovenian Economic Mirror 9/2021

Economic activity in Slovenia remained high in the third quarter of this year, exceeding pre-epidemic levels. Private consumption in particular is growing faster than expected, meaning that economic growth in the year ending 2021 will be half a percentage point to one percentage point higher than predicted in our Autumn Forecast. In addition to the adjustment of consumers and activities related to private consumption to the changed situation, private consumption is also supported by the more favourable conditions in the labour market. In the third quarter, activities related to international trade, particularly manufacturing, were already affected by supply chain disruptions, especially semiconductor shortages, and the slower growth was in line with our forecasts. Available data for the last quarter point to the possibility of a slowdown in economic growth in the last quarter, mainly due to the deterioration of the epidemic situation and stricter containment measures, as well as continued production problems and constraints. Inflation will be higher this year and next than forecast in the autumn, mainly due to the sharp rise in energy prices in recent months and ongoing supply chain disruptions. Expectations for economic growth next year, which continue to be accompanied by a high degree of uncertainty, are in line with our autumn forecasts. A new forecast of economic trends will follow in March 2022.

Related Files:

- International environment

- Economic developments

- Labour market

- Prices

- Balance of payments

- Financial markets

- Public finance

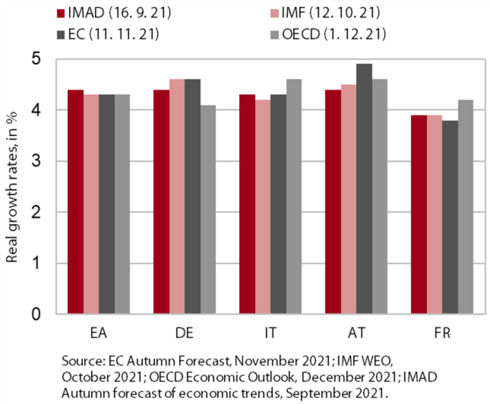

GDP growth forecasts for 2022 for Slovenia’s main trading partners

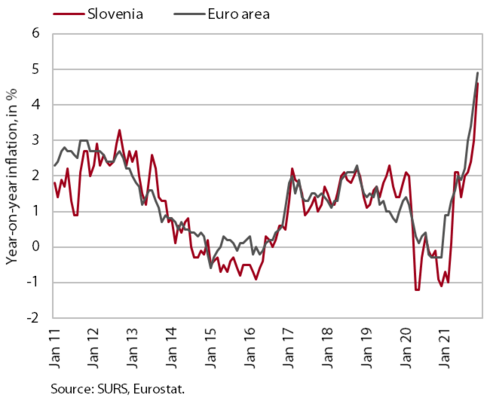

After a strong increase in the previous two quarters, growth of economic activity in the euro area slowed in the final quarter, according to available indicators. This is also indicated by the average value of the composite Purchasing Managers’ Index (PMI) for October and November, which fell compared to the third quarter. With the worsening epidemic situation, economic growth in the services sector is slowing down and ongoing supply chain disruptions are increasingly hampering the manufacturing sector, especially the automotive industry. The economy is also affected by high commodity and energy prices and the lack of skilled labour. This is also having a significant impact on rising inflation in the euro area, which stood at 4.9% in November. International institutions expect higher inflation to persist for several more months until global supply chain disruptions and price pressures caused by energy prices ease (probably by mid-2022). In its latest forecast, published in early December, the OECD expects euro area GDP to grow by 5.2% this year and 4.3% in 2022. For Slovenia’s main trading partners, the OECD predicts similar, albeit slightly lower, growth next year. The latest forecasts by international institutions are very similar to IMAD’s projections in its Autumn Forecast of Economic Trends.

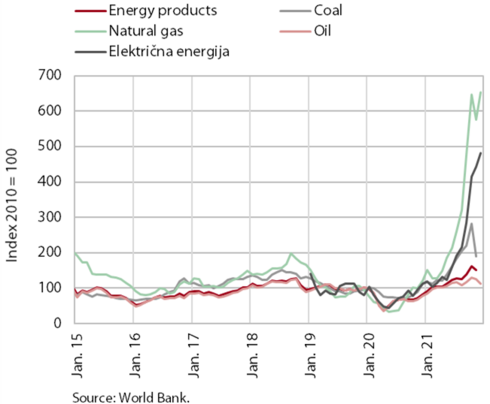

Energy prices

After rising in the previous two months, the average energy price on international markets fell slightly in November compared to the previous month. The average dollar price of Brent crude oil decreased by 3% to USD 81 per barrel and was up by 91% year-on-year. The sharp decline at the end of November was mainly due to the emergence of a new COVID-19 variant, Omicron, and the agreement of the largest oil consumers to release strategic reserves. According to the World Bank, prices of most other energy resources also fell in November compared to the previous month, especially of coal (by about 30%). Natural gas prices fell by 11% on the European market (and were 471% higher year-on-year), while the increase in electricity prices slowed. At the beginning of December, natural gas prices rose significantly again, and electricity prices continued to rise while oil prices further decreased. Prices for non-energy commodities in November remained similar to the previous month. (they were 14% higher year-on-year).

