Charts of the Week

Charts of the week from 17 to 28 June 2024: consumer prices, number of persons in employment, average gross wage per employee and other charts

Consumer price growth is rapidly weakening. In June, the year-on-year price increase was the lowest it has been in three years (1.5%), mostly due to the high base of last year. Amid slightly lower inflation, the year-on-year real growth of the average gross wage was higher in April than in March with the increase primarily recorded in the private sector. In April, the year-on-year growth in the number of persons in employment was due to foreign citizens. Real income in most trade sectors rose in April and remained higher than a year earlier. However, real income in market services decreased slightly in April, but in the first four months, it was lower year-on-year only in transportation and storage. Economic sentiment improved in June, mainly due to improvements in trade and among consumers. Economic sentiment also improved year-on-year, with the exception of construction, where it declined.

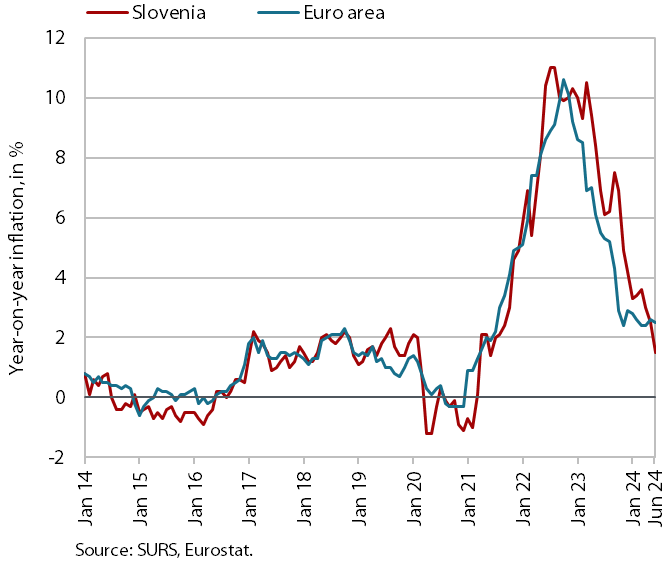

Consumer prices, June 2024

Year-on-year price growth weakened rapidly in June, reaching its lowest level in three years (1.5%). This was partly due to a further weakening of upward price pressure, but to a greater extent also to the high base of last June, when the reduced VAT rate on some energy products was abolished. This also had an impact on the year-on-year fall in the prices of housing, water, electricity, and gas and other fuels (-2.3%), whereas prices in this group had still risen by around 3% year-on-year in May. The price increase for goods in particular is weakening and was only 0.2% year-on-year in June. Non-durable goods prices went up by 0.3%, and semi-durable goods prices by 1.5%, while durable goods prices dropped by 1.4%. The slowdown in service prices has been interrupted in recent months, their year-on-year growth was still above 4%. The strongest price increase (6.7%) was observed in the restaurants and hotels group, which in our assessment is still the consequence of labour shortage and the associated upward pressure on wages, but also to a certain extent to the relatively high demand.

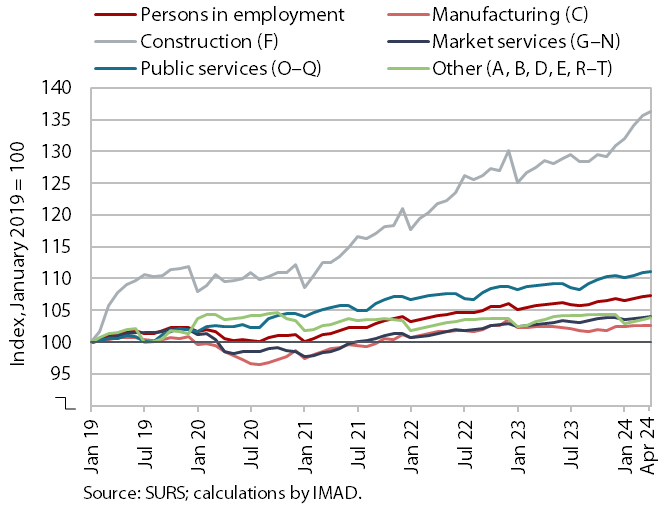

Number of persons in employment, April 2024

The number of persons in employment continued to rise year-on-year in April. Growth was similar (1.4%) to the first three months of this year and higher than in the last months of 2023. The acceleration of growth at the beginning of the year was mainly due to a change in the definition of persons in employment, which now also includes workers posted abroad. In April, growth in the number of persons in employment was still the highest in construction, which faces major labour shortages. The year-on-year increase in the total number of persons in employment in April was due to a higher number of employed foreign nationals, while the number of employed Slovenian citizens fell slightly. The share of foreign citizens among all persons in employment was 15.7% in April, 1.4 p.p. higher than a year earlier. Notably, the activities with the largest shares of foreign workers were construction (50%), transportation and storage (33%) and administrative and support service activities (29%).