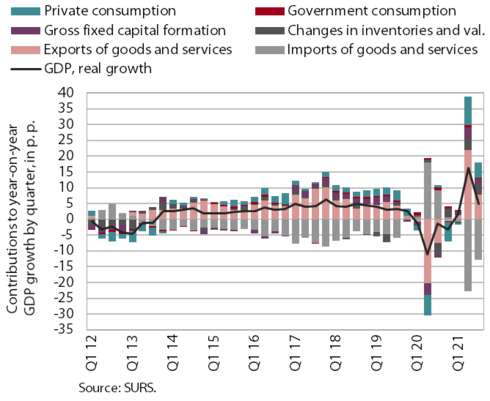

GDP, Q3 2021

Economic growth continued in the third quarter. GDP increased by 1.3% compared to the second quarter and by 5% year-on-year. GDP thus exceeded the pre-crisis level reached in the last quarter of 2019. This development reflects the continued easing of the containment measures, as well as the adjustment of the economy and consumers to the changed conditions. This led to further strong growth in private consumption and related activities (retail trade, entertainment, sports, recreational and personal care services and accommodation and food service activities). Private consumption thus exceeded the level of the same period in 2019, and the aforementioned service activities, with the exception of trade, fell slightly short of the pre-epidemic level. Activities related to international trade (especially export-oriented manufacturing) were already affected by supply chain disruptions, which is why their growth slowed. Manufacturing and exports and imports of goods, which were generally less affected by the containment measures, reached pre-crisis levels by the end of last year. Trade in services increased quarter-on-quarter, with exports of services still lagging behind pre-crisis levels, mainly due to lower travel activity. Year-on-year growth of gross fixed capital formation remained high and final government consumption was still higher year-on-year, with employment, spending on goods and services, and spending on pharmaceuticals and health services continuing to rise.

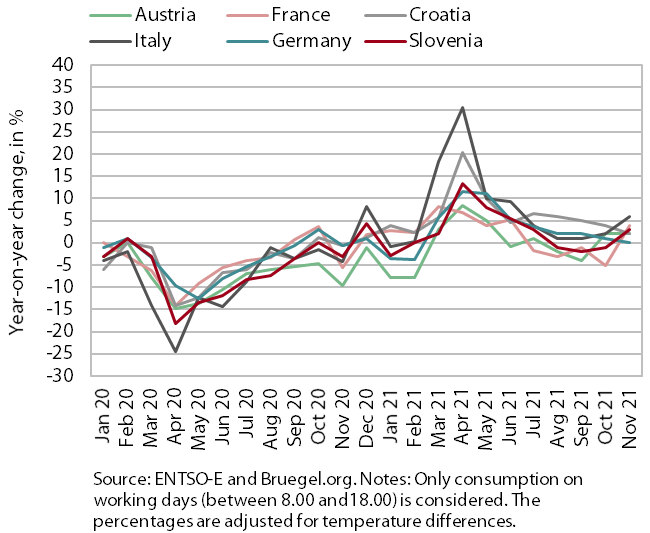

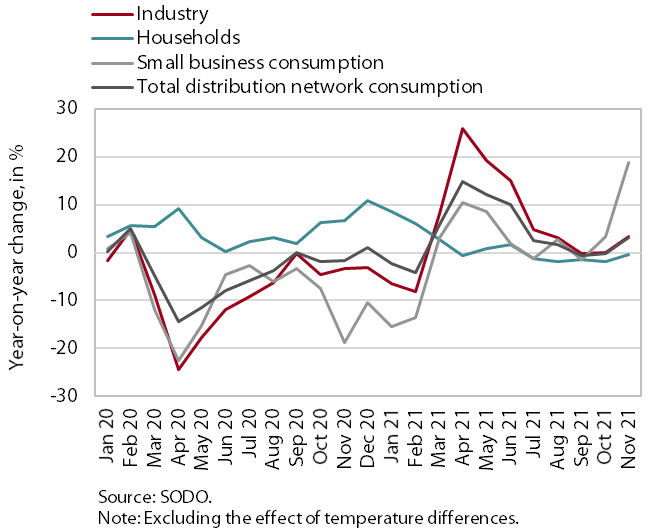

Electricity consumption

Electricity consumption in November was 3% higher year-on-year and only 1% lower than in the same period of 2019. The year-on-year increase is related to lower consumption at the beginning of the second wave of the epidemic last year, when containment measures were stricter than this year. Compared to November last year, consumption was higher in most of Slovenia's main trading partners – by 2% in Austria and Croatia, 4% in France, and 6% in Italy, while it remained about the same in Germany. The largest decrease in consumption among Slovenia’s main trading partners compared to November 2019 was recorded in Austria, at 7% (as a result of the lockdown). Compared to November 2019, consumption was also lower in France and Germany (by 3% and 1% respectively), while it was higher in Croatia and Italy (1%).

Electricity consumption by consumption group

Year-on-year, industrial and small business electricity consumption were higher in November, while compared to the same period of 2019, industrial consumption remained about the same and small business consumption was lower. Compared to November last year, industrial electricity consumption increased by 3.4% and small business electricity consumption by 18.7%. The main reason for the high year-on-year growth in small business consumption was last year’s low base, as containment measures were introduced last November during the second wave of the epidemic, restricting mainly trade and services activities. Household consumption in November was similar to the same period last year (lower by 0.5%), as household members spent more time at home – similar to last year – for various epidemic-related reasons (illness, remote working, etc.). Compared to November 2019, industrial consumption remained about the same, while small business consumption, which has lagged behind comparable periods in 2019 since the start of the epidemic, was lower (by 2.6%). Compared to November 2019, household consumption increased by 6.2%.

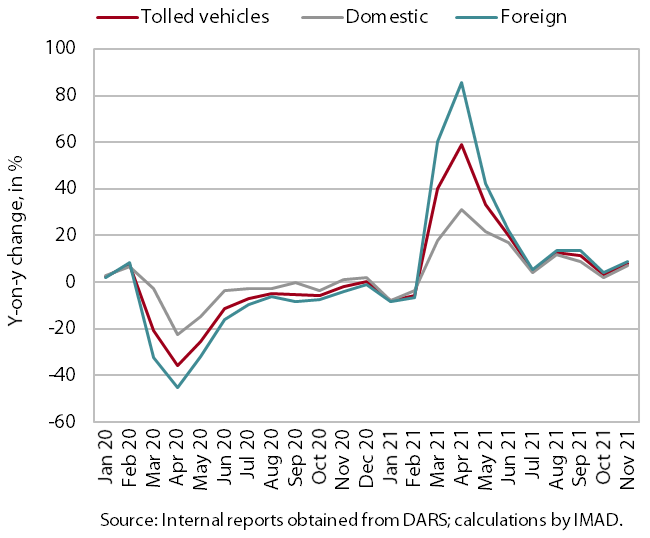

Traffic of electronically tolled vehicles on Slovenian motorways

Freight traffic on Slovenian motorways increased by 8% year-on-year in November. The high year-on-year increase was due to lower traffic volumes in the second wave of the epidemic last year. Compared to November 2019, the volume of freight traffic was also significantly higher due to one more working day, but after adjusting the data for working days, it was only one percent higher. The share of foreign vehicle traffic on Slovenian motorways, which had fallen slightly year-on-year in November 2020, returned to its pre-epidemic level of 61% this year.

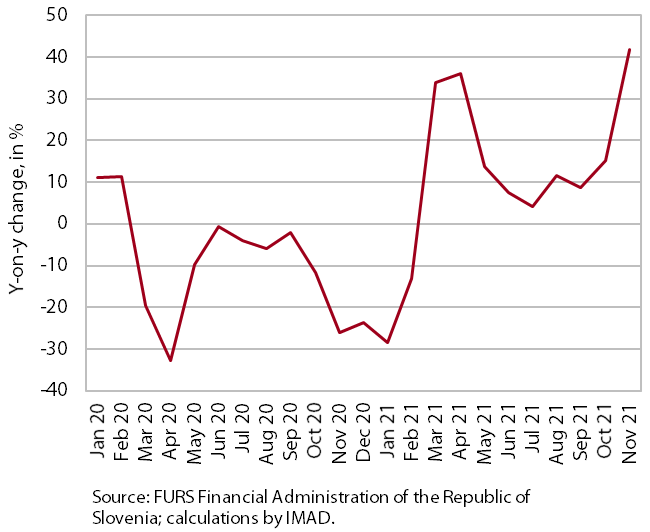

Fiscal verification of invoices

According to data on the fiscal verification of invoices, turnover in November was 42% higher year-on-year and 5% higher than in the same period of 2019. Compared to October, year-on-year growth strengthened in all activities, mainly due to last year’s low turnover, with restrictions in the supply and sale of goods and services that persisted throughout the month. With one working day more this year, sales growth was also higher than in November 2019. This was due to 6% higher turnover in trade (higher turnover in retail and wholesale trade, while turnover in the sale of motor vehicles was lower). Following growth in the summer months, turnover in accommodation and food service activities was lower than in November 2019 due to the deterioration of the epidemiological situation and the introduction of stricter business restrictions, while the decline in turnover in creative, arts and entertainment activities, travel agency activities, and gambling and betting activities increased.

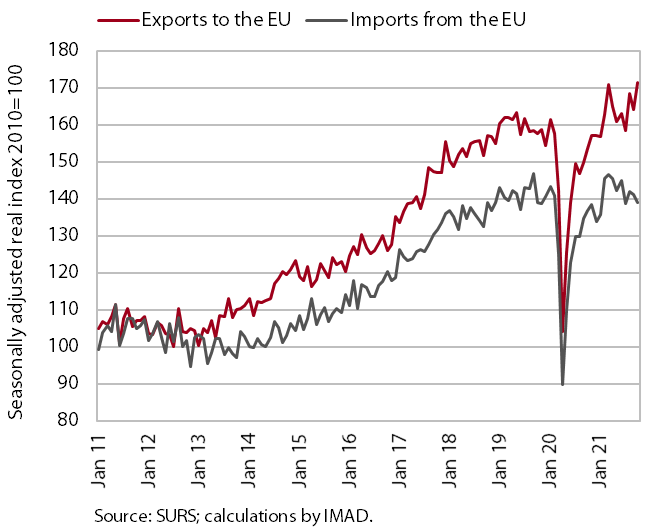

Trade in goods

The increased uncertainty in the international environment in recent months has had an impact on export and import activity in Slovenia. Uncertainty related to high commodity prices and supply chain disruptions particularly affected the automotive and related industries in Slovenia and among its main trading partners. At the same time, there have been more marked monthly fluctuations in trade with other EU Member States in recent months, with exports rising slightly and imports falling. In our opinion, the fluctuations in exports are mainly related to the vehicles group, which is also the only one of the main product groups to lag behind the level of the same period in 2019. The stronger monthly fluctuations in imports have been largely related to the import of capital goods and some consumer goods (passenger cars, non-durable goods excluding medical and pharmaceutical products). Compared to the same period in 2019, trade in goods, especially with other EU Member States, was slightly higher in October (higher exports, lower imports). Export expectations and new orders rose in November, well above the long-term average, and their fluctuations in recent months indicate increased uncertainty.