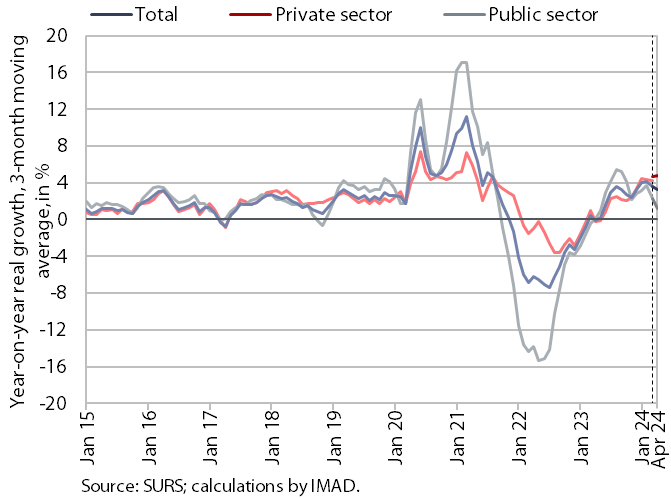

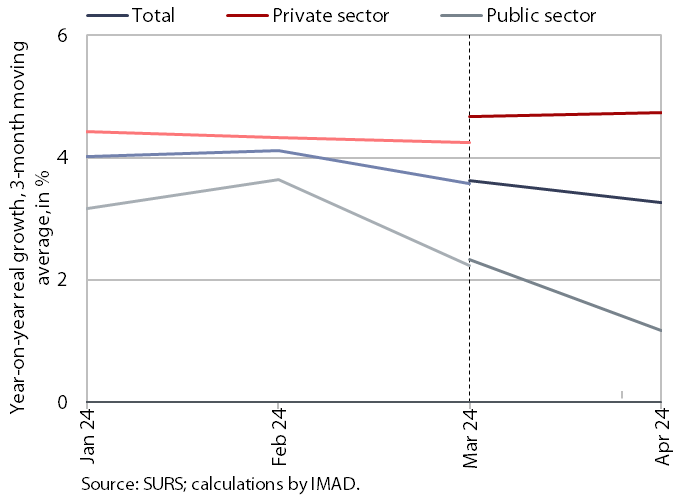

Average gross wage per employee, April 2024

Since April, calculation of data on earnings uses a new data source; the year-on-year growth in the average gross wage was slightly higher (3.4%) than in March. With a slightly lower inflation, this was mainly due to the relatively high growth in the private sector (5.7%). The highest growth was recorded in construction and administrative and support service activities. In the public sector, the average gross wage fell by 0.8% year-on-year in real terms, which is linked to last year's base (wage increase in April 2023). In the first four months, overall average gross wage increased by 7% in nominal terms – by 8.2% in the public sector and by 4.9% in the private sector.

SURS now uses data from the REK-O form, which differs from the old ZAP/M form by the different reporting of extra payments and overdue payments. The monthly gross wage differences between the two sources are between -2.2% and +2.0%, with the exception of December 2023, where the data from the new source was 14.9% higher. Consequently, growth rates also differ slightly. As the raw data according to the new methodology is published for the last 15 months, the calculation of the year-on-year growth and then the 3-month moving average means that the series shown only overlap by one month.