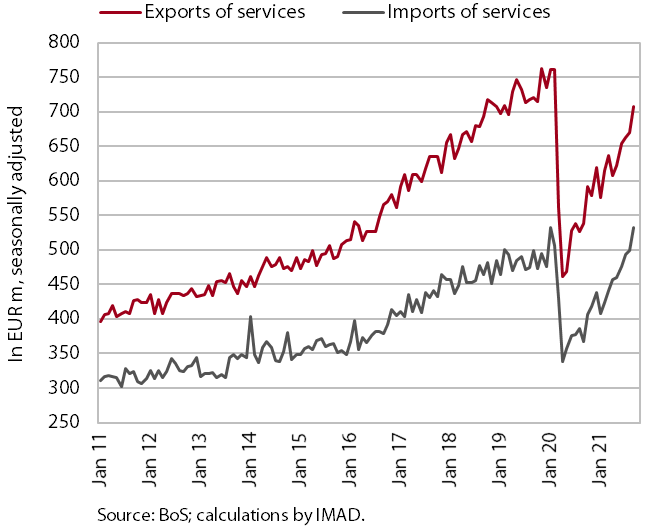

Trade in services

Trade in services increased sharply in the third quarter compared to the previous quarter (seasonally adjusted). The favourable trends in trade in most major services continued, the increase being mainly due to the recovery in trade in tourism-related services, which were the most affected by the containment measures. In the third quarter, total trade in services approached pre-epidemic levels, with imports of services recovering faster than exports. This was mainly due to tourism, where we estimate that the decline in spending by foreign tourists, same-day visitors and transit passengers in Slovenia was greater than the decline in spending by Slovenian guests abroad. Trade in personal, cultural and recreation services, which declined sharply during the epidemic, also fell short of pre-crisis levels. Other important groups of service activities (transportation, construction, ICT, other business services) were mostly well above comparable pre-crisis levels in the third quarter.

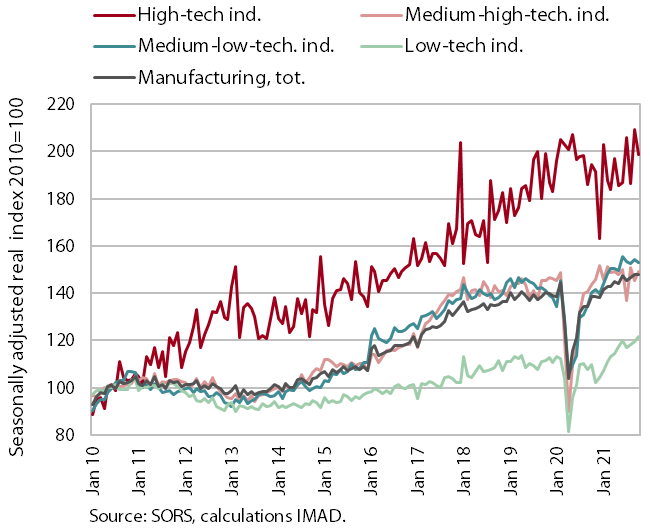

Production volume in manufacturing

Manufacturing activities were already affected by supply chain disruptions in the third quarter, with growth slowing slightly year-on-year in October as well. Medium-low- and low-technology industries recorded relatively high year-on-year growth, but at a lower rate than the previous month. Medium-high-technology industries recorded modest year-on-year growth, while high-technology industries recorded a decline. The decline was even slightly higher than in the same period of 2019. Production in medium-technology industries was limited by supply disruptions, especially in the automotive industry, but also in the rubber and plastics industry and in the manufacture of electrical appliances. In high-technology industries, the year-on-year decline was mitigated by the production of electronic and optical products.

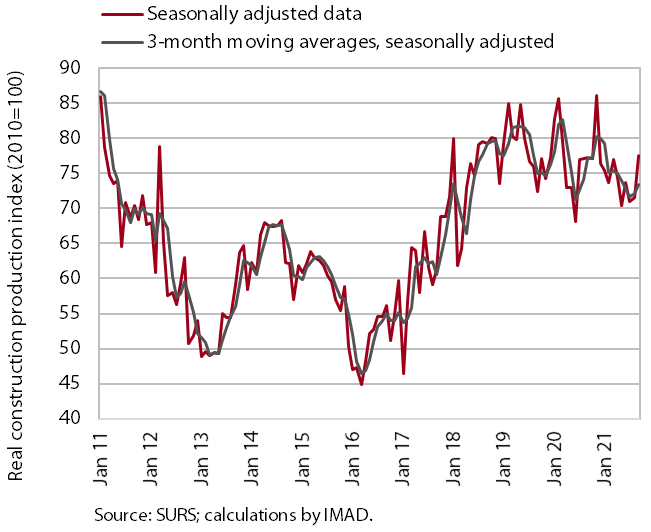

Activity in construction

Construction activity increased in September but remained similar to the previous quarter on average in the third quarter and was lower than a year ago. At the monthly level, the value of construction output increased by 8.5%. On average, it remained at a similar level in the third quarter as in the second quarter and was 4.8% lower than a year ago. With strong monthly fluctuations, activity in specialised construction has been stagnant for three years at the highest level since 2011, while activity in civil engineering works has picked up somewhat this year after stagnating in 2019 and 2020. The situation is similar in residential construction, where activity has increased even more this year. The decline in non-residential construction activity that began last year has intensified this year. The stock of contracts, which increased in the first half of the year and exceeded last year’s level, remains very volatile. It fell sharply in August and has remained below the previous year’s level since then.

Construction price growth, driven by rising commodity prices and labour shortages, slowed somewhat in September but still remains high. The implicit deflator of the value of completed construction works (used to measure prices in the construction sector) was 7% in September, which is one percentage point lower than in August.

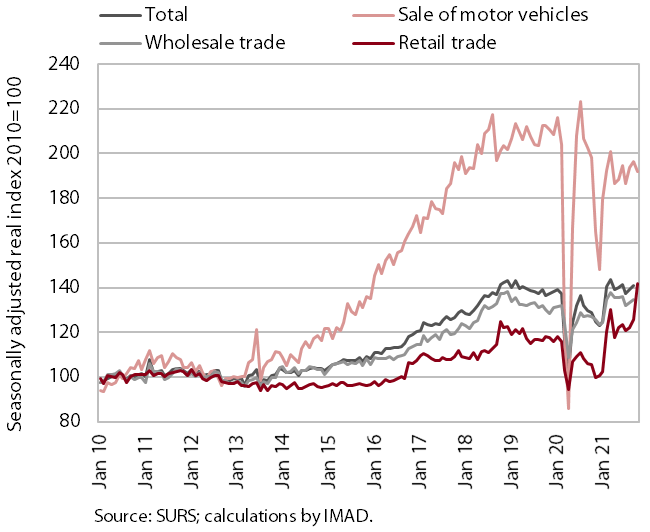

Turnover in trade

Turnover in trade decreased slightly in the third quarter compared to the second quarter but was higher year-on-year and compared to 2019. Of the three main trade segments, only wholesale trade recorded lower turnover than in the previous quarter, this due to poorer business performance in July. Turnover in retail trade increased mainly due to higher sales of automotive fuels, influenced by increased transit through Slovenia, and higher sales to households and legal entities. Quarter-on-quarter, turnover also increased in motor vehicle sales, though it was lower year-on-year and motor vehicle sales was the only major sector, apart from automotive fuel sales, to lag behind in terms of turnover in the third quarter of 2019. Compared to the latter period, sales of non-food products (15%) and food products (7%) were significantly higher. In the non-food group, sales via mail order and the internet rose in particular, almost doubling, and sales of pharmaceutical and medical products, furniture, and computer and telecommunications equipment also rose by about a tenth. According to preliminary data, turnover in retail trade rose strongly in October, while turnover in motor vehicle sales decreased.

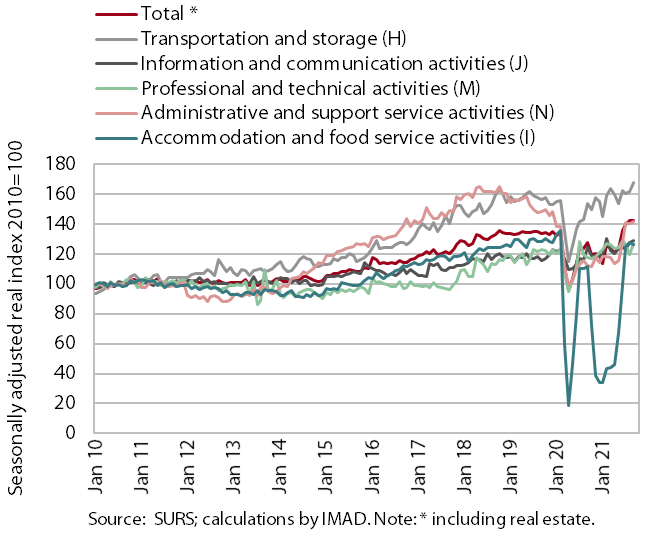

Turnover in market services

Real turnover increased further in most services in the third quarter. Turnover increased by 11.7% compared with the previous quarter and by 13.3% year-on-year. The highest quarter-on-quarter increase in turnover was recorded in accommodation and food service activities (by 77%), due to an increase in overnight stays by foreign and domestic tourists and a higher number of same-day visitors, also driven by the redemption of last year’s and this year’s vouchers. Turnover, which was 15% higher year-on-year, was only one percent behind that of the same period in 2019. High quarter-on-quarter growth was also recorded in administrative and support service activities (19%), where turnover almost tripled in travel agencies, while it continued to decline in employment agencies. Turnover in transportation continued to grow moderately, mainly due to increases in the storage sector. Turnover in information and communication activities improved again due to higher sales in the domestic and foreign markets for telecommunications and computer services. Lower turnover was recorded only in professional and technical activities, mainly as a consequence of declining turnover in architectural and engineering services. Year-on-year turnover growth was positive across all market services in the third quarter. Compared to the same period in 2019, only travel and employment agencies saw significantly lower turnover (by 47% and by 20% respectively).

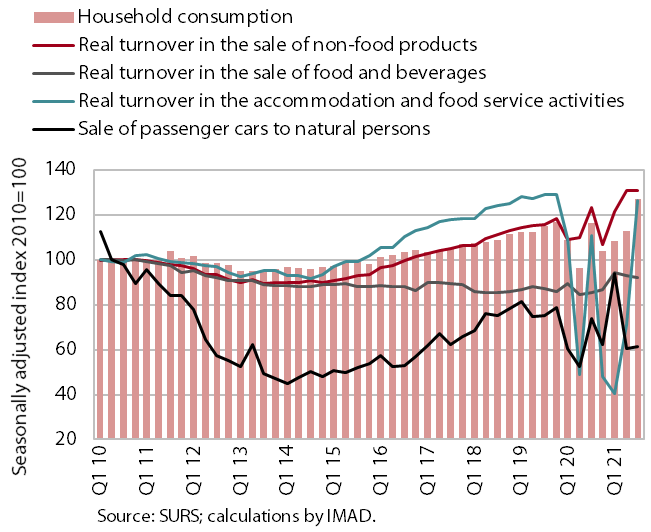

Selected indicators of household consumption

Household consumption increased sharply in the third quarter, up 9.3% year-on-year. In the summer months, households increased their spending on accommodation and food service activities both at home, also due to the redemption of vouchers, and abroad, where many more Slovenians travelled this year than last year. In the third quarter, households also spent significantly more on sports, cultural, entertainment and personal care services (8.0%) and on food, beverages and tobacco products (8.8%). Expenditure on non-food products (6.3%) also remained higher year-on-year, with a marked slowdown in the growth of durable goods sales. Sales of passenger cars were lower year-on-year, which we assess is also due to car delivery delays.