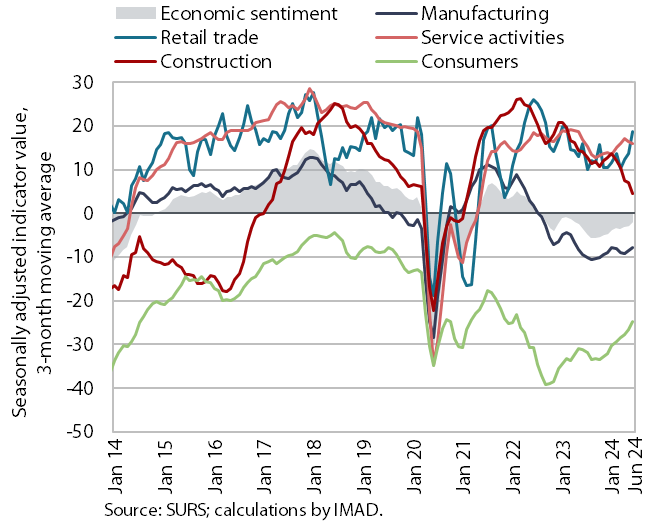

Economic sentiment, June 2024

The economic sentiment indicator improved slightly in June and remained higher year-on-year. The improvement compared to the previous month was due to improvements in the confidence indicators in retail trade and among consumers, which have improved the most since the beginning of the year. The confidence indicators in construction and services deteriorated, while the confidence indicator in manufacturing remained unchanged. With the exception of the confidence indicator in construction, which has deteriorated the most since the start of the year, all confidence indicators contributed to the year-on-year increase in the economic sentiment indicator in June.

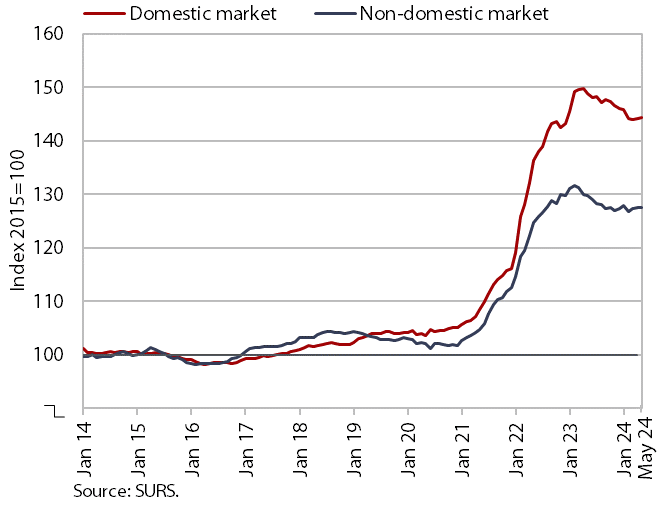

Slovenian industrial producer prices, May 2024

Slovenian industrial producer prices remained unchanged in May, with the year-on-year decline continuing to slow slightly (-2.4%). The slowdown in the year-on-year decline in May was mainly due to a deceleration in the decline of prices in the intermediate goods group (-4.3%), which was attributable to both a higher base and monthly growth of 0.6%. Energy prices were 11% lower year-on-year, mainly due to lower prices in electricity, gas and steam supply (-15.8%). Price growth for capital goods remained at around 0.5% year-on-year, while prices of consumer goods continued to rise by around 1%. Industrial producer prices on the domestic market were 3.0% lower year-on-year. The decline on foreign markets was 1.8%.

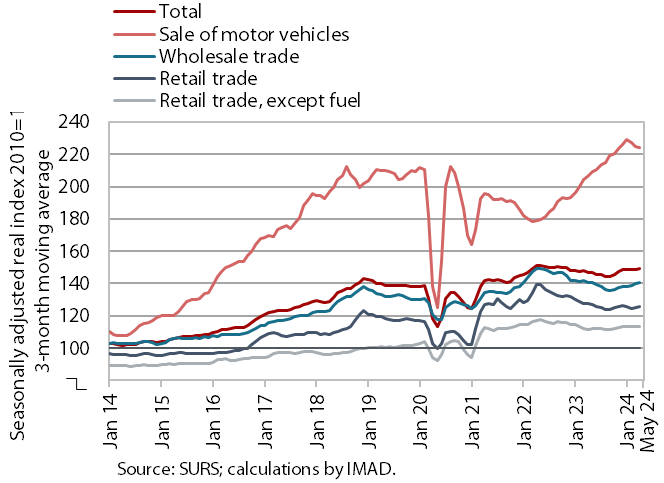

Turnover in trade, April–May 2024

In April, real turnover increased in most trade sectors and was also higher year-on-year. Turnover in the sales of motor vehicles was a good fifth higher year-on-year in April. After high growth last year, it declined month-on-month in the first quarter. In the first four months, it was more than a tenth higher year-on-year. In April, turnover in wholesale trade rose by just over a tenth compared to the previous year and by 1% in the first four months. Turnovers in the retail sales of non-food and food products were also up year-on-year in the first four months (by 1% and 3% respectively). According to preliminary SURS data, turnover fell in most sectors in May and was also down year-on-year in the retail sales of non-food products, while it continued to rise year-on-year in the retail sales of food products and sales of motor vehicles.