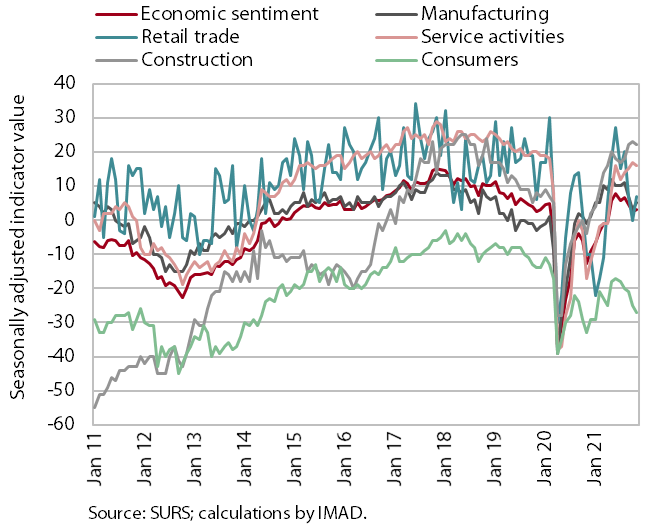

Economic sentiment

The Economic Sentiment Indicator improved in November, but its average value for the last two months points to a slowdown in the growth of economic activity in the last quarter. The monthly rise in the indicator was primarily attributed to increased confidence in manufacturing and in retail trade. Most indicators improved in both sectors. Confidence in service activities and construction and among consumers declined slightly. Confidence in all sectors and among consumers was significantly higher in November than in the same period last year. It was also higher in most sectors than in the same period in 2019, except in services and among consumers, probably reflecting uncertainty about the epidemic situation and related measures.

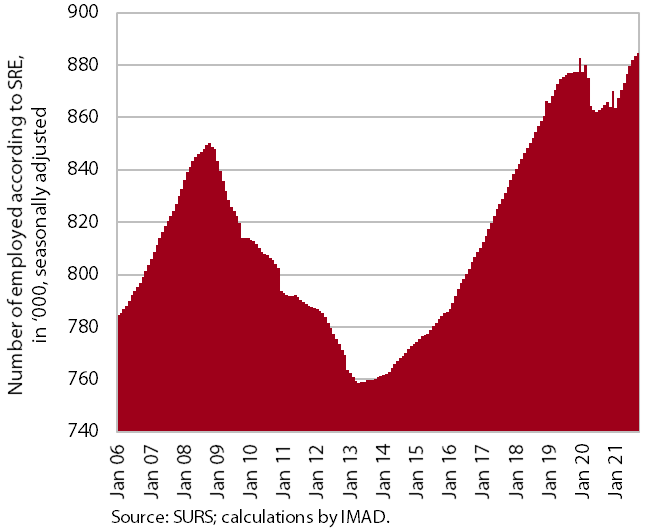

Number of employed persons

The historically high level of employment further increased in September. In the first nine months, the number of employed persons was 0.9% higher than in the same period last year. Employment growth was higher for the self-employed (1.4%) than for employees (0.7%), although the decline in the number of self-employed last year was much smaller than for employees. In September, the highest year-on-year increases were again recorded in construction and human health and social work activities. Employment growth was also high in the accommodation and food service activities, reflecting a relatively quick recovery after last year’s sharp decline, but the number of employed persons remained below September 2019 levels. The containment measures also had a strong impact on the arts, entertainment and recreation, where the number of employed people also remained lower this September than in the same period of 2019.

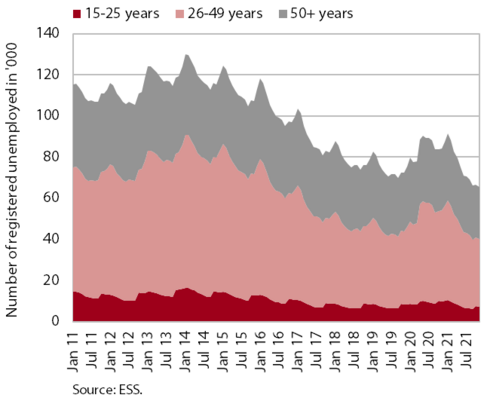

Number of registered unemployed persons

According to the seasonally adjusted data, the decline in registered unemployment in November was higher than in the previous months, at 2.4%. According to original data, 65,379 people were unemployed at the end of November, 1.9% fewer than at the end of October and 22.3% fewer than a year earlier. The number of unemployed persons was also lower (by 9.7%) than at the end of November 2019. In the first eleven months of this year, the inflow into unemployment was lower than in the same period of 2019. The outflow from unemployment has fallen in recent months, but it remains higher than the inflow, meaning that the number of unemployed continues to fall. Given the high demand for labour, which is also reflected in the high vacancy rate, the proportion of unemployed people aged over 50 with low employment prospects has been rising this year. In November, their share was 38.8%.

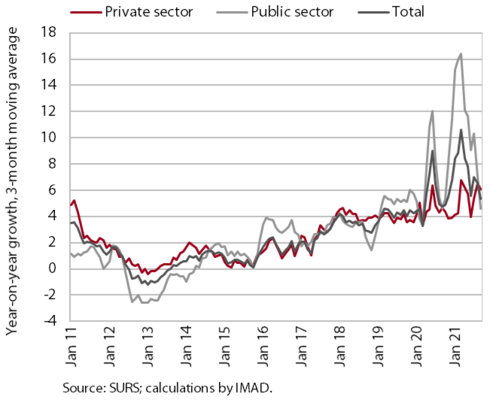

Average gross wage per employee

In September, year-on-year wage growth was 1% in the public sector, while it remained relatively high in the private sector (6.2%). In the first nine months, public sector wages were 10.1% higher than in the same period last year, but year-on-year growth has slowed since June due to the cessation of epidemic-related bonus payments. In the private sector, the average wage increased by 5.7% year-on-year in the first nine months, mainly due to the impact of the minimum wage increase at the beginning of the year, but also to the return to employment of workers who participated in job retention measures. According to our estimates, wage growth in some private sector activities (administrative and support service activities, construction, and accommodation and food service activities) may already be affected by labour shortages.

Consumer prices

Year-on-year consumer price growth rose sharply again in November, to 4.6%. About half of the year-on-year increase was due to higher prices of energy, especially petroleum products and heat energy, which rose by more than 40% and 55% respectively. The higher year-on-year increase was also largely driven by the prices of semi-durable goods. The latter fluctuate strongly due to the different seasonal price movements in the clothing and footwear sector. After falling in the last two months, they rose by 4.3% year-on-year in November. In the face of higher commodity prices and supply chain bottlenecks, durable goods prices continued to rise year-on-year (5.8%), with car prices up 6.7%. Services price growth increased again somewhat year-on-year (1.5%). Prices in the restaurants and hotels group (6.2%) continued to rise, as did prices in the recreation and culture group, with a slightly stronger month-on-month increase in package holiday prices. The year-on-year increase in food prices also strengthened slightly (by about 1%).

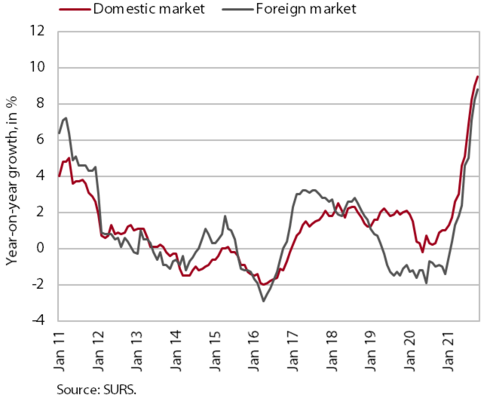

Slovenian industrial producer price

Slovenian industrial producer prices rose year-on-year in October (by 9.2%), but the increase was somewhat less pronounced than in previous months. Price growth in the domestic market is similar to that in foreign markets. Overall growth continues to be driven mainly by commodity and capital goods prices, which rose by 14.2% and 8.8% year-on-year respectively in October. Growth in energy prices fell by about a quarter, to 6.2%, compared to September, reflecting lower year-on-year price growth in foreign markets (38.4%). Growth in consumer goods prices was still relatively moderate (1.9%) but has been gradually strengthening. Prices of durable goods rose somewhat more markedly (3%), mainly due to higher growth in the domestic market, where they were more than 5% higher year-on-year (the highest increase in the last ten years).

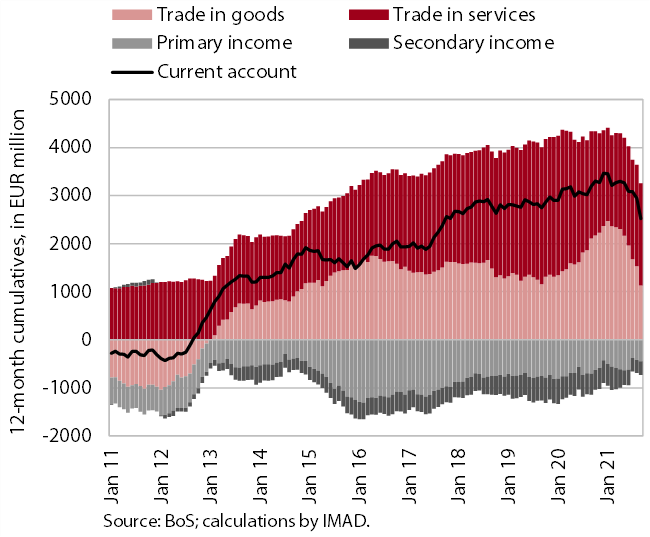

Current account

The current account surplus was again lower year-on-year in the third quarter. With deterioration in the terms of trade and higher real growth in imports than exports, this was again largely due to a lower trade surplus. The surplus in trade in services was higher year-on-year, mainly due to a larger surplus in administrative and support service activities and travel services. Net outflows of primary income were lower year-on-year in the third quarter, mainly due to lower net payments of dividends and profits to foreign investors and lower net payments of interest on external debt. Net outflows of secondary income were also lower year-on-year, mainly due to higher private sector transfers (net payments of non-life insurance premiums and other transfers). The 12-month current account surplus on the balance of payments stood at EUR 2.5 billion in September (5% of estimated GDP).