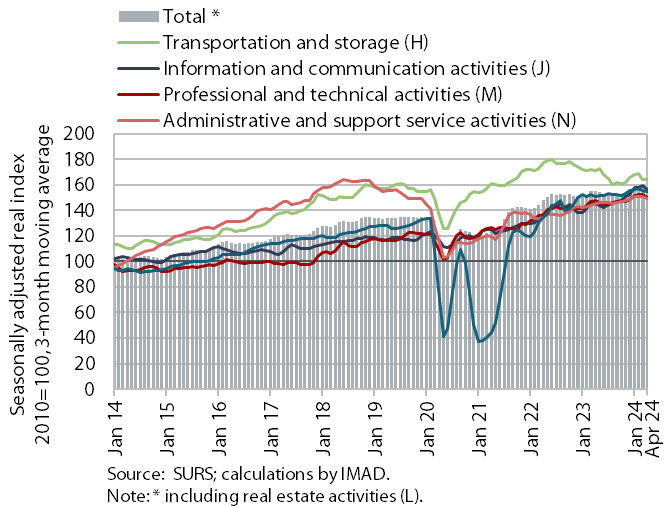

Turnover in market services, April 2024

In April, total real turnover in market services fell (by 0.6%), though it remained 6.8% higher year-on-year in real terms. Following relatively high growth in March, the sharpest fall in turnover was recorded in professional and technical activities, with the deepening of turnover decline in architectural and engineering services. A slightly smaller decline in turnover was observed in administrative and support service activities, with a further contraction in employment services. Turnover in accommodation and food service activities fell for the fourth month in a row. In addition, the decline in turnover in the real estate activities contributed to the overall turnover decline in market services. However, turnover in transportation and storage increased slightly, primarily due to growth in warehousing and support activities for transportation. In information and communication, turnover growth accelerated due to higher sales in telecommunication services. In the first four months, real turnover was down year-on-year only in transportation and storage.

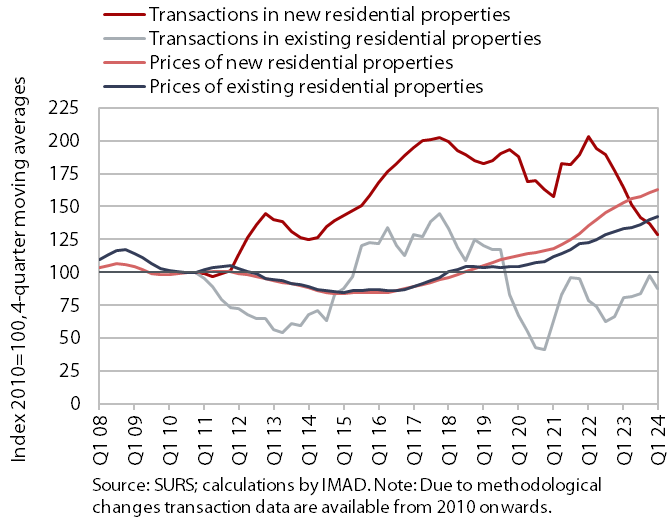

Real estate, Q1 2024

Amid a further decline in the volume of sales, the year-on-year growth in dwelling prices moderated slightly in the first quarter. After price growth halved last year (to 7.2% on average), prices were 6.3% higher compared to the first quarter of 2023 and 1.2% higher compared to the fourth quarter of last year. Prices of existing dwellings, where the number of transactions fell by almost a quarter year-on-year and reached their lowest level since the third quarter of 2013, rose by 6.9% year-on-year. Prices of newly built dwellings were also higher year-on-year (by 8.7%), but 7.6% lower than in the last quarter of last year. The number of their transactions, although only a small part of total sales (8%), also fell sharply year-on-year (by a third), after their number was relatively high in 2023 (according to the revised data).