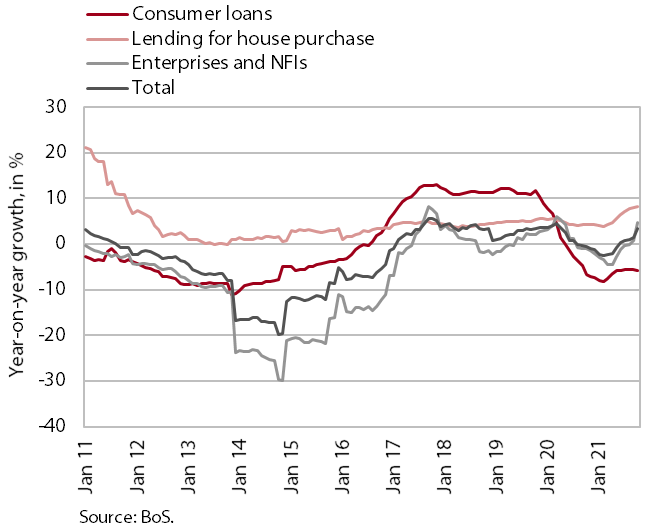

Year-on-year growth in loans to domestic non-banking sectors

The year-on-year growth in the volume of bank loans to domestic non-banking sectors increased considerably in October, to 3.4% (1.4% in September), mainly due to increased borrowing by enterprises. The higher growth was mainly driven by corporate and NFI borrowing. The volume of corporate and NFI loans increased by EUR 430 million on a monthly basis, which is the largest increase since 2008. Corporate and NFI loan growth increased to 4.6% year-on-year, slightly outpacing household loan growth. A large part of household borrowing continues to be in the form of housing loans, the year-on-year growth of which has stabilised at just over 8% in the last two months. The volume of consumer loans continues to decline, largely due to unfavourable credit conditions, while other loans (especially overdrafts) have been increasing in the second half of the year due to higher household spending. At the same time, the volume of household bank deposits declined for the third month in a row in October, amounting to EUR 24.2 billion. Their year-on-year growth slowed slightly but remained relatively high (8.9%). Thus the share of non-performing loans remained low in September, at 1.3%.

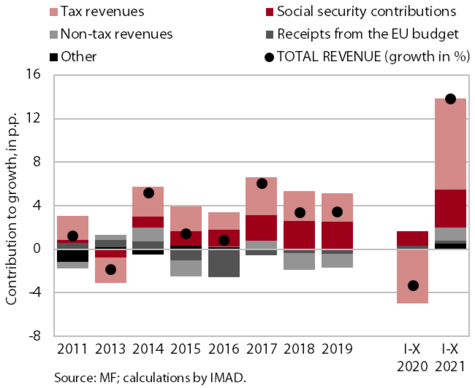

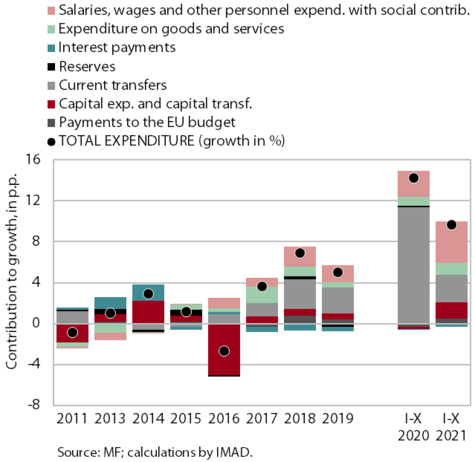

Growth of revenue and expenditure of the consolidated general government budgetary accounts

The deficit of the consolidated general government budgetary accounts amounted to EUR 1.9 billion in the first ten months and was 0.4 billion lower than in the same period of 2020. This reflects the high growth in revenue (13.8%), which fell in the same period last year, and the lower growth in expenditure (9.6%). The economic recovery, in particular the recovery of domestic demand and the improvement of labour market conditions, has pushed up tax revenues and revenues from social contributions this year, while the growth of receipts from the EU budget remains modest. In addition to lower expenditure growth, the structure of growth is different this year, with a higher share for public servants’ wages (allowances for work in hazardous conditions and employment growth) and for investment, while expenditure on subsidies, which had increased last year, fell sharply. Total expenditure on measures to mitigate the consequences of COVID-19 amounted to EUR 2.4 billion in the first ten months of this year, EUR 0.8 billion more than in the same period last year, mainly due to high payments at the beginning of the year. As a number of measures expired, the volume of these payments has decreased considerably since July 2021. We expect the deficit of the consolidated general government budgetary accounts to increase in November and December due to the usual increase in year-end capital expenditure and again somewhat higher payments to mitigate the impact of the epidemic, which is already suggested by the preliminary data on the realisation of the state budget for November 2021.

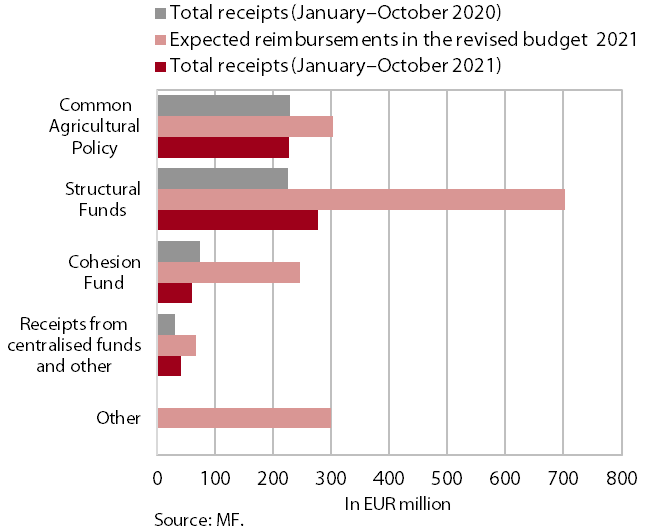

Receipts from the EU budget

Slovenia's net budgetary position against the EU budget was positive in the first ten months of this year (at EUR 112.0 million). In this period, Slovenia received EUR 605.6 million from the EU budget (37.4% of receipts envisaged in the state budget for 2021) and paid EUR 493.6 million into it (87.4% of planned payments). The bulk of receipts were resources from structural funds (40.8% of all reimbursements to the state budget) and resources for the implementation of the Common Agricultural and Fisheries Policy (37.5%), while the shares of resources from the EU Cohesion Fund and resources for the implementation of centralised and other programmes were significantly lower (9.9% and 6.7% respectively). According to SVRK data, confirmed operations accounted for 98% of funds available under the 2014–2020 financial perspective by the end of October, while only 62% were paid to beneficiaries.